Review of What Shaped the Technological Scenario of Treasury

A look at what shaped the technological scenario of Treasury and how is new technology causing disruption in the field

Executive Summary

Treasury has always played an important role in any business and has placed itself as being even more so in the past decade. Earlier, Treasury was focused more on the cash-side of the business, such as cash forecasting and management, bank reconciliation, loans and borrowings, foreign exchange, taxes. These were the basic functions that defined Treasury and were very limited in their scope to be valuable to the CFO.

Now, the objectives of Treasury positions it as a critical component of any business. Functions such as identifying and investing in new revenue streams, risk management, finding bottlenecks, setting up financial plans and policies play an important role in a company, and help executives and CFOs plan the future roadmap. At the end of the day, Treasury is the reason behind a business’ financial well-being.

Being an initiator of change in any business, Treasury itself has changed rapidly in recent years, owing to increased roles and responsibilities, with an increase in expectations and demands from the CFOs. A poorly functioning Treasury can largely impact the business and hence it needs to be robust and well-equipped to carry out its functions. Today, the business world is shifting towards technology-oriented operations to improve supply chain, increase efficiency, optimize cash conversion cycle, and ultimately drive revenue growth. With technology supporting almost all business operations these days, it is no surprise that Treasury seeks the same. With new software and services surfacing, it becomes more and more imperative to discuss them.

Technologies like Cloud, Robotic Process Automation (RPA), Application Program Interface (APIs), Machine Learning (ML), and Artificial Intelligence (AI) are revolutionizing Treasury functions today, and lead the path towards a future where it becomes an integral part of Treasury. Continue reading to understand how these technologies evolved and what they mean for Treasurers.

What’s Driving the Change?

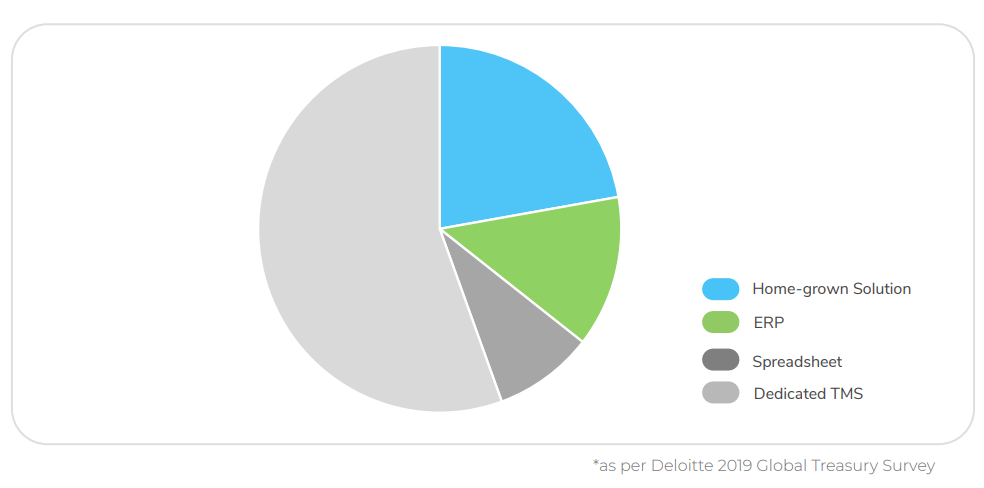

In the past decade, the use of spreadsheets has steadily declined to owe to the use of systems like TMS or ERP in Treasury functions. With an adoption percentage around 55% for TMS and 23% for ERPs, they have still not evolved entirely to meet the demands of treasurers. The low rate of adoption of these systems, especially in SMEs can be linked to a high cost of ownership, adoption and maintenance complexity, and a smaller demographic for business operations. Another reason may be their ability to run only simple functions, where they fail to accomplish complex tasks due to lack of specialization or updates from vendors, such as accurate cash forecasting or robust risk management.

Giant players in the market fail to understand the requirements of treasurers, and therefore many newer and smaller vendors and service providers are investing in new technology which could help fill the gap.

With these new groundbreaking technologies, treasurers will now be able to do more with less, add value to their role, and take a more strategic step towards their company’s growth. These new types of solutions aim at improving workflow, automating certain processes, and helping Treasury with better decision making on investments, borrowings, and optimizing cash conversion cycle.

There is still an inertia in the adoption of these technologies. Since they take up a few tasks of Treasury, it creates a sense of fear of job loss amongst Treasury teams. This creates a dilemma for them, as they must choose between increasing their chance of job loss or keeping up with tedious tasks and surmounting them. The lack of understanding among Treasury teams on the way these technologies operate also casts a shadow of doubt and creates a fear of the unknown. It becomes important to understand the sentiment of treasurers and highlight what is truly beneficial, and how more value can be derived not just from newly implemented solutions, but from themselves as well.

