Guide to buying and implementing treasury technology

A step-by-step process of buying and implementing treasury technology and get started with your digital transformation in treasury.

Prerequisites: How to get started with buying treasury technology

Digital transformation projects come with a lot of how-tos and what-tos. Implementing new technology requires proper guidance and care.

Things to consider before you embark on your buyer’s journey:

Here’s a quick table that summarizes the key essential points you need to consider with each step.

| Vision |

|

| Business requirements analysis |

|

| Stakeholders buy-in |

|

| Budget, cost, and benefits |

|

| Third-party consultants |

|

Vendor selection and shortlisting

Once you have sorted out your business requirements, your vision, budget, and the stakeholder’s buy-in, you are now in the most tricky phase in the buying process. A successful implementation comes down to choosing the right technology and the right technology vendor.

2.1 Identify vendors

- Cast a wide net

- Research on the latest technology options in the market and features provided by vendors by browsing through Google, LinkedIn, or by attending conferences (both online and offline).

- Reach out to the existing users to understand their experience with the product.

- Screen the vendors

- Screen via online technology guides such as AFP, Strategic Treasury, Bob’s Guide, or other treasury technology resources.

- Browse vendor websites

- Visit vendor websites to gather product collateral and read client stories for better understanding product capabilities.

- Set up an initial call or a brief demo

- Understand the genuineness of the solution and the solution provider.

- Gather information from vendors on the most recent technology, market trends, and product changes.

A few items should be kept on hand before the demo call, such as:- The current landscape or process of the company

- The current problems and challenges

- The priorities, including the ‘must-haves’ and the ‘extras’

- The planned budget

- The general timelines

- The buying plan

Once you’ve seen all the demos, selected a few top vendors, and answered all the last-minute questions, it’s time to decide. For each organization, the final decision will be made differently, and it will often involve comparing prices, considering delivery times, and taking security into account.

2.2 Prepare an RFP (Request For Proposal)

RFP is one of the most important documents you’ll generate as a client during the technology buying process. While preparing an RFP, make sure to

- Give a brief project overview

- State your company’s background information and core values

- Emphasize your goals and objectives clearly

- Highlight the selection criteria

- List the pricing structure and calculate ROI

Once the RFP is completed, send out to different selected vendors and score their responses.

Refer to this vendor evaluation scorecard to compare vendors objectively feature-wise.

After looking at the evaluation scorecard and calculating the final weight scores, it becomes easier for the C-suite to decide which vendor to choose.

Adding another layer of detail to the vendor shortlisting process, the committee should look for certain exceptions and a few final details before choosing the right vendor. These details are

After the vendor selection, it is essential to build a business case and present it to the C-suite. This business case would help the senior executives get an overview of the planned automation project and the vendor’s contribution to it. While building the business case, it is important to highlight the Savings & Average Rate of Return(ARR) as the C-suite is always eager to know what profit their investments would bear soon.

Contracting knowhow

Contracts govern almost every interaction between businesses. A closed deal isn’t officially set in stone until someone signs on the dotted line. Contract agreement is critical to the project’s success as it will form the basis of any redress if something does not perform as expected.

Furthermore, here are some of the best practices or tips/tricks for the smooth flow of the contract agreement:

- Pre-negotiating the essential components of your deal, such as the price of the product, the scope, and length of the agreement before entering the contractual negotiation.

- Collecting the additional documents that might be helpful for the IT department from the cash vendor beforehand.

- Choosing the payment terms of 40-60 days is somewhere between the happy medium.

- Using the blended rates to keep the budget in check.

- Maintaining good versions of the agreement’s draft before passing back and forth.

- Planning ahead for urgent contracts and negotiations, which allows ample time for legalities.

Treasury technology implementation 101

Once done with all the basic requirements of buying a treasury technology, from gathering resources, planning the budget, creating a team, completing the RFP process, and selecting the best solution for your organization, it’s time for the implementation phase.

