Checklist for treasury tech in 2022: How treasury software meets the expectations

Treasury technologies are shaping the treasury department towards a more strategic future by automating recurring tasks and increasing forecast accuracy. Read this eBook to discover how treasury software meets the expectations in the checklist for treasury tech in 2022.

Strategic value from using a treasury software

Treasury software automates a company’s financial operations such as cash flow, assets, and investments. With that, it also automates the management of a company’s cash positions, debits and credits, interest rates, and foreign exchange rates. It gives CFOs real-time visibility into the company’s financial position, tracks payables and receivables, ensures that the funds are being used properly, and manages global, multi-bank payments. With an accurate cash position as a preliminary step, it is easier to create and analyze global cash forecasts by day, week, month, or year by leveraging multiple data sources.

Benefits of using treasury software

The following are the benefits of using a treasury software:

- Optimizes cash: A treasury software solution provides the clarity and visibility required to support critical financial decisions and strategic business goals.

- Controls bank accounts: A treasury software’s value proposition is generally seen in the bridge to multiple banks and accounts by providing flexibility in banking and connectivity.

- Manages liquidity: Treasury software enables smarter financial decisions by providing greater visibility into cash and payments.

- Tracks A/P and A/R: Treasury software is capable of accurately tracking A/P and A/R. Accurate A/P and A/R tracking have the potential to impact bottom-line improvements such as cost control and productivity enhancement.

- Supports bank payment: A treasury software provides global, multi-bank payment, which aids users to incorporate payment and disbursement.

Evolution of treasury software

Treasury software has evolved and will likely evolve further as the business landscape changes. There are numerous challenges associated with treasury management, such as forex volatility, rapidly evolving market restrictions, and regulatory changes, which has made treasury software a requirement for almost all businesses these days, regardless of size or type.

The four phases in the evolution of treasury software

- First phase (From 1947 to 1970): Transactions are processed manually and in a decentralized way using registers.

- Second phase (From 1971 to 2006): The use of spreadsheets and computers increased transparency and control over financial risk management.

- Third phase (From 2007 to 2015): Treasury software has become a necessity for businesses of all sizes due to the need for globalization, efficiency, and closer collaboration with business partners.

- Fourth phase (From 2015 to 2021): Further automation and centralization have increased the emphasis on internal controls and reporting, making the role of treasury software much more important.

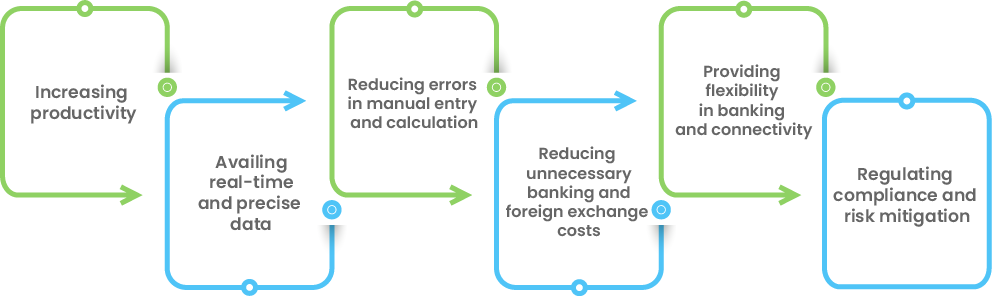

Role of a treasury software in achieving strategic business growth

A treasury software provides complete cash visibility, which is a basic requirement for any organization. Aside from that, a centralized treasury software can assist in making wise financial decisions and achieving strategic business goals by:

- Increasing productivity: A treasury software excels at streamlining and automating manual processes and time-consuming data management tasks, thereby increasing daily productivity. Automation reduces overall organizational bottlenecks and reduces dependence on different places.

- Availing real-time and precise data: Treasurers use treasury software to access and view financial data, as well as to benefit from integrated reporting tools that extract real-time data to make informed decisions. The main advantage of real-time data availability and reporting is that treasurers can optimize their short-term cash management and view historical cash flows.

