Why do companies need to re-engineer credit and collections processes?

This e-book, with research on more than 500 receivables projects, concludes that credit and A/R leaders are more likely to positively impact A/R KPIs if they start with an assessment of their collections operation maturity on 5 key parameters -people, processes, data, collaboration, and technology. The Collections Operations Maturity Model has been devised to help finance decision-makers perform an in-depth evaluation of their current operations and identify clear next steps to advance up the maturity pyramid.

Why do companies need to re-engineer credit and collections processes?

Economics Today: Top Priorities

With rapidly changing technologies and evolving processes, the economy has become a tough and unpredictable domain for companies. The competition is global and aggressive, making sales representatives desperate for orders. As every customer is important in this hypercompetitive environment, they are ready to sell to unqualified buyers and even agree to ?all? the business terms of the customers. Often times, A/R operations take a backseat on the priority list of finance leaders. However, poor A/R practices cause a number of issues for businesses. In order to meet their strategic objectives, companies need to take a hard look at their accounts receivable processes. They need to invest in means and measures to reduce operational costs, protect the cash and support sales in making wise calls. But most importantly, to maintain the financial health of a company, top priority must be given to Days Sales Outstanding(DSO) and its reduction. It is one of the most widely used measures employed by finance professionals to analyze the success of their efforts. The next section explores how DSO significantly impacts the financial health of a company.

Impact of DSO

Days Sales Outstanding (or DSO) is the value of receivables outstanding or waiting to be collected from customers, expressed in the equivalent number of days of revenue. As per the Credit & Collections Global Benchmarking Study Whitepaper by SUNGUARD, 77% of companies with revenue less than $1 Billion and 87% of companies with revenue greater than $1 Billion adopt DSO as a basic KPI to evaluate the effectiveness and efficiency of their credit and collections process. The lower the DSO is, the more cash is available for investing in other avenues, be it marketing, sales or operations. Different industries have different credit terms and DSO needs to be benchmarked across close industry peers. As a thumb rule though, DSO should be slightly higher (no more than 50%) than the payment terms. To elucidate, if the operating payment term is 30 days and payment comes in 45 days, then the company has a decent DSO. A high DSO indicates:

- Generous payment terms

- Inefficient collections process

- Paper invoicing

- Slow payment methods such as checks

- Inefficiency in the credit risk management process

- Poor disputes/deductions management process

- Bad macroeconomic situation

Since DSO is the value of receivables outstanding or waiting to be collected from customers, expressed in the equivalent number of days of revenue, it is directly proportional to the performance of the collections process in A/R. The next section explores how the collections process plays a major role in DSO.

Importance of Collections and how it affects DSO

Collections Management is at the heart of driving the DSO reduction goal of finance executives. Whether one is a business owner, accounts receivable manager, or simply the person responsible for recovering a company?s unpaid commercial debt, collecting aging receivables isn?t a cakewalk. Pursuing unpaid debt is never a fun or easy task, which is why so many businesses put off this task, resulting in poor cash flow and an unhealthy bottom line. The reality is, however, the task of collecting delinquent commercial and business-to-business debt needs to be one of the top priorities for a company to lower its DSO. According to the National Association of Credit Management, the value of an uncollected dollar after:

- Three months depreciates to 87 cents,

- Six months depreciates to 67 cents,

- One Year depreciates to 46 cents.

A high DSO number shows that a company is selling its product to customers on credit and taking longer to collect money. Generally, a high DSO can suggest a few things, including that the company?s customer base has credit issues or that the company is deficient in its collection processes. This deficiency can be alarming for the overall smooth running of a business.

Key Problem Areas in Collections

Traditionally, the collections process has been riddled with pitfalls due to extensive manual intervention, lack of real-time insights, limited internal and external collaboration and inefficiencies due to non-standardized operations. The collections management is further entrusted to answer questions like ?who to contact?? and ?how to contact?. The following explores the key problem areas in collections, which could bolster or thwart business growth and DSO reduction initiatives, depending on how you deal with them.

