Finance teams are struggling with slow collections, rising labor costs, and manual AR workflows that can’t keep up with business growth. These fragmented invoice to cash processes not only drain productivity but also cost organizations 3–5% of EBITDA, leading to revenue leakage and unpredictable cash flow. Invoice-to-Cash automation eliminates these bottlenecks by accelerating payment cycles, improving accuracy, and delivering AI-driven insights through deep ERP integration. This guide covers the leading platforms that can help future-proof your AR operations in 2026.

Unmatched Invoices. Unseen Losses. Unstoppable Fix.

See how AI powered Invoice to cash software helps Fortune 1000 firms fix invoice mismatches, recover hidden cash, and stop revenue leakage

Download NowWith AI, customer portals, and deep ERP integrations now standard, today’s invoice to cash solutions are reshaping how finance teams operate. Below is the list of leading invoice to cash automation solutions that are setting the benchmark for speed, accuracy, and smarter AR management.

| Platform | Best Suited For |

| HighRadius | Mid-to-large enterprises with complex, multi-entity Invoice-to-Cash operations looking for AI-led automation, global ERP connectivity, and analytics. |

| Billtrust | Mid-to-large companies seeking faster invoicing, integrated payments, and improved visibility into cash flow. |

| Invoiced | High-growth SMBs and SaaS firms looking for quick deployment, recurring billing, and self-service payment capabilities. |

| Esker | Global enterprises aiming to unify AR processes through a modular, AI-driven automation suite. |

| BlackLine | Public companies and audit-focused finance teams prioritizing AR accuracy, compliance, and close automation. |

| Gaviti | Mid-market firms targeting DSO reduction through AI-driven collections sequencing, and risk-based prioritization. |

| YayPay (Quadient AR) | Organizations managing multi-format remittances that need AI-powered cash application and collaborative dispute management. |

| VersaPay | B2B enterprises seeking a collaborative, customer-facing invoice-to-cash workflow with real-time payment visibility. |

| Tesorio | Finance teams focused on cash flow forecasting and collections optimization through predictive analytics |

| Emagia | Multinational corporations seeking a unified AR platform with multicurrency support. |

Invoice to cash automation is a solution that streamlines the full AR cycle—from invoice generation, through collections, dispute resolution, cash application, and reconciliation. Invoice to Cash software digitizes workflows, automates reminders, enables online payments, and uses AI to accurately match payments with invoices, reducing manual effort and delays.

Businesses use Invoice to Cash to accelerate DSO (days sales outstanding), reduce manual data entry and clerical mistakes, and increase finance team productivity. In addition, automation makes cash positions and receivables status visible in real time, giving CFOs actionable insights that drive strategic financial decisions.

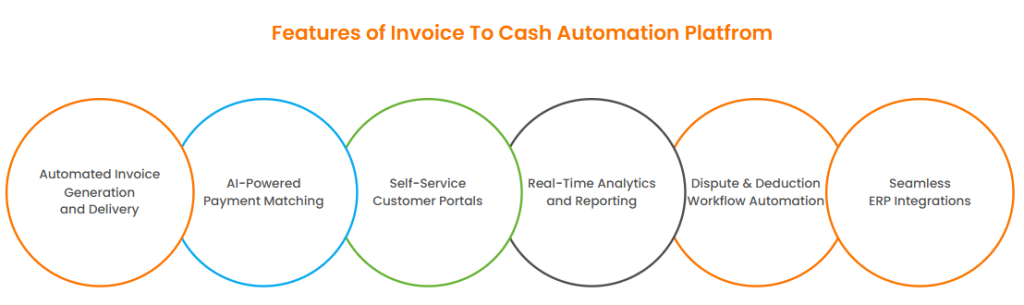

Today's most reputable invoice to cash automation solutions deliver a robust set of capabilities designed for speed, accuracy, and visibility. Here are a few features to look for when choosing invoice to cash automation platform:

In 2026, the invoice-to-cash software market continues to evolve as finance leaders prioritize automation, faster cash realization, and ERP connectivity. From AI-driven cash application to end-to-end AR Automation, these platforms help enterprises and mid-market firms improve accuracy, reduce DSO, and streamline workflows. Below are the top 10 Invoice to Cash solutions leading the charge.