- Reducing errors in manual entry and calculation: Users create digital automation workflows for easier data entry and data verification using treasury software.

- Reducing unnecessary banking and foreign exchange costs: Treasury software can provide quantitative benefits by consolidating payment systems and banking relationships, resulting in lower cross-bank and FX fees.

- Providing flexibility in banking and connectivity: A treasury software’s value proposition is typically seen in the bridge to multiple banks and accounts. Corporate treasurers can use a centralized treasury software to take advantage of emerging connectivity options and switch providers without slowing down productivity by having complete control over their cash and activity.

- Regulating compliance and risk mitigation: Utilize integrated risk mitigation functionality to ensure company-wide compliance with industry regulations within the systems. Users can also ensure that the organization is fully compliant with the emergence of global and regional financial messaging standards such as SWIFT, SEPA, and ISO20022.

Checklist for selecting the best treasury technology in 2022

A well-featured treasury software can automate, record, and control treasury functions accurately. The selection of the right treasury software can be easier said than done. Mentioned below are some of the features a company should look for in a treasury software vendor before investing in one:

-

Cash Management: The treasury software you choose should allow you to easily view the historical data and forecasted information relating to the cash flow in the organization to help manage cash and liquidity.

Some of the ways in which a treasury software with the cash management feature helps is:

- Tracking cash inflow and outflow transactions on operating, investing, and financing activities in real-time.

- Monitoring the status of a cash transfer (sent, in transit, delivered).

- Automating cash transaction classification (Accounts Receivable, Accounts Payable, Taxes, Payroll, etc.).

- Tracking cash balances across multiple bank accounts, currencies, regions, and entities.

- Automating cash positioning (daily, monthly, yearly) based on cash flow data from bank statements.

- Calculating and monitoring working capital.

- Monitoring current and quick liquidity ratios in order to plan operating, investing, and financing cash activities.

- Reallocating cash between bank accounts and intercompany accounts according to rules based on liquidity needs.

- Reconciliation: The treasury software a company chooses should help with the following matters through the reconciliation feature:

- Automatically matching data on cash transactions provided in bank statements with those recorded in the general ledger.

- Cash reconciliation on a one-to-one, one-to-many, or one-to-all basis based on predefined rules.

- Automatically defining outstanding transactions and flagging them for manual reconciliation.

-

Payment Management: Whether it is about current payments or scheduling payments, your treasury software should allow you to manage all your global payments in a centralized and secure manner.

Some areas a centralized treasury software helps in are:

- Payments to vendors, suppliers, contractors, and others, both scheduled and ad hoc.

- Principal and interest payments on existing liabilities are calculated and scheduled automatically.

- Using user-defined rules, assigning optimal bank accounts and payment methods (e.g., ACH, BACS) for various payment transactions.

- Multi-currency cash pooling, POBO and COBO services, and multilateral netting via in-house banking.

-

Debt & Investment Management: A company’s treasury software should help in the storing, tracking, and executing of contracts, debt activities, FX exposures, and other documents with high-end security.

Debt & Investment Management helps in the following areas:

- Monitoring real-time debt and investment transactions across multiple asset classes, including stocks, bonds, and cash equivalents.

- Opening, confirming, renewing, and closing debt and investment transactions based on rules.

- Calculating capital gains and losses, interest earned, average daily balance, weighted yields, duration, and total return by investment portfolio, asset class, currency, and region.

- Developing custom investment portfolio structures that include a variety of asset types.

- Generating schedules based on investment and debt maturity dates automatically.

- Limiting debt and investment transactions,

-

Financial Risk Management: Businesses can easily analyze risks with the help of treasury software and design risk management strategies to benefit the organization in terms of profitability and sustainability.

Some of the areas it can help with are:

- Calculating and monitoring liquidity and credit risks using current liquidity ratios, up-to-date credit rates, and aggregated market data on asset volatility

- Limiting maximum exposure to liquidity, credit, and market risks.

