Essential Credit and AR Skills to Propel Your Career During an Economic Downturn

An insightful summary of the essential skills required to steer your accounts receivable in the right direction while climbing your career ladder at the same time!

Preamble

As an AR professional experiencing digital transformation in an ever-changing economic environment, its important to not just stay relevant but also excel in your domain. This unanimous sentiment was also echoed in one of our recent surveys, take a look:

✓ 53% of the A/R professionals surveyed consider understanding the transformation of A/R processes with new technologies such as AI and RPA to be the next big skill that they need to acquire.

✓ 26% believe that leveraging data analytics and reporting can help them slice and dice their accounts receivable to know the real issues.

✓ 16% believe that developing a robust credit process and collections policy framework can help them rudder their accounts receivables in the right direction (away from bad debt!)

✓ 5% believe that defining a stringent collections strategy would be a key transformation in their A/R space.

What is the ‘next big thing’ for you in your credit and A/R career?

Keeping in mind these requirements of all the credit and A/R leaders, we have summarized the 5 key essential skills that any A/R personnel would need to excel in order to climb their career ladder. The following chapters describe these essential skills and what needs to be done to excel in each.

Defining the 5 Essential Skills

1. Drive Compliance

Understanding Credit and Collections Laws

Understanding commercial debt collection laws are critical, especially for those businesses that extend credit to international customers. Knowing what language to use in dunning correspondence and what law to look for in order to file a lawsuit can both help in debt recovery and shield the company against any lawsuits for inappropriate collections practices.

2. Standardize Collections

Customer Segmentation and Correspondence Strategies

Still wondering which customers to call, what correspondence method to use, and how to track the communication? All you need to do is go through this chapter for a crash-course on how to correspond with the right customers at the right time.

3. Minimize Credit Risk

Developing a Credit Policy Framework

Under the burden of bad debt and uncollectible receivables? Here is the solution. Learn how to develop a robust credit and collections policy framework to reduce credit risk exposure while extending lines of credit to strategic accounts and SMBs.

4. Process Improvement

Reporting and Analytics

While it is essential to keep driving the processes and implementing new technologies to earn better results, it is more important to analyze process performance and KPIs and change course accordingly. An advanced reporting A/R dashboard could help you and your executive teams keep track of DSO, bad-debt, and customer profitability.

5. Transform A/R Operations

Understanding Latest Technology

Still unaware of fifth-generation technologies, such as Robotic Process Automation and Artificial Intelligence, and how they are revolutionizing the A/R landscape? This chapter is all about the application of advanced technologies to fundamentally transform credit and A/R operations.

Skill #1 Drive Compliance

Understanding Credit and Collections Laws

Bad debt is inevitable regardless of the industry or size of an enterprise. According to the “Financial Accounts of the United States,” September 21, 2017, Federal Reserve

Statistical Release, the amount of debt is approximate:

- US Consumer Debt = $14.9 Trillion (Including Mortgages)

- US Commercial Debt = 13.9 Trillion

This certified data is enough to torture faint-hearted executives and drive the credit and collections team into a frenzy. However, the credit and collections team could alleviate this problem by understanding the various credit and collections laws that govern debt collection practices. Incorporating fair debt collection practices into collection processes is the first step to recover past due.

