In the volatile economic landscape of 2026, cash is no longer just “king”; it is the oxygen of the enterprise. Yet, many finance departments are still operating on “manual respirators.”

If your team is still toggling between ERP screens, manually matching line items, or sending generic dunning emails, you aren’t just losing time; you are leaking working capital and compromising cash flow. Accounts receivable (AR) automation has fundamentally evolved. We have moved past simple “if-then” rules into the era of Agentic AI Orchestration, where AR automation systems don’t just follow instructions. It thinks, predicts, and executes, enhancing the capabilities of accounts receivable automation software.

Accounts receivable automation is the use of AI, machine learning, and integrated software to digitize the end-to-end invoice-to-cash cycle. By 2026, the industry has shifted toward Autonomous AR, where Agentic AI proactively predicts payment behavior, resolves disputes, and applies cash with 90%+ accuracy. This shift allows B2B organizations to reduce Days Sales Outstanding (DSO) by 30% and eliminate manual cash application.

Table of Contents

- What is Accounts Receivable Automation?

- Defining AR Automation for the Autonomous Era

- Why AR Automation is Non-Negotiable in 2026

- Transformative Benefits of Accounts Receivable Automation

- Beyond the "Add-On" Band-Aid: The HighRadius Accounts Receivable Automation Software

- The Future of Cash Flow: B2B Accounts Receivable Automation Best Practices for 2026

- AR Automation Implementation Checklist: Getting Started

- Overcoming Implementation Hurdles: The Power of XAI

- The ROI of "Autonomous" vs. "Traditional" Automation

- Essential FAQs

- Conclusion: The Path to $0 DSO

Modern AR automation is the strategic application of AI, Machine Learning (ML), and Generative AI agents to digitize the end-to-end invoice-to-cash cycle, offering significant automation benefits. In 2026, this definition has expanded far beyond “going paperless.” True AR autonomy creates a digital twin of your financial operations, providing real-time visibility into liquidity through five core pillars:

For decades, accounts receivable was dismissed as a back-office necessity. Today, it is a strategic growth engine. The manual era, defined by spreadsheets, stale aging reports, and reactive phone calls, is officially over thanks to automated AR solutions. According to a 2025 Gartner Finance Survey, 59% of finance leaders have integrated AI into their core operations, with AR automation serving as the primary driver for enterprise-wide efficiency gains.

The B2B landscape has undergone a tectonic shift. Your customers now expect a B2C-like payment experience: self-service portals, embedded payment links, and instant credit decisions. If your AR process remains manual, you aren’t just slow; you are a risk to your company’s working capital and may face late payments if you don’t implement AR automation.

For years, the industry benchmark was “digitization,” simply moving from paper to PDF. However, a 2025 McKinsey report on financial transformation highlighted a stark reality: while 70% of companies have automated parts of their AR, only 15% have achieved a truly Integrated or Autonomous state.

The gap lies in the difference between Rule-Based Automation and Agentic AI:

A 2025 IDC MarketScape report found that companies utilizing AI-driven AR platforms saw a 35% improvement in labor productivity. To build a compelling business case for the C-suite, focus on these three pillars: Liquidity, Productivity, and Experience.

| Benefit | Manual Impact | Automated Impact (HighRadius Benchmarks) |

| DSO Reduction | High (45+ Days) | 20-30% reduction via predictive collections. |

| Cash App Match Rate | 40-50% (Manual matching) | 90%+ “Straight-Through” processing is achievable with our AR automation solution. |

| Bad Debt Recovery | Reactive / Late | Proactive risk monitoring & 10% lower write-offs. |

| Team Productivity | 70% time spent on data entry | 75% increase in strategic “value-add” time due to implementing AR automation. |

| Customer Experience | Opaque / Phone-heavy billing processes hinder efficiency. | Self-service portals with 24/7 visibility improve the automated accounts receivable experience. |

| Data Accuracy | High Error (Spreadsheet lag) can significantly delay faster payments. | Real-time ERP sync with 99.9% accuracy accelerates billing and minimizes late payments. |

When organizations search for the best add-ons for accounts receivable automation, they are often looking for a quick fix for a singular pain point. However, in an enterprise or mid-sized company’s landscape, a band-aid cannot manage global scale or complex buyer behavior, highlighting the need for an effective AR automation solution. True transformation requires an ecosystem where specialized Agentic AI orchestrates the entire accounts receivable process.