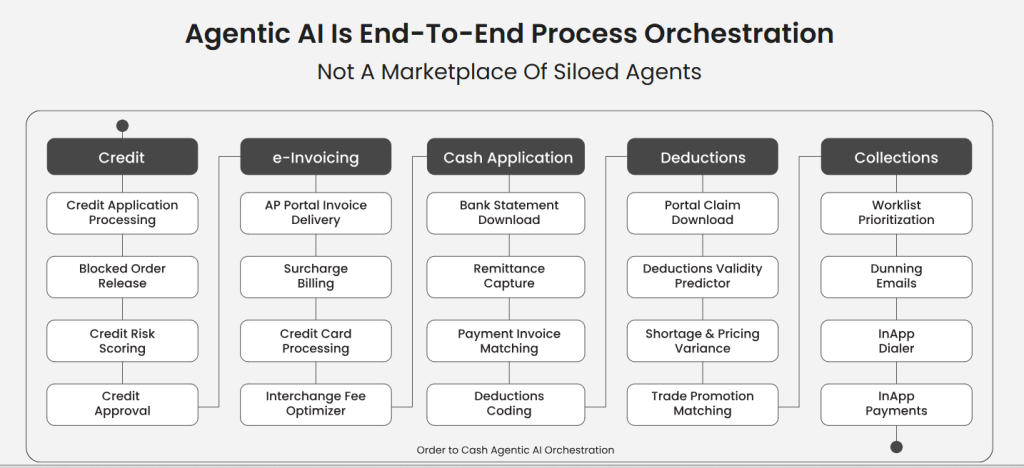

HighRadius is the leading enterprise-grade, AI-powered invoice-to-cash platform used by 1,100+ global companies, built to handle complex, high-volume, multi-entity AR operations. It unifies credit, invoicing, cash application, deductions, and collections under one connected ecosystem with bi-directional ERP integrations. Powered by Agentic AI, the platform goes beyond automation by planning actions, prioritizing accounts, predicting payment behavior, drafting customer outreach, and resolving disputes faster.

Key Features:

Billtrust helps mid-to-large organizations digitize and automate their AR processes with a focus on speed, customer convenience, and interoperability. It offers flexible automation modules covering invoicing, payments, and collections—making it a solid choice for businesses with distributed finance operations and supply-chain dependencies.

Key Features:

Invoiced is a fast-deploying, cloud-native AR platform designed for growing SaaS and tech businesses. It focuses on automating the customer billing cycle end-to-end while maintaining flexibility for recurring billing, subscription management, and online payments, making it ideal for modern, fast-scaling organizations.

Key Features:

Esker brings all AR automation capabilities together on a single global platform, helping finance teams manage their processes in one unified system. Its modular setup allows enterprises to scale gradually—from automating invoice delivery to enabling full-cycle cash application and dispute management, suitable for multinational teams.

Key Features:

BlackLine Invoice-to-Cash automation platform unifies credit, collections, cash application, and disputes under a single, AI-driven platform. It is designed for enterprises seeking full transparency and control over working capital and customer payments while ensuring compliance throughout the order-to-cash cycle.

Key Features:

Gaviti focuses on helping AR teams reduce DSO and automate collections through predictive intelligence. It’s designed for mid-market firms seeking measurable improvements in cash flow without heavy IT dependency.

Key Features:

YayPay, now part of Quadient AR, empowers small to mid-sized businesses with AI-driven automation for invoicing, collections, and cash application. It’s known for its ease of use, quick setup, and strong visual analytics that make AR management highly transparent.

Key Features:

VersaPay simplifies collaboration between AR teams and customers through shared online workspaces. It’s ideal for B2B companies with complex billing cycles, distributed customers, or multiple payment channels.

Key Features:

Tesorio stands out for its predictive AI that connects AR automation to real-time cash flow forecasting. It’s best suited for finance-led organizations that prioritize liquidity optimization and actionable intelligence.