Skill #2 Standardize Collections

Customer Segmentation and Correspondence Strategies

All about which customer to call and when

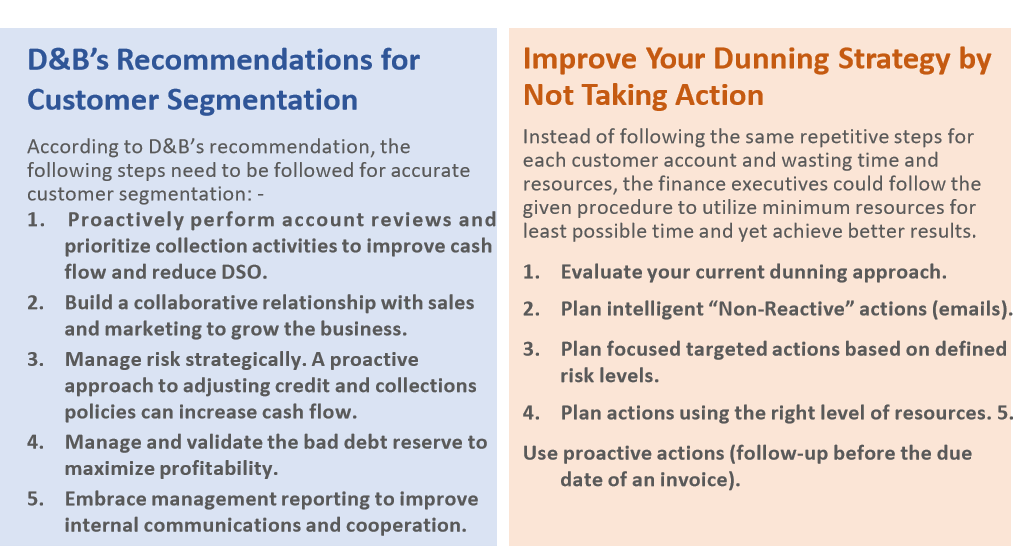

Customer segmentation refers to the strategy of dividing customers into groups based on specific characteristics with the goal of refining a collections strategy to improve collection rates.

Segmentation characteristics may include:

- Age of debt

- Amount of Debt

- Product type

- Geographic location

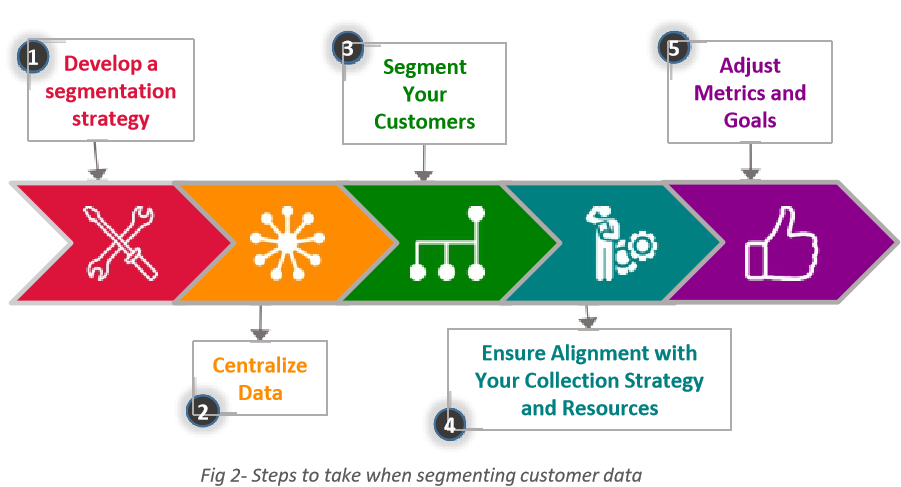

Steps to Take When Segmenting Customer Data

Skill #3 Minimize Credit Risk

Developing a Credit Policy Framework

A credit policy is a set of guidelines that:

- are used to determine which customers are extended credit and billed

- set the payment terms for parties to whom credit is extended

- define the limits to be set on outstanding credit accounts

- outline the steps or procedures used to deal with delinquent accounts.

A credit policy is an encapsulation of how risk-averse a company is regarding the extension of credit.

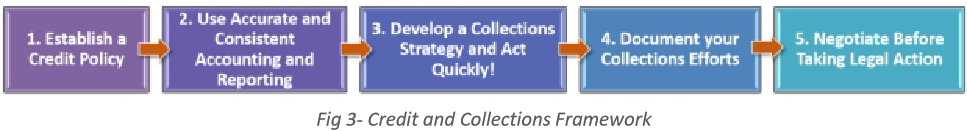

A Credit and Collections Process Framework

Streamlining the entire end-to-end process of assigning credit and collecting receivable can be effectively guided by a 5-point credit and collections framework. It consists of the following 5 processes:

- Establishing a credit policy is the stepping stone to develop a successful credit and collections framework. It should clearly define the roles and responsibilities of each A/R member and how to find the accurate creditworthiness of a customer.

- This framework also encourages executives to use reporting and data analytics to measure the success of their processes and spot trends for further strategic planning.

- Developing a robust collections strategy helps to target essential accounts based on risk level while investing only the minimum required resources for the task.

