Harmonizing Global O2C Processes for GBS: Moving Beyond Legacy ERP Applications to an AI-based Strategy

- The roadblocks caused due to the usage of legacy platforms across most GBS models and what are its implications in the internal processes

- How can GBS leaders adopt a harmonized approach to resolving the challenges associated with global O2C operations

- How AI-based automation systems enable A/R operational agility

Understanding the Order to Cash landscape in Global Business Services

Most successful GBS organizations are capable of managing an ecosystem of internal and external partners

Caroline Basyn

Senior VP, Strategy and Transformation Europe

Pepsico

Several large enterprises have started moving away from traditional Shared Service Centers (SSCs) and toward the Global Business Service (GBS). The GBS model offers more harmonized processes and organizational structures.

But the journey of such a sudden transition does not come without its challenges:

- O2C processes have been seen as not standardized and siloed from each other

- Key teams in the O2C process work in the background of several major departments like marketing, sales, finance, and collections, adding to the complexity of internal processes. This obstructs the seamless transfer of information and data from one department to another, affecting the harmony of operations

It often takes a crisis to pinpoint a dysfunctional part of a system. This is because the entire organization structure is typically complacent regarding critical siloed operations that might need quick resolutions and immediate addressing.

With the globalization of enterprises, it is typically a strenuous activity for the GPO to keep up with every operation taking place in the background.

Many current O2C processes have higher operational costs and potential delays and errors because of their manual nature. Moreover, most GBS organizations are no longer content with a collection of discrete processes in which data is available only at certain stages. Instead, they expect O2C to be transparent with real-time visibility into customer data.

The Roadblocks of Using Contrasting ERP and Legacy Applications

Separate ERPs for different lines of businesses pose a challenge for GPOs to consolidate their A/R operations. They end up having dedicated teams that extract data separately from each line of business. It becomes challenging for leaders to have control over the system.

We previously had to involve the IT team in generating reports from a siloed reporting tool. With the implementation of a reporting tool that sits over all their databases, it has become easier to get data and mine data faster

Tammy Lindorf

Director of Shared Services

Martin Marietta

Traditional ERP systems are doing an excellent job at digitizing and storing information. However, according to Linda from Uber, accessing and analyzing data from ERPs requires manual effort. To provide monthly or biweekly reports on performance parameters like expected payments or weekly processed payments, information has to be collected from individual systems and then analyzed; several processes need customization, which is a limitation for the ERP systems.

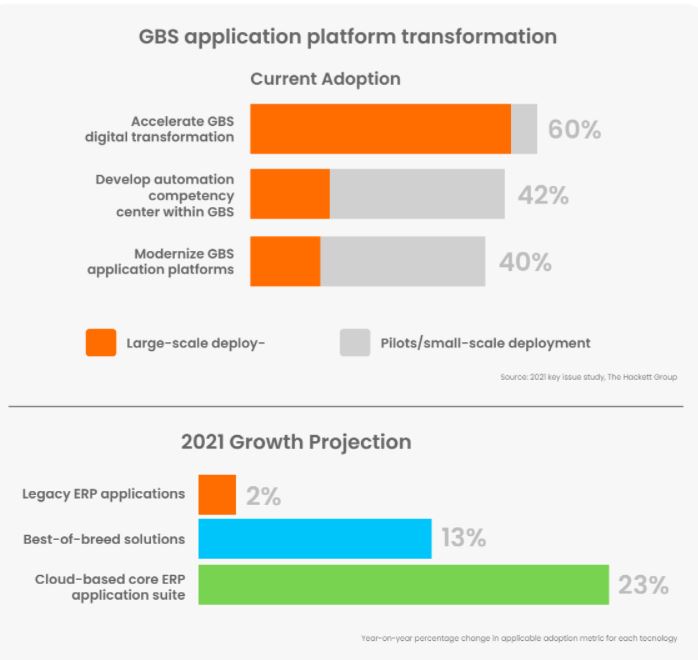

Customizing existing ERP systems to manage the workflow can lead to further investments. Current ERP systems should be integrated with AI-powered automated solutions to tackle these issues. These can ensure seamless connectivity and accessibility across siloed processes to tackle these issues and a lower cost of ownership in the long run.