Key Features:

Emagia combines cognitive automation, analytics, and robotic process automation to transform enterprise AR. Its AI-driven approach supports end-to-end credit-to-cash digitization for large, global enterprises managing complex receivables.

Key Features:

Navigating the crowded landscape of Invoice to Cash Automation platforms requires clarity in your goals:

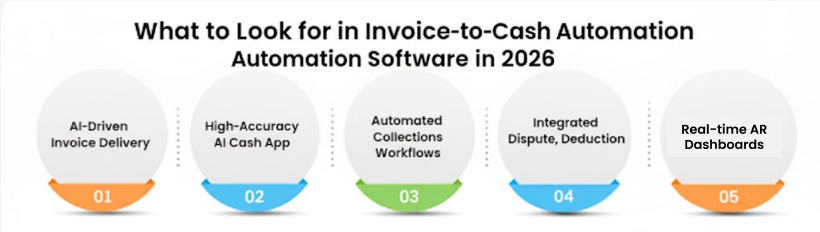

CFOs are demanding faster cash conversion, fewer disputes, and real-time insight into AR health. Traditional invoicing and collections workflows cannot support this scale or complexity. The next generation of invoice to cash automation replaces manual tasks with AI-driven processes that create predictable cash flow, higher match rates, and complete transparency across the AR lifecycle.

AI automates invoice creation, delivery, tracking, and follow-ups while predicting customer payment behavior. Treasurers and AR leaders receive recommended next actions that accelerate collections and reduce delinquency.

AI reads remittances from portals, emails, PDFs, and bank files, auto-applying cash with 90–95% accuracy. Teams eliminate manual research, reduce unapplied cash, and shrink exception queues significantly.

Configurable workflows schedule reminders, prioritize risky accounts, and centralize communication across channels. Collectors resolve disputes faster, shorten DSO, and maintain consistent customer engagement.

End-to-end platforms embed dispute workflows, deduction categorization, document capture, and automated escalation paths. This reduces revenue leakage and cuts dispute aging cycles.

Performance insights track aging shifts, collector productivity, cash forecast accuracy, at-risk accounts, and process bottlenecks. CFOs gain the data needed to optimize collections strategy and working capital.

The future of invoice to cash automation platforms lies in deeper AI integration, predictive analytics, and autonomous processing. Emerging solutions will not only automate routine tasks but also predict payment behaviors, identify cash flow risks, and recommend collection actions in real time.

Choosing the right invoice-to-cash automation tool can transform how your business manages receivables, from faster invoice generation to quicker cash realization. Whether you need enterprise-grade AI automation or flexible modular tools, the key is alignment with your ERP, workflow, and growth goals. The right solution doesn’t just streamline AR, it helps your finance team focus on strategy, not manual tasks, and ensures healthier, more predictable cash flow.

** This blog reviews top 10 Invoice to Cash platforms; the 1–10 sequence is for reference only and does not indicate ranking or quality.

For large enterprises with complex AR processes and global operations, the most effective solutions are those that offer AI-driven automation and robust, bi-directional ERP integrations. These platforms centralize invoicing, collections, cash application, and deductions into a single ecosystem.

Yes, most advanced solutions offer real-time, bi-directional integration with major ERPs like SAP, Oracle, NetSuite, and Dynamics. This enables faster posting, reduces manual errors, and keeps financial data seamlessly synchronized across systems. Such connectivity also ensures end-to-end visibility across the invoice-to-cash cycle

Companies with high invoice volumes, multi-location operations, or remote finance teams see the most impact. Enterprises and mid-market firms in manufacturing, distribution, SaaS, and wholesale can significantly improve cash flow, reduce DSO, and boost AR team productivity.

Invoice-to-cash automation software digitizes and automates invoicing, payment tracking, cash application, collections, and dispute resolution. It reduces manual tasks and accelerates cash flow by improving accuracy and visibility across the AR lifecycle.

Automation decreases DSO, reduces unapplied cash, improves collection effectiveness, and delivers real-time insights for AR and finance leaders. Companies gain faster payments, fewer errors, and stronger working capital performance.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center