- It is equally essential to document all the collection efforts while dunning the customer.

- It is customary to fight for your dollars, but this should not be at the cost of customer experience. Therefore, it is imperative to negotiate with the customer before taking any legal action.

What To Have In Your Credit Policy ?

Evidence of a Debt

- Contracts signed by both parties agreeing to the payments.

- Canceled checks of previous payments.

- Emails that indicate concession of a debt.

- Purchase orders showing the amount owed.

- Invoices previously submitted for the debt.

- Account statements showing payment history or lack thereof.

- Any other relevant documents that demonstrate the existence and nature of the debt.

Developing a Credit Policy Framework

1. Mission Statement of the Credit Department

- To support the financial goals of [company] and, specifically, to support its sales efforts, while maintaining the highest quality of accounts receivable within the corporation’s capacity for risk.

- To provide flexible mechanisms to sell to a broad range of customers while ensuring that only prudent credit risks are taken and cash flow is maintained.

- To maintain customer goodwill during the collection process.

- To keep the sales team and senior management informed about emerging problems including credit holds and uncollectible accounts.

2. Credit Department Goals

- Establish a target for the percentage of bad debts to sales.

- Sets targets for acceptable account aging, i.e. % current, average days delinquent, percentage over 90 days past due.

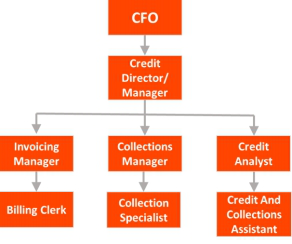

3. Roles & Responsibilities and Authorization Levels

Setting authorization levels for all A/R managers, analysts, and executives is an integral part of the credit policy. Although they differ from company to company, some common examples of roles and responsibilities of different A/R leaders are:

- CFO – Ultimate authority for Credit Department; hires/fires, sets overall policy.

- Credit Director/Manager – Reports to the CFO. Plans organize, leads and controls the credit function. Responsible for day-to-day management and training of the credit staff, determine procedures and rules for the entire department, authorize credit limits over $500.00. Selects outside collection agencies and/or outsourcing firms with the approval of the CFO.

- Billing/Invoicing Manager – Reports to the Credit Manager. Responsible for the day-to-day management and training of the personnel within the Billing Department, maintaining high standards of invoice accuracy, handling invoicing disputes, deductions, and all matters pertaining to billing. Reviews the daily aging report.

- Collections Manager – Reports to the Credit Manager. Responsible for the day-to-day management and training of the in-house collection team. Coordinates with outside collection agencies. Authorizes payment terms with the approval of the Credit Director.

- Credit Analyst – Reports to the Credit Manager. Obtains and analyzes financials, analyzes credit reports for clients requesting credit limits of more than $500, assigns credit limits up to $250.00.

- Billing Clerk – Reports to the Billing Manager. Responsible for preparing the invoices and ensuring that they are sent on time, maintains the aging report, provide other support services to the Billing Manager as required.

- Collection Specialist – Reports to the Collections Manager. Contact past due accounts per requirements. Accepts payment terms with the approval of the Collections Manager. Maintains records in the collection system.

- Credit and Collection Assistant – Obtains signed credit applications, reviews for completeness. Requests credit references and follow up. Pulls credit reports. Provides other support functions as needed.

4. Pre-defined Procedures

Strategic planning for all basic tasks, including assigning credit limits and implementing a dunning strategy, still plays a crucial role in the A/R space. Therefore, it should be part of the credit policy.

4.1 Procedures – Determine New Customer Credit Worthiness (Example)

Table 1 shows a strategic plan on how to determine the creditworthiness of a new customer based on :

- Requested credit limit

- Credit application completed and signed

- Verification from check references

- Data obtained credit report

- What to set as initial terms

- What should be the assigned credit limit

- Who will give the approval

4.2 Procedures – Establish Collections Process (Net 30 Terms Example)

Table 2 describes three different portfolios of customers and the correspondence approach that could be followed based on Aging and due amount. The sample table uses the following set of simple steps to select the dunning strategy:

- If the amount is high ($5000+) or ($2500- $5000), then regular reminders and follow ups are done even before the invoice is due. It is then escalated to the manager who can then approve sending the final demand notice and forwarding to a 3rd party.