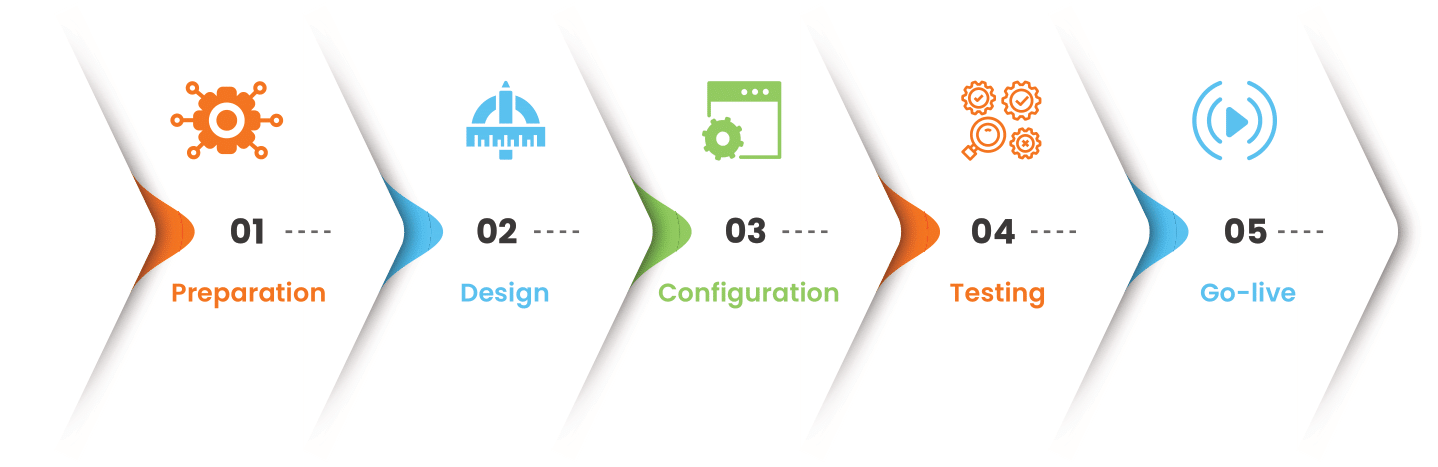

Let’s talk about how to navigate the implementation process. Most vendors will use a 5 phase implementation methodology. Here’s a breakdown of the 5-phases:

01. Preparation

- Also known as As-Is, Analyze, or Just preparation.

- The vendor initiates the project onboarding process after signing the contract.

- Pro-tip: Allow your most knowledgeable resources to participate in the As-Is sessions. Be prepared to share current files, reports, and the best way to do this is to walk the vendor step by step on your daily process and let the vendor ask questions along the way.

02. Design

- This phase is where the vendor will prepare the To-Be blueprint document to show you how the system will be configured for you based on the data they gathered during the As-Is session.

- You and your SME team need to ensure that you are clear on how the system will work with your own data.

- Most likely, the vendor will either provide you with a design or blueprint document or sometimes even configure a test system and walk you through it with a subset of your data. There’s usually a signoff tollgate event during this phase where the vendor will not proceed with the next phase until you have signed an agreement.

03. Configuration

- The typical tasks are the configuration and or loading of your master data, integrations with your ERP, integrations with banks, and integrations with third parties if they are part of the scope.

- During this phase, your core project team will be trained on the system in preparation for the test phase that will start once the configuration is completed.

- Some vendors will provide you with test scripts. Even if your vendor provides test scripts, you might still want to add steps to your scripts that are not necessarily relevant to the system, but it will be part of your daily process.

04. Testing

- During this phase, it’s key that your core team participates heavily in executing the test scripts. This is where you must ensure that the system delivers the value you expect based on what you signed off during the design phase.

- It is necessary to block time daily for your key users to execute the test scripts and to have frequent standing calls with your vendors to review issues you might encounter during testing. The sooner you can test and report issues to your consultants, the sooner they can solve them and allow you to retest.

05. Go-Live

- Once you have signed off on the test phase then, the cutoff activities will happen, and your vendor will move configurations and data required to your production environment that you will be using on a live mode.

- Once you’ve agreed on your go-live date, it is important that you use your new system as the system of record.

Summary

Treasury today must be agile to swiftly react to changing circumstances, rather than relying on outdated systems. The need of the hour is to conduct a comprehensive examination of internal processes to identify components that must be kept and those that may be enhanced utilizing the current technological solutions.

With relative certainty, technology is currently altering the way the Treasury runs. As new features and functionalities are introduced to these systems, they continue to improve Treasury processes. One such aspect is using a voice-enabled virtual assistant to make working with these solutions even easier. When workers enter into the solution, another option is to display an ordered work schedule on a dashboard. Treasury’s future is bright, with so many features that substantially enhance productivity.

Over time, vendors and service providers engaged in newer technologies will become more experienced in their fields.