Many business leaders know the frustration of strong sales on paper but weak cash in the bank. In fact, 60% of CFOs state late payments as their #1 challenge. Finance teams spend hours chasing payments, sending reminders, and updating spreadsheets, only to find visibility into receivables that are still unclear. This constant juggling not only drains productivity but also creates real risks for planning and growth. That’s why companies are adopting accounts receivable tools to keep cash flow steady.

Software for accounts receivable management gives companies the structure they need, replacing scattered efforts with streamlined workflows and clear visibility into every outstanding invoice. In this blog, we have curated a list of the top 11 accounts receivable automation platforms that are helping businesses move away from manual methods and toward modern, efficient receivables management.

Here’s a quick look at the top accounts receivable platforms in 2026. Find the right AR software to streamline collections and improve cash flow for your business.

| Platform | Best Suited For |

| HighRadius | Large and mid-sized companies seeking advanced AI-driven automation for the entire AR process with seamless ERP integration. |

| Billtrust | Mid-to-large firms focused on digitizing the AR cycle. |

| Versapay | Teams focusing on collaborative AR and customer interactions. |

| Bill | Small to mid-sized businesses seeking a unified AR process and invoicing. |

| Quadient AR | B2B finance teams tasked with automating collections outreach. |

| Esker | Companies looking for e-invoicing and cash application automation. |

| Gaviti | Businesses seeking modular AR features and predictive insights. |

| Invoiced | Companies that manage complex or recurring billing. |

| Upflow | Fast-growing B2B teams streamlining collections. |

| Tesorio | Mid-market and enterprise firms seeking cash flow insights. |

| Younium | SaaS & subscription businesses managing billing and dunning. |

Accounts receivable tool is a system that automates and streamlines the financial operations of the accounts receivable process. It reduces the manual effort involved in tasks such as generating and sending invoices, tracking payments, and following up on late payments. This helps businesses collect payments faster, reduce errors, and improve cash flow visibility.

An accounts receivable automation software helps finance teams stay ahead by creating a structured, efficient process for billing, collections, and cash application. Here are key reasons businesses need AR automation:

HighRadius is a cloud-based accounts receivable automation platform designed to streamline the entire accounts receivable process. It provides end-to-end automation from credit, invoicing, cash applications, collections, and deduction management. With agentic AI capabilities, the platform predicts late payments, prioritizes collection activities, and provides real-time visibility into key business metrics like DSO, past dues, etc., driving lower bad debt, higher productivity, and an improved net recovery rate. It integrates with major ERPs, supports global compliance, and offers customer self-service portals to simplify payments.

Key Features:

HighRadius: Recognized Leader 3 Years in a Row in Gartner® Magic Quadrant™ for Invoice-to-Cash

Download The ReportBilltrust is a unified accounts receivable automation platform for invoicing, payments, cash application, and collection, serving mid-sized to large enterprises. Billtrust’s strengths include robust digital billing features and superior payment processing capabilities, particularly for batch processing and payment scheduling.

Key Features

Versapay differentiates itself with a "Collaborative AR" approach that focuses on connecting AR teams with their customers in a cloud-based portal. The platform’s core strength is in its ability to facilitate real-time communication, share documents, and resolve disputes, transforming the collections process from a back-office function into a collaborative one.

Key Features

Bill excels in streamlined AR automation with intuitive workflows designed for small to mid-market businesses. It offers strong automated workflows for invoice entry, approval, and payment scheduling, with seamless integrations with major accounting software like QuickBooks and NetSuite.

Key Features

The platform is designed to make the O2C process more efficient for B2B finance teams across a wide range of industries. It offers a comprehensive suite of features, including collections management, credit assessment, and AI-powered analytics.

Key Features

Esker is a sophisticated AR automation solution that combines a comprehensive suite of tools with advanced AI capabilities. The platform's core functionality is built around four specific AI engines that serve different purposes: predictive analytics, prescriptive analytics, data extraction, and content analysis.

Key Features

Gaviti’s core value proposition is its unparalleled flexibility and a platform "built around you, not the other way around". Gaviti’s modular product structure allows companies to select only the features they need, such as credit management, dunning, dispute management, cash application, or a payment portal. This modularity makes it a suitable fit for both medium-sized companies and large enterprises.

Key Features

Invoiced is a platform that serves a wide range of customers, from freelancers to enterprises, with a focus on streamlining invoicing, payments, and collections. It has been consistently praised for its ease of use, intuitive interface, and high-quality customer support. The platform excels in digital billing and credit management, and some comparative reviews highlight its superior ease of use and setup.