- If the amount is between $500-$2500, the dunning is followed up internally and it is forwarded to 3rd party only when the invoice is 70+ days past due.

- If the amount is <$500, a few follow-ups are done and then the credit limit is put on hold and a demand letter is sent.

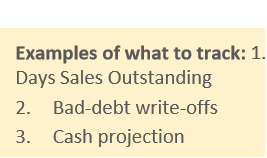

5. Measuring Results – Implement a Scorecard

After finalizing the mission statement, credit goals, and the roles and responsibilities of A/R workforceand setting up the strategic procedures for all essential processes, now it is time to measure your results!

Here is a to-do list that every credit and A/R leader must follow to get the most accurate measurement of its accounts receivable:

- Start with your aging analysis and the metrics identified.

- Look at the impact your credit policy has on sales and cash reserves.

- Revise your credit policy-based results.

Just three steps and you are ready with a revised credit policy that will give you better results.

However, there is another common question here: What metrics should I use?

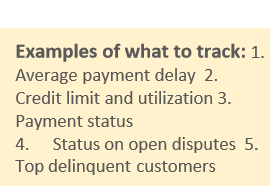

Here are the metrics that should be tracked while making a monthly collection of individual performance scorecard :

- Aging and/or tracking monthly dollar objectives or goals.

- Dollars collected expressed in total dollars collected and/or using a comparative DSO.

- Aging, not only of the collector’s unit but how long has the collector had the account, including how many calls, emails, and letters have been used to qualify the customer’s intentions.

- Has the collector secured a promise of full payment or a reasonable payment plan?

- Are there any items in dispute and can a settlement or adjustment be reached?

- Recovery Rates – The dollar amounts collected divided by the total amount in each unit’s inventory.

- Number of calls per day, week, or month.

- Telephone monitoring – Is the collector abiding by all State and Federal laws?

- Account Audits – Have calls been made when necessary and results and comments entered into the system?

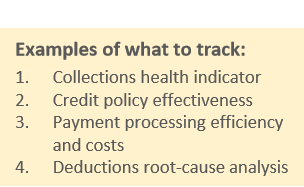

Skill #4 Process Improvement

Reporting and Analytics The Art of Transforming Data into Information into Insights

In today’s complex dynamics, managing accounts receivable without reporting and analytics is like driving a car without having the slightest idea how fast you’re going. Therefore, it is essential to have an accounts receivable dashboard that quickly translates the company’s objectives into measurable metrics.

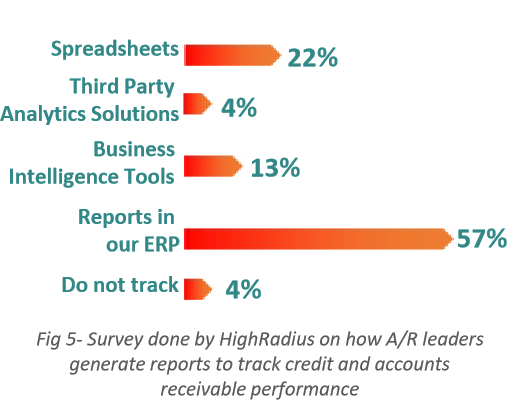

According to a survey by HighRadius, reportsare commonly made with these tools:

It generates the same set of reports for all users!

Be it a finance executive, a functional manager, or a process analyst, ERP provides the same reports to all users without considering their needs or requirements.

Not only ERP, but most of the reporting tools including spreadsheet-based processes, BI tools also do not customize the reports based on the A/Rpersonnel’s need.

Why?

- Too much data to dig through

- Lack of real-time information

- Time-consuming to design drill-down that can be used by all users

The Solution

An ideal accounts receivable dashboard provides instant access to both basic and advanced data elements to help execs and process owners better understand the current state of their receivables to drive progress towards organizational goals.

It should be able to provide the following critical information as required for each of these report consumers: –

Finance Executive

Overall A/R impact on finance strategy

- Cash flow trends

- Health of A/R and balance sheet impact

- Cost of A/R processes

- Support for long-term finance strategy

Functional Manager

Process health

- Team/analyst productivity

- Process KPIs

- Performance improvement guidance

Process Analyst

Individual performance and customer data

- Customer/account level insights

- Transaction level insights – accuracy, speed

- Individual performance reports

Skill #5 Transform A/R Operations

Understanding Latest Technology RPA and AI – What’s the Buzz?