People

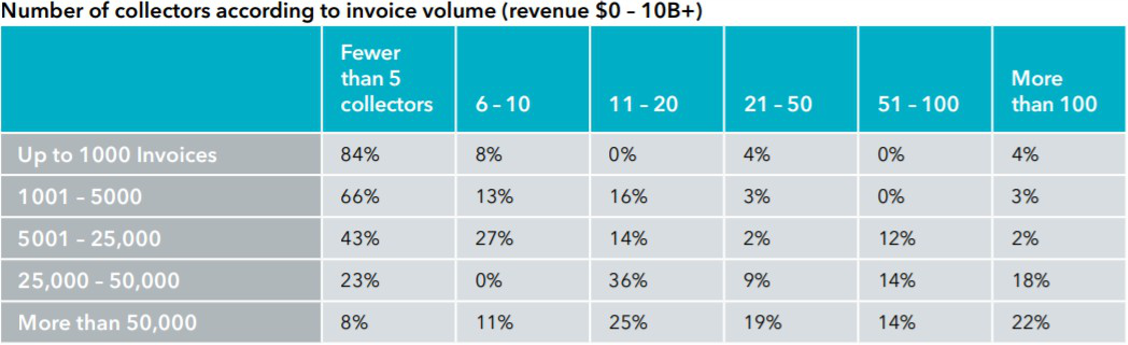

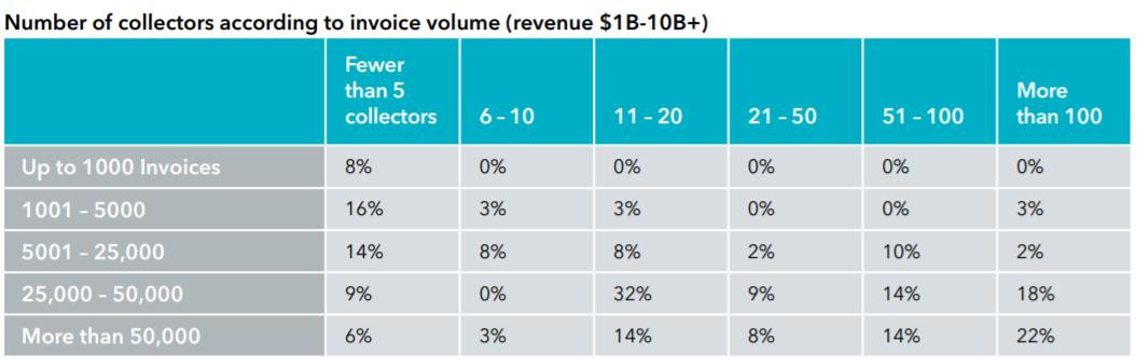

Making sure that people work as assets and do not inhibit the ability to scale the collections process is one of the most important concerns of an A/R manager. The following was concluded about staffing in collections process by the Credit & Collections Global Benchmarking Study by SUNGUARD:

A noticeable turnover in the collections staff with increasing invoice volume can destroy the DSO of the company. When turnover is high in the collections department, communication is not clear on who has been contacted, what to charge, if an invoice has been sent out or not and leads to decreased productivity and clogged operations. It can easily get out of hand if communication is not seamless and follow up can get completely disabled. Moreover, the collectors need to be educated with A/R, credit and collections best practices, the laws and regulations with respect to customer correspondence and management skills. The traditional collections management paradigm relies heavily on the skill and speed of individual collectors and therefore the collectors play a significant role in enhancing or disrupting the efficiency of collections.

A noticeable turnover in the collections staff with increasing invoice volume can destroy the DSO of the company. When turnover is high in the collections department, communication is not clear on who has been contacted, what to charge, if an invoice has been sent out or not and leads to decreased productivity and clogged operations. It can easily get out of hand if communication is not seamless and follow up can get completely disabled. Moreover, the collectors need to be educated with A/R, credit and collections best practices, the laws and regulations with respect to customer correspondence and management skills. The traditional collections management paradigm relies heavily on the skill and speed of individual collectors and therefore the collectors play a significant role in enhancing or disrupting the efficiency of collections.