Key Features

Upflow is a collections-focused AR automation platform designed to simplify the cash collection process for fast-growing B2B companies. Its strategic approach is built on a foundation of simplicity, transparency, and a clear focus on core collections functionality. The platform's main features include automated collection workflows, customizable dunning strategies, a self-service customer portal, and dashboards that provide real-time KPIs like DSO.

Key Features

Tesorio's core value proposition is to transform AR operations from administrative tasks into strategic growth drivers by providing highly accurate cash flow predictions. The platform's functionality is built on four pillars: intelligent workflow automation, predictive analytics, connected systems, and performance analytics. The tool supports multi-entity operations and is designed to scale with enterprise-level organizations.

Key Features

Younium is a specialized AR automation and financial management platform designed to address the unique complexities of subscription and SaaS businesses. It is not a general-purpose AR tool but a niche solution that serves as a "single source of truth" for the entire quote-to-cash process. The platform’s key features are built to handle the intricacies of recurring revenue models, including flexible pricing (flat, tiered, usage-based), complex billing schedules, and automated dunning for subscription renewals.

Key Features

With so many options available, choosing the right accounts receivable software for business can feel overwhelming. The key is to match the tool to your business size, industry, and long-term financial goals. Here are quick considerations for you to keep in mind:

Managing cash efficiently depends on having the right processes in place. The ideal accounts receivable software for businesses handles everything from invoicing and collections to cash application and deductions. By unifying these functions, it reduces process gaps and ensures consistency across the entire order-to-cash cycle.

Cash flow can be unpredictable, but software with predictive capabilities can help. By analyzing historical payment patterns and current receivables, the system highlights accounts that may pay late and prioritizes them for collections.

Accounts receivable doesn’t operate in isolation. The software should integrate seamlessly with ERP platforms like SAP, Oracle, or Microsoft Dynamics. Real-time integration ensures that all financial data is accurate and up to date, and it removes the need for repeated manual data entry that can cause errors.

Every business faces different credit risks. The right accounts receivable automation platform lets finance teams set rules for credit approvals and order limits based on risk profiles. These rules can be adjusted as circumstances change, helping protect cash flow without slowing down operations.

Keeping in touch with customers is critical, but it can also be time-consuming. AR platforms that automate communications—via email, portal notifications, and reminders- ensure follow-ups are consistent, timely, and effective. This keeps collections on track while reducing the manual workload.

Maintaining a clear record of all AR activities is essential for both internal controls and regulatory requirements. The accounts receivable automation platform should provide detailed logs of actions, approvals, and updates. For full visibility, choose a software for accounts receivable for business that logs all invoice and payment actions, making audits simple and ensuring compliance.

Understanding accounts receivable performance at a glance saves time. Dashboards should display metrics like days sales outstanding (DSO), overdue invoices, and collection efficiency. Clear visualizations help finance teams spot trends, identify bottlenecks, and respond quickly to potential issues.

As businesses grow, accounts receivable management software must keep pace. It should be able to handle higher transaction volumes, multiple subsidiaries, and international operations without performance issues. Cloud-based platforms are especially effective for this, as they can scale resources dynamically.

Financial data is highly sensitive. Leading accounts receivable automation platforms include role-based access, data encryption in transit and at rest, multi-factor authentication, and adherence to compliance standards such as GDPR and SOX. These measures safeguard data while giving teams confidence in the system.

Account receivable software shouldn’t just manage day-to-day operations. It should also provide insights that help CFOs and finance leaders make strategic decisions. Whether it’s cash flow planning, risk assessment, or prioritizing collections, actionable data ensures that AR processes align with broader business goals.

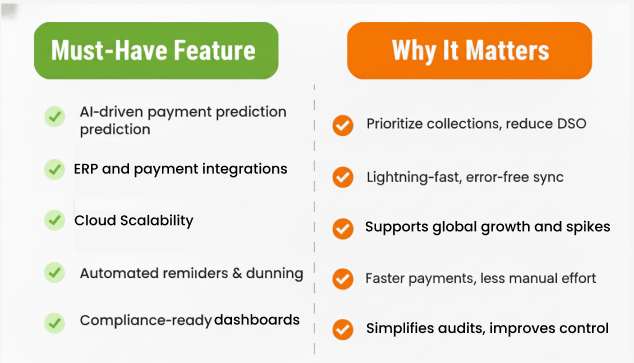

The best AR automation software in 2026 goes beyond invoice tracking — it uses AI, analytics, and predictive insights to accelerate cash flow and reduce manual work. Finance leaders are now prioritizing tools that integrate directly with ERP systems, automate collections, and deliver real-time visibility into receivables performance.