At HighRadius, we’ve moved beyond static workflows to a digital workforce of AI Agents:

In 2026, the Office of the CFO has officially moved past “doing more with less.” The focus has shifted to autonomous finance. With liquidity tightening and global supply chains remaining volatile, B2B Accounts Receivable (AR) is no longer a back-office administrative task – it is a strategic lever for growth.

HighRadius and other industry leaders have redefined the “Invoice-to-Cash” cycle using Agentic AI, moving beyond simple rules-based automation to systems that can think, prioritize, and execute.

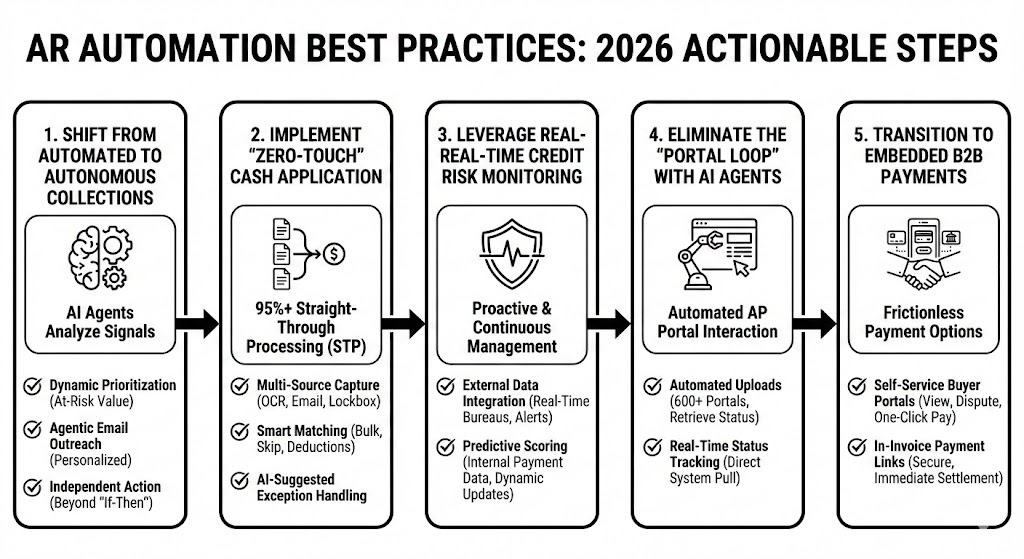

Here are the best practices for B2B AR automation in 2026, broken down into actionable steps.

Traditional automation follows “if-then” rules. In 2026, the best practice is to use AI Agents that analyze hundreds of signals (payment history, macro-economic trends, and even email sentiment) to act independently.

Manual reconciliation is the biggest bottleneck in the AR cycle. In 2026, the standard for “best-in-class” is a 95% or higher straight-through processing (STP) rate.

Static credit scores updated once a year are obsolete. In 2026, credit management must be proactive and continuous.

One of the biggest drains on AR productivity is the manual upload of invoices into customer AP portals (like Ariba, Coupa, or OpenText).

In 2026, the “check is in the mail” is a thing of the past. Frictionless payment options are now a competitive advantage.