Robotic process automation (RPA) is the application of technology that allows software “robots” to mimic human actions on a computer to complete a business process

Features:-

- Rules-based and repetitive

- High volume tasks preferred

- No self-learning

- Costly setup and maintenance

- Strict compliance of orders

- Inputs should be in predefined structured format only

Artificial Intelligence(AI) is the ability of computer systems to learn, reason, think, and perform task requiring complex decision-making

Features: –

- Tasks need judgment

- Complex tasks can be handled

- Evolves with experience

- Looks for better ways to execute

- Reduced cost of setup

- New information formats can be handled based on experience

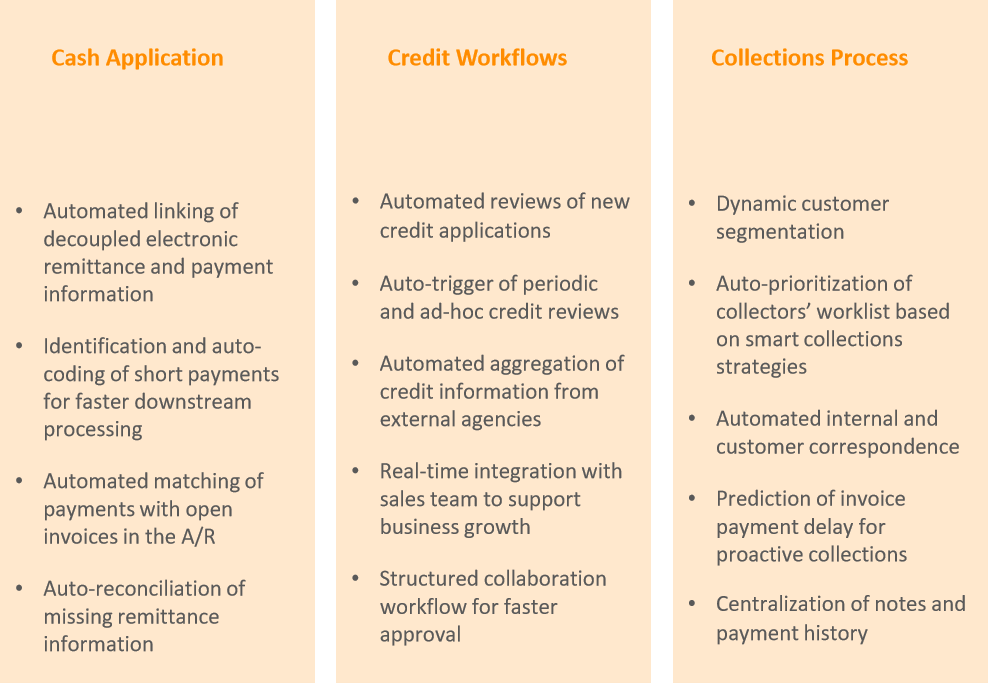

Technology Applications in O2C Processes

Summary

Yes. Those are the things on the horizon that are going to completely change the outlook of accounts receivable in the next two years!

Here is a quick overview of what you need to beat the odds, accelerate your growth, and drive your A/R which is as advanced as Tesla:-

- Drive compliance for everyday tactical work by understanding critical trade credit and collections laws

- Standardize collections operations with the help of customer segmentation and dunning strategies

- Minimize credit risk with a step-by-step approach to creating a credit policy framework that aligns with business growth objectives

- Build process improvement recommendations by leveraging reporting and analytics for immediate course-correction and strategic insight

- Transform credit and A/R processes by leveraging cutting-edge technologies including Robotic Process Automation and Artificial Intelligence

Acquiring these skills can help leaders and pioneers across the credit and A/R space regardless of their individual job roles reach to the pinnacle of their success while delivering top of the class results.

On another note, want to know what beyond the curve technologies look like?

Turn the page.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freeda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The RadiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit https://www.highradius.com/.

HighRadius’ Integrated Receivables Platform

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadius™ Integrated Receivables platform stands out by enabling every credit and A/R the operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.