What are the Issues Faced by O2C SSCs with Siloed Operations?

- Restricted data flow across different processes slows down the data upgrading process. Therefore, finding correct and updated information takes time and can result in erroneous reporting, especially when there are multiple instances of data transactions across systems.

- Disintegrated data forces manual switching between different systems. This causes applications to migrate all data into one report, affecting productivity.

- Adopting new applications or upgrading existing ones often lowers profit

Why Should GBS Models Adopt an AI-based Approach?

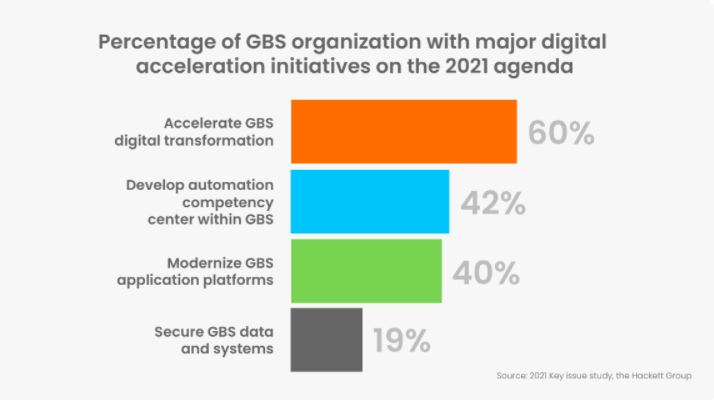

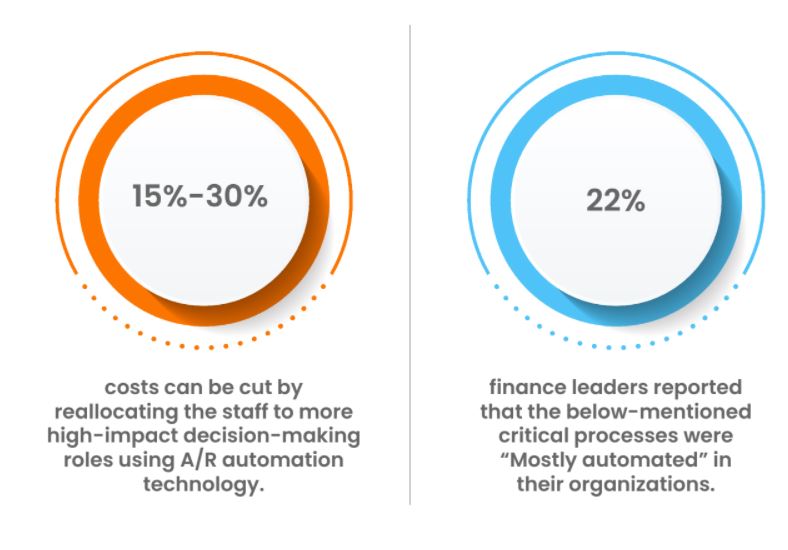

Automation should be a part of the core strategy to make processes agile, transparent, streamlined, and cost-effective. To enable this, running disparate ERP systems will not be an ideal approach. Organizations should go forward with advanced technologies like AI to help A/R teams reallocate their bandwidth to more strategic decision-making tasks.

Seamless data availability provides customers with real-time information, such as real-time updates on shipments and payments. Furthermore, the ability to automatically transfer data in any format to any device or system to share details on an order, shipping notice, tracking details, payment information, or remittance advice improves customers’ experience. Automation also empowers them with data insights to optimize order and payment processes.