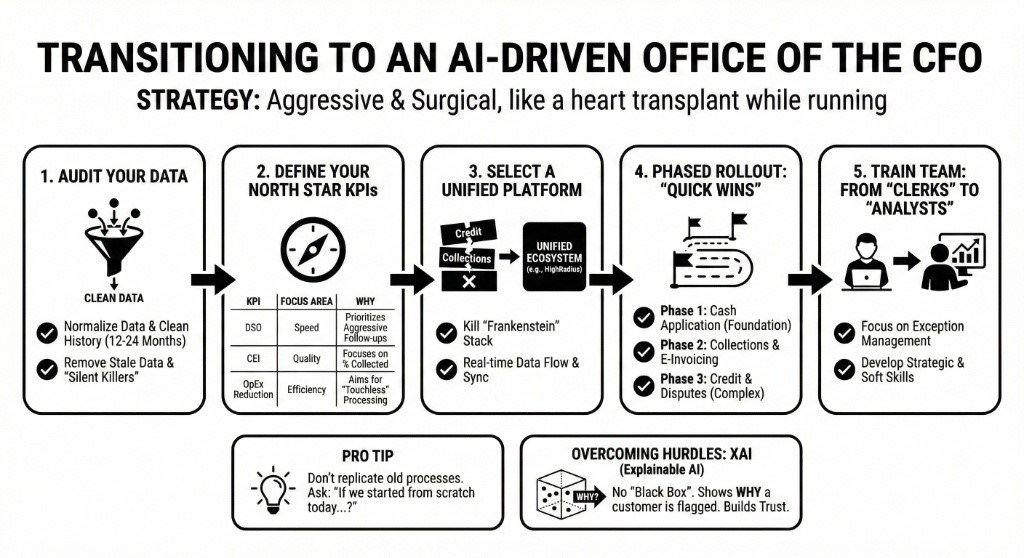

Transitioning to an AI-driven Office of the CFO isn’t just about flipping a switch; it’s more like performing a heart transplant while the patient is running a marathon. You need a strategy that’s both aggressive and surgical.

AI doesn’t have “intuition” – it has patterns. If your ERP data is a graveyard of duplicate customer profiles and inconsistent payment codes, your AI will simply automate your mistakes at a much higher velocity.

You can’t optimize everything at once. Your primary KPI dictates the “flavor” of AI logic you’ll deploy.

| KPI | Focus Area | Why it matters for AI |

| DSO (Days Sales Outstanding) | Speed | AI prioritizes aggressive follow-ups on high-value, late-paying accounts. |

| CEI (Collection Effectiveness Index) | Quality | AI focuses on the percentage of available credit collected, regardless of timing. |

| OpEx Reduction | Efficiency | AI aims for “Touchless” processing to reduce the headcount-to-revenue ratio. |

Many CFOs make the mistake of buying a “best-of-breed” tool for Credit and a different one for Collections. This creates “data silos” where the Credit team doesn’t know the Collections team is currently disputing a major invoice.

Don’t try to boil the ocean. A phased approach builds internal buy-in and proves ROI to stakeholders early.

The biggest hurdle isn’t tech; it’s culture. Your team might fear that “AI is coming for my job.” Reframe the narrative: AI is coming for the parts of your job you hate.

Pro Tip: When moving to AI, don’t just replicate your old manual processes in a new system. Use this as an opportunity to ask: “If we started this department from scratch today, would we even do it this way?”

Overcoming Implementation Hurdles: The Power of XAI

A common concern with AI is the “black box” effect. At HighRadius, we emphasize Explainable AI (XAI). Our platforms don’t just flag a customer as a risk; they show you why, identifying specific trends like a 12% increase in payment delays over three months. This transparency builds trust between the AI and your finance professionals, ultimately helping to improve cash flow.