The Treasurer’s Sentiment

It is without a doubt understood why Treasuries hesitate to implement new technologies. This inertia of adoption can be attributed to various reasons, which are

Fear of Job Loss

CFOs are always looking for ways to strategize their business operations and increase revenue, and this is only possible when they have more people working on that, specifically Treasury people. And with the adoption of new technology, treasurers can focus more on higher-value roles, and identify and implement new strategies for driving revenue growth.

Lack of Understanding

With so many types of solutions being offered, treasurers and economic buyers think they have to invest that much time in researching and understanding these technologies and selecting what is right based on their requirements. Vendors understand this and offer multiple resource materials to make it easier and faster to understand the benefits of each type of solution on offer.

Fear of Lack of Control

These technologies do not perform end-to-end automation and they require some human interaction, such as deciding data sources, recalibrating models to reduce variance and manual moderation.

Fear of Data Theft

All of the solutions on offer either run on cloud, which offers industry-standard security for data protection and privacy, or based on-premise, which relies on a company’s already implemented in-house data security model.

Multiple Options Available

Treasurers only need to understand what functions they need to apply technology to and can then easily evaluate what type of solution they should implement, instead of reading about each and every one of these technologies and creating more confusion and complexity.

With more than dozens of service providers to choose from in each type of technology, it becomes more hectic to keep in touch with the trends while doing regular treasury work. This is where a maturity model comes into the picture, helps understand where a Treasury team currently stands, and where they want to get to.

Understanding the Treasury Maturity Model

The typical maturity model has five stages –

Foundational: This is the lowermost stage of the maturity model. The roles are very

basic, related to cash and liquidity management, financial planning, etc, and there is no

standardization of work or centralization of data to optimize processes.

Developing: There is some level of clarity of tasks between the team and some amount

of data is standardized for functions. There is still a lack of clearly defined roles as certain

tasks overlap due to lesser core activities being centralized.

Established: Here, the Treasury team is well structured and experienced, and have

certain tools such as an ERP or TMS at their disposal. The functioning is nominal with little

to no scope for process optimization.

Enhancing: This is where Treasury functions delve into other departments as well to help with strategic planning and optimization, while it itself has a centralized process.

Optimized: The uppermost stage in the maturity model, this is where Treasury actively

takes part in strategizing and advising the CFO on investments and operations. This stage

is achieved after implementing and becoming experienced in treasury solutions to use the

data presented to its maximum potential.

For a lot of Treasuries, the uppermost stage is still a long shot which they plan in achieving

later in the decade. What they need to understand is that with technology in place, it

becomes much easier to climb the maturity model ladder. Technology can be an enabler

for Treasury to achieve a strategic position in the CFO’s office and the most disruptive

technologies have their own benefits and use cases.

Treasury Technologies

Over time, vendors have poured in resources to create products that suit different functions of the Treasury. While some help manages cash easily, others focus on easy data aggregation, bank integration, or forecasting. The four most innovative and promising technologies are mentioned, with what happens under the hood, their advantages and limitations explained.

Cloud

The next consideration for a lot of treasurers is to move its operations to a cloud server. This means all the data is stored in a cloud server away from office locations and is accessed by employees online. While this enables them to access data remotely, from different locations, it also ensures regional treasuries can collaborate at any time. This also allows upgrading or improving any computing done without the need for upgrading the IT infrastructure available.

Advantages –

1. Eliminates a disconnect allows real-time data to flow continuously

2. Data access can also be restricted based on job roles

3. Maintenance is easier and cheaper than in-house Treasury Management Systems

4. Vendors use multiple firewalls and encryption to prevent data theft

Limitations –

1. Internet outage or downtime can affect operations

2. Access from insecure networks can leak credentials and sensitive information

3. Numerous vendors provide limited flexibility and control in the solution

4. Vendors provide little to no support in migrating to a different cloud solution

Use Cases –

1. The seamless flow ensures the data that goes into forecasts are accurate and up-to-date

2. Enables faster forecasting since data gathering is easier

3. Treasuries can sync real-time bank data into the system to improve global cash visibility

4. Information can be accessed anywhere, even outside workplaces

5. Offices with different geographical locations can work together

Application Program Interface

APIs are software interfaces that redefine how applications interact with each other. Consider it as a door that connects one entity to another directly. In Treasury, it can be used to enable a direct link to banks to gather real-time information.