Collaboration

Correspondence with other collectors, with other business teams and with the customers lies at the epicenter of the collections process. Collections cannot exist as an isolated process in business and collaboration is the key to break down the silos. Collectors need to correspond during the transition of accounts from one collector to another and in instances of account escalation. The more transparent, well-logged and seamless this correspondence is, the easier and faster the collection is. Collectors also need to collaborate with other departments like cash application to get the accurate, real-time open A/R data for generating collections worklist, credit department for getting credit scores and risk categories to evaluate the best-suited rules and strategies for collections, the deductions team to forward pre-deduction line items and stay updated on disputed invoices. Corresponding with so many business counterparts to get accurate and real-time information is a major challenge for the collectors. The most important role of collectors is to correspond with the customers through reminders, emails, and calls to collect the amount due. This collaboration is the most complex, sensitive and strategic operation as it is dependent on a number of factors like the mode of correspondence preferred by the customer, the kind of account ? Small to Medium (SME) or Large, the payment trends of the customer ? fast paying or slow-paying customer, the credit score and risk category of the customer. Optimizing on multiple, dynamic factors makes customer collaboration a huge pain point for collections teams.

Data

Data serves as a fuel to the collections engine. This includes all the information extracted from the Enterprise Resource Planning (ERP) system; the data obtained from other A/R teams like cash application, credit management, deductions management, billing, and A/P; and the information gathered from the customer like payment commitments and invoice discrepancies. Due to the diversity in the type and content of data, a single format is insufficient to store the data. Moreover, for a stable and seamless collections process, it is important to have a single source of information without having to deal with disparate points of reference to carry out their routine tasks. The operations in collections like customer correspondence are high value and strategic and hence require reliable, accurate and real-time data along with easy access to it, in the absence of which, collectors lose time and productivity falling short of meeting business objectives.

Process

Despite the evolution of collections process over decades, process inefficiencies fail to disappear from the collections operations. The shortfalls in the process include untimely or incorrect invoice delivery; inaccurate or unclear payment terms; delayed, wrong or faulty items? shipment and Accounts Payable(A/P) not receiving the invoice. A report by NACM suggests that 88% of companies are still using age and value to drive collections prioritization. Using the age of invoice value as the driver of collections prioritization leads to unworked, current, high-risk receivables rolling into past due buckets in the short-term future. The same report also states that 61% of companies do not have a method of monitoring collection output in real-time! Moreover, 59% of organizations operate in a regional or decentralized model; for companies with 50K+ in open invoices, this figure rises to 83%. This can open up a huge level of risk if the company is unable to view credit exposure across the entire enterprise while presenting challenges related to compliance with one corporate credit and collections policy. Further, 55% of companies hold up the entire invoice once there is a dispute recorded, versus segregating the disputed portion from the collectibles. Segregating the disputed portion of an invoice from the collectibles is a critical step in helping to reduce DSO and bad debt expenses associated with invoice exceptions. All the above represent the key fallouts of a non-standardized and unscalable collections process.

Technology

While using technology for automating the collections process is the current trend, a misguided decision on the ?right? technology can be the Achilles heel for a company?s receivables. The ?right? technology provides an efficient, compliant and cost-effective process. Lack of accuracy and real-time information is a major glitch in collection technologies found these days. The collections process ?needs? to have updated information about invoices and cash applications before corresponding with a customer and the glitches due to technology play a significant role in making or breaking customer relationships. Further, many collection software claims to automate prioritization while all they do is re-order the collections worklist based on some static factors like invoice value and age, which need to be manually entered and therefore give a false sense of automation. A ?right? technology would slice and dice the worklist based on a number of factors like credit score, risk category, invoice value, age along with dynamic factors like the payment trends of an account in the worklist and the size of the account. Most of the collections technologies miss out on providing functionalities like tracking correspondence with the customers and keeping their logs, monitoring the invoice delivery, options to store and add reminders for payment commitments, real-time prioritization and easy, single-touch access to information like customer account details, preferences with respect to time, mode and language for correspondence and other invoice details. Moreover, it is necessary for management to train collectors specifically to access and adopt a complex, difficult-to-use software, which involves huge cost and time without any assurance of compatibility with the company?s process and results. A lot of these technologies provide no means to access and evaluate the performance of the process. They also involve risk and exposure to power failure, computer viruses, and hackers affecting the software, if proper precautionary and security measures are not in place. All the above list the key problem areas in collections. Tackling them by measures like optimizing the skill and headcount of collectors, ensuring seamless internal and external collaboration, securing real-time data, adopting a scalable and standardized collections process and using the ?right? technology can go a long way in improving collections process and as a result help in reducing the DSO.