Why is Blockchain Important for Accounts Receivable?

This e-book is an actionable summary of how A/R teams in B2B companies could leverage blockchain to transform their business processes

Why is Blockchain Important for Accounts Receivable?

How blockchain fills the gaps in A/R processes

- Automated transaction management

- Real-time visibility for multiple stakeholders

- Fast and accurate process execution

- Stakeholders on the same page

Blockchain Opportunities in A/R

- Manual Transaction ManagementAnalysts end up being clerks instead of doing researchAnalysts spend a major chunk of their time doing low-value, manual work such as remittance aggregation, invoice preparation, deduction coding, collaborating with multiple stakeholders.

- Limited visibility/transparencyLimited visibility = inability to identify areas of improvementAbsence of a single source of truth provides limited managerial visibility. Analysts need to gather data manually from individual processes, resulting in inaccurate, outdated statistics and making it difficult for process owners to adopt process improvements.

- Error-prone and sluggish process executionAnalysts commit mistakes in doing manual workDependency on a largely manual-driven process is slow and prone to errors.

- Limited trust among stakeholdersSuppliers and buyers are not in syncDue to limited visibility and data stored in disparate sources, there is limited trust between suppliers and buyers. Lack of transparency leads to complicated referral and credit scoring mechanisms, and untimely payment of invoices.

How blockchain fills the gaps in A/R processes

Accounts receivable accruals automation

For A/R accruals, following proper accounting standards requires periodic auditing, keeping track of payments received, and allocating them in either of receivables, liability or revenue. For tracking hundreds of A/R accruals, the process is time taking, cumbersome, and prone to errors.

Smart contractsenable real-time reconciliation of A/R accruals for both suppliers and buyers by getting triggered at each stage of service completion, eliminating the need for accountants to record individual transactions but rather monitor them.

Real-time visibility for multiple stakeholders

Reducing deductions

Deductions are a common occurrence for CPG, Food & Beverage and Apparel industries arising out of reasons such as discounts, damaged goods, late deliveries. For CPG giants such as Walmart, it results in hard to resolve conflicts with suppliers.

Chief Product Officer at HighRadius, Sayid Shabeer, explains:

“Conflict resolution often gets delayed because of restricted access to data owned by different stakeholders. For example, stakeholders from different departments among both suppliers and customers (Walmart), logistics providers, auditors, as well as issues related to traceability of related transactions and documents.“

Blockchain technology provides the much-needed level of transparency required to avoid these conflicts from happening. Or, simply resolve them in an automated manner, without complications.

Shabeer continues, “Walmart could, for example, host a blockchain for trucking companies so that both suppliers and Walmart could use the distributed ledger for reconciliation. The expedited resolution of disputes would benefit both the suppliers and the buyers in relation to AR/AP.”

Fast and accurate process execution

Pre-approved transactions for faster procure-to-pay cycle

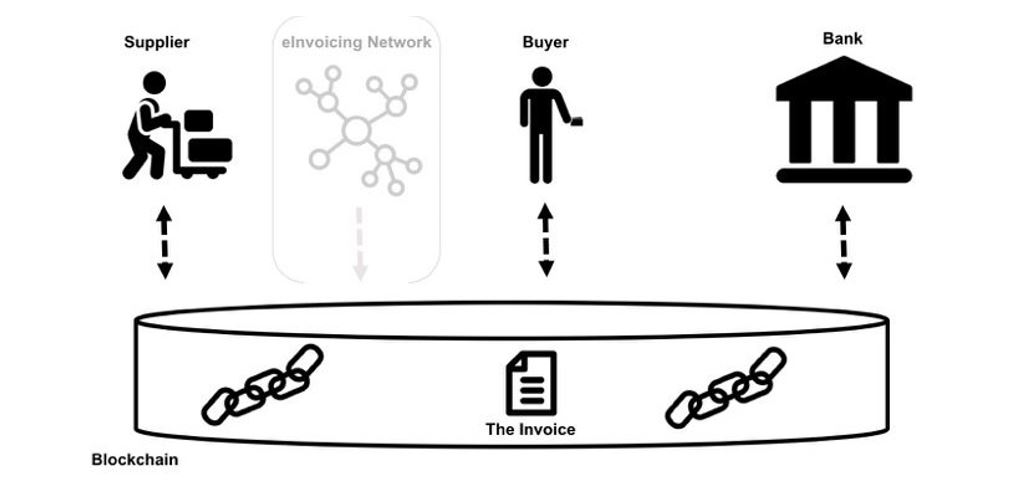

In current A/R processes, different versions of the same invoice are stored in disparate locations such as supplier’s billing system, buyer’s accounting system, supplier side e-invoicing provider’s database, and financial institution records. Each invoice copy gets modified independently from each other, making it inconsistent with other versions and leading to inefficiencies across the order-to-cash cycle.

Fig : Blockchain as the single source of truth, Source: Blockchain First, Markus Ament

With a distributed ledger, every participant has access to a single valid document and use it for further processing in their ERP system. Hence there are no inconsistencies with A/R and A/P. The buyer could also embed remittance details into the blockchain which everyone can access.

“Buyer generated purchase order and supplier received sales order is the same blockchain”

This eliminates the need to

- generate invoice

- pause for human validation

- approve agreed transactions

- issue remittance

- manually record individual transactions

All this results in accelerated settlements and improved cash flow.

Stakeholders on the same page

Increased trust among stakeholders through centralized credit information accessibility

Blockchain technology would help increase trust among clients and vendors through easy access to buyer credit score across the supplier community based on buyer payment behavior, purchase history, the validity of deductions claimed. The accumulated and stored history of transactions would help build trust and transparency among stakeholders.

“Distributed credit information accessibility leads to swift distribution of authentication rights”