Automation allows for smooth data integration across a distributed network where data is verified, validated, transformed, and transmitted according to the receiver’s requirements. Overall, automation provides a connected ecosystem where relevant users can share data as and when needed.

But is Automation Sufficient?

Integrating and automating individual processes does not resolve the issue of siloed operations. Instead, it adds another layer of complexity to the overall process. An AI-based platform strategy is needed to create a layer of system engagement that encompasses all IT systems, to manage end-to-end O2C processes.

A unified platform is placed above all processes, ensuring a seamless exchange of information irrespective of geography or business function. It also eliminates the hurdle of integrating ERP systems with AI-powered solutions. Furthermore, business leaders are keen to accept an integrated platform to improve workforce productivity, cost-effectiveness, and efficiency.

How AI-based automation systems enable A/R operational agility across GBS teams

A centralized O2C system unites and facilitates communication with different businesses operations. Automating A/R processes helps to fast track the low-impact and transactional tasks like data aggregation. It also helps the team focus on more value-added activities like exception handling.

Integration can also change the role of the SSCs to drive real business value. For example, when the end-to-end process data is integrated, new insights are generated that can drive better customer service.

An integrated platform is an effective solution that acts as a top layer. Such a platform works across the process to enable data normalization compared to migrating data from multiple ERPs to a single ERP.

Homer Smith

GPO of Billing, Credit, and Collections

Uber

The following are necessary to adopt a platform approach towards harmonizing global processes –

Process Integration:

Process integration is key to overcoming complexity in the O2C process. An A/R automation system must be able to adapt to new technologies as new solutions become available. The system should be able to synchronize data between disparate IT landscapes across processes by integrating systems.

Data is required to be made sharable, and a hybrid platform is needed on which the in-house and third-party applications run in sync. This will establish an ecosystem without boundaries that optimizes process performance.

Customer Centricity:

Customers expect real-time information on processes. A customer service executive who fails to provide order status or share payment receipts negatively impacts customers. Hence, customer expectations should be kept at the forefront of the automation approach by seamlessly blending the processes with technology.

AI-powered solutions provide intelligent recommendations to analysts for them to stay abreast of events in the customer portfolio. This enables proactive follow-up and faster resolution of disputes.

Shared Responsibility:

With several processes operating under a single platform, it is crucial to assign process owners who will be the point of contact for any query. Leaders investing in technology that provides global visibility of receivables performance and team productivity can ensure faster course correction.

The next generation of O2C technology and platforms can deliver the extra velocity needed to gain an advantage. We have been scanning the market for platforms and technology that can change the game with O2C outcomes. Out of the solutions we’ve reviewed, the strongest came from providers that delivered data orchestration, automated insights and predictive analytics, and simple self-service functionality for customers to create frictionless processing

Source: Capgemini 2020 Article, AI-driven order-to-cash

Conclusion

- The majority of GBS leaders are now shifting their gears, trying to go beyond cost savings and deliver direct working capital impact. They are looking to constantly ensure equal quality standards across different business units, make changes, and gain buy-in across the enterprise.

- With each business unit having its own set of processes and operating policies, it becomes very difficult to gain control over them. Thus, most leaders target harmonization as the way forward.

- Due to existing process silos created by the use of on-premise ERP solutions, the flow of information is not as seamless as it should be. There are a variety of concerns that arise from this. These concerns include a lack of access to the latest customer information, decreased employee productivity, 360-degree global visibility, high cost, and dissatisfied customers.

- Many organizations have moved towards integrating their individual processes and automating them to counter these difficulties. Although this provides global visibility and real-time access to data, it does not resolve the issue of siloed operations. Instead, it just adds another layer of complexity to the overall process.

- The ultimate solution to create a harmonized O2C function is an end-to-end automation-oriented O2C platform. The platform serves as a top layer above all processes and systems, bridging data integration hurdles. It creates an interconnected environment by optimizing all O2C operations and allowing these processes to feed into core business decisions.