- Calculating the Cash Flow at Risk (CFAR) and the Value at Risk (VAR) (VaR).

- Calculating the fair value of assets and liabilities, as well as credit and debit valuation adjustments (DVA).

- Tracking real-time FX rates and commodity prices.

- Calculating FX and commodity exposures

- Monitoring transactions involving hedging activities involving various derivative instruments.

- Trade Finance Management: Treasury software help a business manage trade finance by monitoring trade finance activities, including factoring, forfaiting, etc., in addition to other things such as:

- Classifying received trade finance documents by type with the help of AI.

- Extracting, validating, and storing relevant data from documents to monitor current assets, liabilities, and due dates on payments under trade finance activities.

- Calculating fees, charges, commissions based on interest rates, and additional charges under various trade finance forms automatically.

- Setting, tracking, and adjusting trade credit limits.

-

E-Bank Account Management (e-BAM): A good centralized treasury software manages multiple bank accounts, including downloading bank statements, analyzing bank fees, etc.

It should take care of various functions such as:

- Creating, modifying, and closing bank accounts.

- Setting cash transaction limits and cash balance thresholds for different bank accounts.

- Keeping track of, analyzing, and comparing bank fees across multiple bank accounts.

- Assigning, tracking, and changing signatories.

- Making sure FBAR compliance is met.

-

Analytics & Forecasting: An automated treasury management system helps organizations analyze their historical data to forecast cash flows based on the historical and current data on cash transactions, the company, and customer payment behavior trends.

It can also help in the following areas:

- Forecasting on financial gains from debt and investment activities based on historical and current debt and investment transaction data, financial market data projections on FX, interest, and credit rates.

- Forecasting of short- and long-term liquidity.

- Performing prospective/retrospective effectiveness to analyze and compare various hedging strategies.

- Analyzing regression.

- Testing for stress.

- Experimenting with different scenarios.

- Reports & Dashboards: Treasury technologies help with automated reports and dashboards. When selecting a particular software, companies need to check if it offers the following features:

- Dashboards with drill-down capabilities.

- Reports on financial transactions, including cash, debt, and investment, as well as hedging transactions, that can be customized (by period, currency, region, and bank account).

- The total cash balance, including cash positions.

- Actual cash flow vs. forecasted cash flow.

- Actual vs. anticipated financial gains and losses from debt and investment activities.

- Ratios of liquidity.

- Net working capital.

- Security & Compliance: A centralized treasury software provides help in security and compliance in the following areas:

- Multi-factor authentication.

- Role-based access control.

- Data encryption.

- Electronic signature workflow.

- Full audit trail for each financial transaction.

- AI-based fraud protection.

- Regular vulnerability scanning.

- Compliance with IAS 39, IFRS 9, IFRS13, ASC 718, ASC 815, ASC 820, FAS133, EMIR (for EU), SOX, PSD2, ISO 20022, industry-specific regulations.

It can be confusing to go through the process of selecting a best-fit treasury software with so many options available in the market. This vendor scorecard showcases the best way to evaluate a vendor to ensure you get the maximum benefit from your centralized treasury software.

How HighRadius’ treasury software meets expectations in the checklist

The HighRadius automated treasury management software is the world’s first AI-powered solution, designed to support treasury teams across all industries by automating and enhancing their cash forecasting, and cash management processes.

Key features of the treasury software:

- Bespoke AI Models optimized for your needs

- Compatible with all systems from local to global

- Better control and visibility over automated forecasts

- Auto roll up of forecasts from local to global levels

- Variance analysis with detailed insights

- Continuous improvement of forecasting accuracy

- Real-time global cash visibility

- Automated bank statement processing

- Auto-classify bank inflows and outflows

- Previous day and intraday cash positions

- FX translated cash positions

In today’s competitive business environment, the market is populated with a wide range of treasury software that can address the needs of any organization. Whether it is SaaS, cloud-based, or a custom solution, one must be specific when selecting treasury software because cash and liquidity are the most sensitive aspects of an organization.