When comparing solutions, CFOs should evaluate:

Modern AR automation goes far beyond billing and reminders. The best accounts receivable software platforms in 2026 feature AI-powered invoice matching, real-time cash flow dashboards, ERP integration, customer portals, and advanced compliance controls. These capabilities help finance teams reduce manual work, improve collections, and boost cash flow, all vital for scaling operations and avoiding late payments.

Managing accounts receivable does not have to feel like a constant chase. The right AR automation software can make a real difference by reducing manual work, speeding up payments, and giving your finance team clearer visibility into cash flow. The key is to find a solution that fits your business, integrates smoothly with your existing tools, and is easy for your team to use.

With the right software for accounts receivable, you can stop worrying about overdue invoices and focus on growing your business, building better customer relationships, and making smarter financial decisions.

Highradius accounts receivable platform brings AI-driven intelligence and specialized tools to help businesses streamline their AR processes. It helps simplify collections, improve cash flow, and transform accounts receivable from a routine task into a strategic advantage for your business.

** This blog reviews 11 AR software solutions; the 1–11 sequence is for reference only and does not indicate ranking or quality.

Accounts receivable automation software can significantly reduce manual work, accelerate cash flow, and improve overall efficiency. Key benefits include faster invoice processing, reduced Days Sales Outstanding (DSO), improved accuracy in cash application, and better visibility into receivables performance.

AI enhances accounts receivable automation by providing intelligent prioritization of collection efforts, predictive analytics for payment behavior, and automated cash application. It can also assist in dispute resolution and offer insights for optimizing credit decisions and collection strategies.

When selecting an accounts receivable automation platform, consider factors such as integration capabilities with existing systems, scalability, ease of use, implementation time, customization options, and return on investment. It's also important to evaluate the specific features that align with your business needs and processes.

Accounts receivable automation can improve customer relationships by providing self-service portals, offering flexible payment options, and enabling more personalized communication. It also reduces errors and disputes, leading to smoother transactions and increased customer satisfaction.

HighRadius leverages AI and machine learning to automate invoice processing, cash application, and collections. It helps businesses reduce DSO (Days Sales Outstanding), improve cash flow visibility, and minimize manual effort. With seamless ERP integrations and predictive analytics, HighRadius enables finance teams to make smarter, data-driven decisions.

Yes, HighRadius seamlessly integrates with major ERP platforms like SAP, Oracle, and NetSuite. This ensures real-time data synchronization, reduces manual data entry, and keeps accounts receivable processes aligned with your existing financial workflows.

By automating invoicing and payment reminders, accounts receivable software for business ensures timely and accurate billing. This reduces disputes, strengthens trust, and allows finance teams to respond quickly to customer queries, improving overall satisfaction.

The accounts receivable software provides detailed dashboards and reports for real-time visibility into outstanding invoices and cash flow, while maintaining audit trails and regulatory compliance, making financial reporting easier and more accurate.

The best AR automation software uses AI and analytics to match payments automatically, send reminders, and forecast collections. This reduces manual work, improves accuracy, and speeds up cash realization for finance teams.

Accounts receivable software applications are digital tools designed to automate and streamline the entire accounts receivable process, from invoicing and collections to cash application and reconciliation. These applications help finance teams improve cash flow, reduce errors, and gain real-time visibility into outstanding payments.

Modern accounts receivable software applications leverage artificial intelligence (AI) and automation to predict customer payment behavior, automatically match payments to invoices, and prioritize collection activities. This reduces manual workload, speeds up cash conversion, and enhances the accuracy of financial reporting.

Analyst firms like Gartner, Forrester, IDC, and HFS note that accounts receivable software applications are evolving with:

Software for accounts receivable improves cash flow forecasting by using real-time payment data, historical trends, and AI-driven predictions to estimate when invoices will be paid. This helps finance teams plan liquidity, reduce surprises, and make more informed working capital decisions.

Software for accounts receivable strengthens credit management by centralizing customer credit data, automating risk scoring, and monitoring payment behavior. This enables finance teams to set smarter credit limits, reduce defaults, and maintain a healthier receivables portfolio.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center