Corporate Treasury Management Software: Significance and Benefits

Treasury software is required to manage several treasury processes. Read the eBook to learn the benefits of using corporate treasury management software.

What is treasury management software?

Treasury management software automates treasury functions such as cash management, investment, debt management, trade finance, and risk management. Corporate treasury software integrates with different financial systems such as banks, ERPs, FP&A tools, and spreadsheets.

What features should you look for in treasury management software for corporate treasury?

The following are the characteristics that corporate treasury software must have:

- Risk management:

- Tracking liquidity and credit risk, as well as calculating current liquidity ratios, current credit rates, and aggregated market data on asset volatility

- FX and commodity exposures calculation

- Hedging transactions across various derivative instruments monitoring, such as futures, forwards, options, and swaps (on equity, commodity, and interest rates)

- Cash management:

- Automated cash transaction classification (accounts receivable, accounts payable, taxes, payroll, etc.)

- Automated tracking of cash balances across many bank accounts, currencies, regions, entities, etc

- Real-time cash flow tracking for operating, investing, and financing activities

- Bank reconciliation:

- Automatic identification of outstanding transactions and flagging them for manual reconciliation

- Bank statement data matching with general ledger data

- Credit and investments management:

- Real-time credit and investment activity monitoring across various asset classes, including stocks, bonds, and cash equivalents (loans, bank deposits, and marketable securities)

- Multi-asset type custom investment portfolio structure creation

- Bank signatory tracking:

- Bank accounts creation, modification, and closing

- Cash transactions and balances limit setting across bank accounts

- Bank fees tracking, analyzing, and comparison across many bank accounts

- Cash flow forecasting and analytics:

- Customer’s payment behavior, scenarios, trends, and seasonality capturing

- Historical to current results monitoring

- Accurate and regular variance analysis

- Precise forecasting for both short-term and long-term cash flows

- Dashboards and reporting:

- Drill-down functionality into cash flows across several entities

- Cash, credit, investment, hedging, and cash position tracking (by period, currency, region, and bank account)

- Compliance and safety:

- Authentication with many factors

- Access control based on roles

- Encryption of data

- Workflow for electronic signatures

- AI-powered fraud detection

- Consistent vulnerability scanning

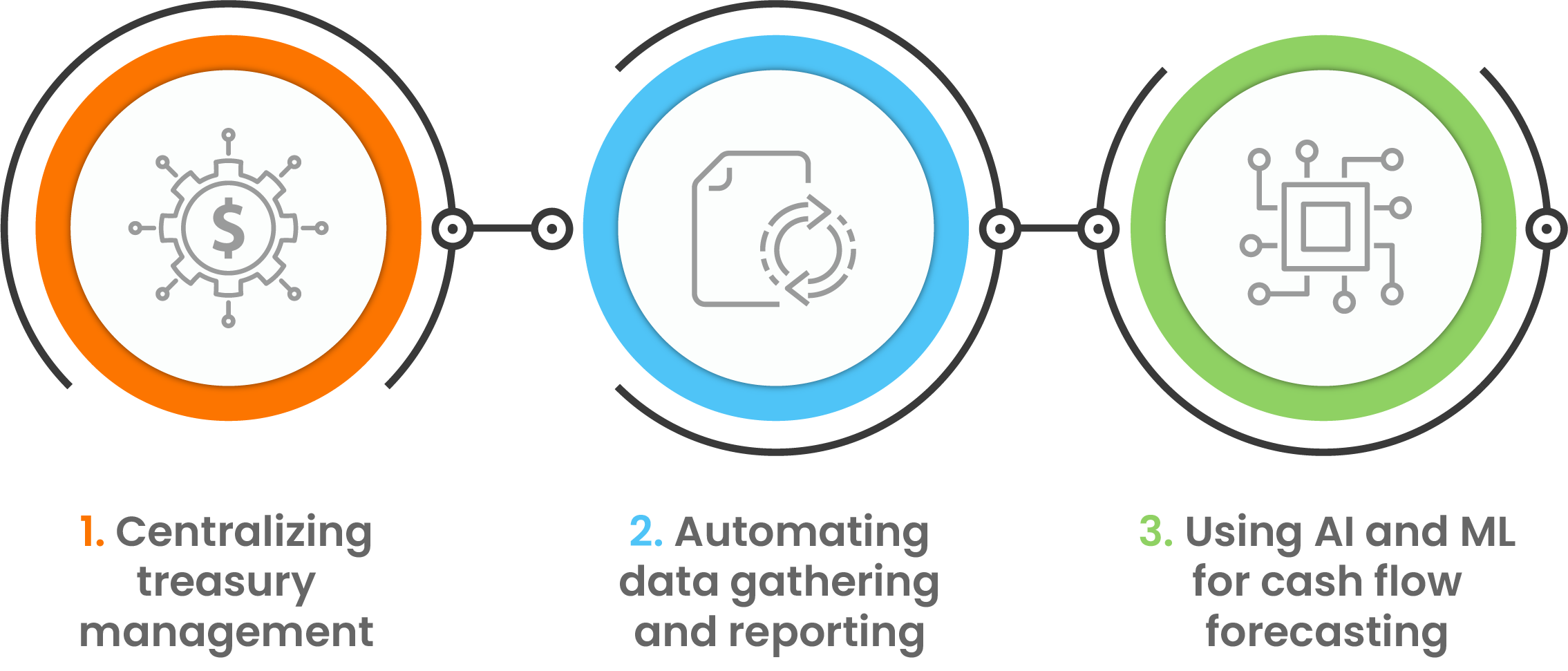

How can treasury operations be improved?

Ways to improve the treasury operations with the help of corporate treasury solutions:

- Centralizing treasury management: Centralized treasury management is the process used by companies with subsidiaries, where funding activities, investment, and foreign exchange decisions are made by one centrally located treasury team instead of a local treasurer. Firms can better set and track centralized policies, execute decisions, and make better-informed decisions by consolidating treasury functions.

- Automating data gathering and reporting: The technology should automatically recognize and capture data from several sources (TMS, bank portals, FP&A systems, and A/P and A/R departments)

- Improved accuracy

- Reduced paperwork and costs

- Minimized human errors

The following are some of the advantages of automated data capturing:

Using AI and ML for cash flow forecasting: Traditional forecasting typically uses only a slice of internal historical data, resulting in inaccurate predictions. AI and ML-based forecasts can incorporate a wide range of historical and external data to help deliver a finely tuned prediction. They track trends and patterns and create highly accurate and timely forecasts. This helps to improve reporting and planning.

What is a treasury management system used for?

Treasury systems manage cash, bank accounts, liquidity, investments, debt, and intercompany loans. The following are the functions of treasury solution:

-

Bookkeeping:

Corporate treasury software integrates seamlessly from internal and external data sources. They also clean data to handle formatting or other data quality issues. Bookkeeping in a single repository ensures easy and continuous data access.

-

Checking and reconciling transactions in finance:

With bank statements arriving in various formats, there is a high possibility of human error when manually reconciling—manual reconciliation results in duplicate payments and failure to follow up on transactions or detect frauds.

-

Multilateral netting:

Corporate treasury software helps calculate net payables and receivables positions. It provides efficient exposure management and integration with in-house banks.

-

Forecasting cash flows

Cash Forecasting Cloud helps to create accurate forecasts fast and easily. It also collects and validates bank and ERP data. It uses the historical variance trends of each forecast to validate accuracy.

Cash Management Cloud connects to all banks and reconciles transactions automatically. It helps keep track of bank connectivity, balances, and reconciliation status at the account level.

How do you choose enterprise software?

Here are some tips for selecting enterprise software:

- Learn about the most recent technological features using Google, LinkedIn, or attending conferences.

- Visit vendor websites to learn more about the product and read Customer reviews to understand its ability better.

- Examine the pain points to see how well the company’s solutions aid growth and revenue creation.