Advantages –

1. Real-time data on payments and transactions is always available

2. Eliminates tedious task of batch-processing

3. Easy to set-up and integrate

4. Instant transactions allow a reduction in interest debts

5. Fraud-detection in payments is faster and easier

6. Adds another layer of data security

Limitations –

1. Failed transactions have a difficult reporting format, making it harder to reconcile

2. Does not eliminate the reliance on manual Treasury processes

3. Setting up and maintaining APIs is costly and time-taking

4. Internet outage affects operations

5. Using a single API-integrated account may hamper operations if servers are unresponsive

6. There may be a limit on transactions-per-second, exceeding which may fail all transaction requests sent in a batch

Use Cases –

1. Real-time data ensures reports are always updated to the last second

2. Instantaneous payments eliminate the cost of holding cash for additional hours

3. Reduction in credit risks by avoiding intraday or overnight cash balances with banks

4. The decrease in time for clearing debt allows availing discounts

5. Reaping benefits from early investments using instant transactions

6. Identifying fraudulent payments with real-time data and mitigating the impacts swiftly

Robotic Process Automation

RPAs are robots that are programmed to run a certain set of tasks with little to no human intervention. This would enable Treasury teams to free up a lot of time previously used in repetitive tasks like data gathering and consolidating, and focus more on higher-value duties like cash forecasting, which remains as the top priorities for Treasuries. RPAs can be easily tweaked to perform different or an updated set of tasks.

Advantages –

1. Eliminates high-volume and high-transactional tasks for employees

2. RPAs can gather, consolidate, and store data for easy reporting

3. Cuts costs and streamlines processes easily

4. Repetitive and time-consuming processes can be integrated with RPA easily

5. Processes are more secure and less error-prone due to reduced human intervention

6. Can be set-up to perform operations round the clock

Limitations –

1. Difficult to identify the right usage and could lead to loss of control over key processes

2. Cannot process complex functions which require human-level intelligence

3. Cannot identify faults in operations such as bugs, and requires human oversight

4. Difficult to integrate security and privacy policies, making it harder to identify threats

Use Cases –

1. Process invoices and payments swiftly without errors

2. Payment information received in different formats can easily be processed

3. Make data available faster with integration with the system for better decision making

4. Automate various back-office operations to focus on higher-value tasks

Artificial Intelligence

Artificial Intelligence utilizes self-learning algorithms to identify patterns and changes in them, and guiding Treasuries on what to do. It can track anomalies in transactions and stop them or find shifting behaviors in operations and suggest better alternatives. With complex computing power and process automation, the scope and utilization capabilities of AI are virtually limitless.

Advantages –

1. Takes over complex processes and aids in shifting to higher-value roles

2. Can mitigate risks by identifying and tracking fraudulent activities

3. Integrate with various systems and collect and process information

4. Learn from past behavior and improve workflow

5. Can analyze and think like a human but within a shorter timeframe

6. Help manage liquidity to optimize usage of cash and prevent avoidable debts

7. Self-learn and improve in unpredictable situations such as pandemics or recessions

8. Auto-report on various functions like cash and risk management

Limitations –

1. Takes time to integrate with individual Treasury functions

2. Identifying patterns requires time as AI looks at historical data to predict what’s coming

3. Lack of reliable and credible data can act as an obstacle for AI

Use Cases –

1. Forecast cash with very high levels of accuracy

2. Help Treasurers in complex decision making by running what-if scenarios

3. Partner with banks to automate payments which are in line with financial policies

4. Predict foreign exchange rates for improved decision making

5. Find better investment portfolios and suggest on financial planning

What Does the Future Hold?

With some amount of certainty, it can be said that technology is disrupting the way Treasury functions now. With more and more features and functions being added to these technologies, they keep improving the processes of Treasury. One such feature is the use of a virtual assistant to which is voice-enabled to ease working with these solutions even more. Another can be a dashboard that presents the work schedule in an organized manner when employees log into the solution. With so many types of features that effectively improve workflow, the future looks very promising for Treasury.

As we move forward, vendors and service providers engaged in newer technologies now will certainly be the first ones to become more experienced in their field as time passes. For Treasuries, being able to adapt faster is how they can stay ahead of the curve.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company that leverages Artificial Intelligence-based Autonomous Systems to help companies automate Accounts Receivable and Treasury processes. The HighRadius® Integrated Receivables platform reduces cycle times in your order-to-cash process through automation of receivables and payments processes across credit, electronic billing and payment processing, cash application, deductions, and collections. HighRadius® Treasury Management Applications help teams achieve touchless cash management, accurate cash forecasting, and seamless bank reconciliation.

Powered by the Rivana™ Artificial Intelligence Engine and Freeda™ Digital Assistant for order-to-cash teams, HighRadius enables teams to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

About Treasury Solutions

The HighRadiusTM Treasury Management Applications are a suite of world’s first AI-powered solutions designed to support treasury teams across all industries by automating and enhancing their cash forecasting, cash management and bank reconciliation processes.

The HighRadiusTM Treasury Management Applications are unique in the approach that they are powered by an Artificial Intelligence technology created exclusively to redefine the forecasting, bank reconciliation and cash management processes, so that treasurers spend lesser manual effort but extract better outcomes such as making more accurate cash forecasts across all cash flow categories, increased forecasting frequency and variance reporting, gaining instant visibility into real time cash positions across bank accounts at any level and achieving 99%+ straight through reconciliation of bank statements without human intervention.

The solutions are delivered via cloud which enable them to be seamlessly integrated with multiple systems including your ERP, TMS, accounting systems and banks instantly and simultaneously.