Skill #2 Standardize Collections

An insightful summary of the essential skills required to steer your accounts receivable in the right direction while climbing your career ladder at the same time!

Skill #2 Standardize Collections

Customer Segmentation and Correspondence Strategies

All about which customer to call and when Customer segmentation refers to the strategy of dividing customers into groups based on specific characteristics with the goal of refining a collections strategy to improve collection rates. Segmentation characteristics may include:

- Age of debt

- Amount of Debt

- Product type

- Geographic location

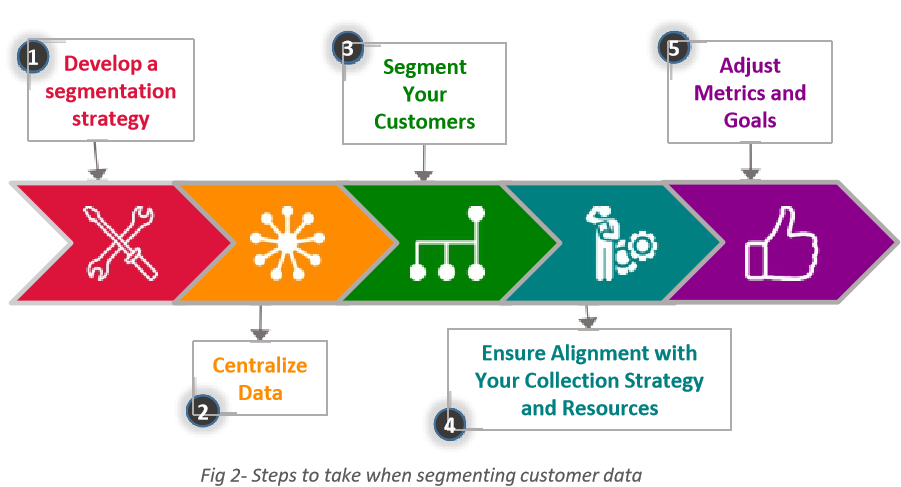

Steps to Take When Segmenting Customer Data