- Schedule an initial call or a brief demonstration to understand:

- The company’s current landscape or procedure

- The current issues and difficulties

- The ‘must-haves’ and ‘extras,’ as well as the priorities

- The budgeted amount

- The deadlines

Why are enterprise software and applications on the rise?

Due to massive technology advancements, business owners are looking for more innovative corporate treasury solutions.

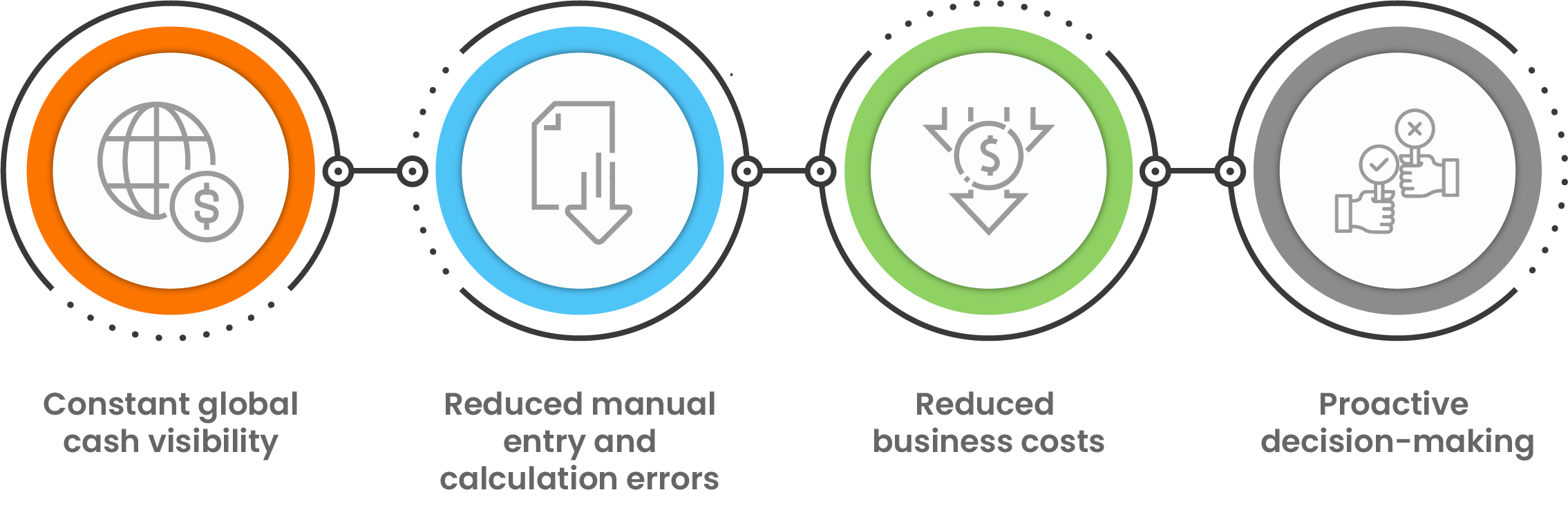

Key benefits of using a corporate treasury management software

Business owners look for corporate treasury software for the following reasons:

- Constant global cash visibility:

Treasurers can gain constant global cash visibility with the help of software for corporate treasury. They are no longer required to estimate their cash positions based on outdated data. Treasurers can get a clear picture of the company’s cash position with accurate data. - Reduced manual entry and calculation errors:

Users can create digital automation workflows for data entry and verification with treasury software. This ensures spotting and reducing manual mistakes as soon as possible. - Reduced business costs:

According to the McKinsey survey, Businesses that automated 50-70% of their tasks saw 20-35% annual cost savings and returns in the triple digits. - Proactive decision-making:

Organizations can make confident, timely decisions based on reliable cash forecasts and reports. This helps protect the business when a crisis strikes and gain a competitive advantage.

An automated treasury software removes bank fees for cross-border and multi-vendor payments. Money saved can be allocated towards business expansion, debt repayment, mergers, etc.