| Feature | Legacy AR Automation | HighRadius Autonomous AR (2026) |

| Logic & Adaptability | Static & Rule-based: Follows rigid “If X, then Y” paths. If a customer changes their payment format, the system breaks. | Dynamic & Agentic: Goal-oriented. The AI “agent” understands the objective (e.g., “Reduce DSO for Retail”) and adjusts tactics automatically. |

| Data Ingestion | Template-reliant: Requires specific EDI or Excel formats. Non-standard remittances (PDFs, body of email) require manual intervention. | Contextual OCR: Uses “Template-less” AI to read any document. It understands that “Inv #123” and “Bill 123” are the same thing, even in a blurry photo. |

| Collections Strategy | Aging-based: Focuses on the “30, 60, 90” day buckets. Collectors waste time on low-risk customers who are simply “slow but sure.” | Probability-based: Ranks your worklist by Likelihood to Pay. It ignores the “slow but safe” and flags the “fast but currently failing” accounts. |

| Customer Outreach | Rigid Templates: Sends “Robot” emails that customers ignore. Often results in “Dunning Fatigue.” | Generative AI Outreach: Drafts empathetic, human-like emails. It can even negotiate small payment plans or suggest discounts autonomously. |

| Dispute Handling | Flagging: Simply marks an invoice as “disputed” and stops the clock, requiring a human to investigate. | Root-Cause Analysis: Automatically cross-references the PO and BOL to identify if the dispute is valid, often resolving it before a human sees it. |

| Portal Management | Manual Upload: Staff must log into 20+ different buyer portals to upload invoices. | Bot-Led Integration: AI “crawlers” log in, upload invoices, and pull “Ready for Payment” statuses back into your ERP. |

In traditional automation, the system handles the 60% of cases that are “easy.” The remaining 40% (exceptions) still require a massive team.

Legacy automation is often “noisy” – sending aggressive letters to your best customers because a check was one day late.

Traditional systems report on the past (what was collected yesterday). Autonomous systems predict the future.

| Metric | Manual AR | Traditional Automation | Autonomous (2026) |

| DSO (Days Sales Outstanding) | 55+ Days | 45-50 Days | <38 Days |

| Cost per Invoice | $15.00+ | $8.00 | <$3.00 |

| Cash App Match Rate | 20% | 65% | 95% |

| Staff Focus | Transactional | Tactical | Strategic/Analytical |

An ERP is a system of record designed for data storage and integration with accounts receivable software. HighRadius AR automation is a system of action. It sits on top of your ERP to proactively manage workflows and automate communication, tasks that standard ERPs require significant manual effort to perform.

Agentic AI acts as a digital hunter. It can read “noisy” or unstructured remittance data from email bodies or portals. It then uses neural networks to match these payments to open invoices with over 90% accuracy in an automated system without human intervention.

Most enterprises achieve full ROI within 6 to 12 months, seeing a 20-40% reduction in DSO and a 60-80% decrease in operational costs.

AI reduces DSO by replacing static aging reports with Predictive Collections. By analyzing 10,000+ data points, the AI prioritizes accounts based on their probability of payment rather than just the due date.

Yes, utilizing an automation solution can enhance efficiency. Deduction Agents automatically validate short-payments by cross-referencing them against promotions and shipping manifests, resolving valid disputes instantly and flagging unauthorized deductions for follow-up.

Key practices include implementing customer self-service portals, using AI for remittance scraping, and utilizing real-time credit monitoring to prevent bad debt before orders ship.

HighRadius Credit Agents pull data from 40+ external agencies and internal trends to provide a continuous risk score, allowing you to block high-risk orders automatically before they impact your balance sheet.

Yes, the automation process is crucial. Modern receivables automation is ERP-agnostic. HighRadius features bi-directional connectors for SAP, Oracle, and NetSuite, ensuring data stays synchronized across your tech stack.

Generative AI is used to create personalized, human-like outreach. It drafts emails that acknowledge a customer’s specific history and sentiment, which improves customer relationships and response rates compared to rigid automated templates.

Absolutely, automation work is essential. High-level platforms are designed for multi-entity and multi-currency complexity, enhancing cash flow management. They consolidate global receivables into a single source of truth for centralized treasury visibility, streamlining the accounts payable process.

We are entering an era where manual back-office processes are a liability. By adopting accounts receivable automation and embracing Agentic AI Orchestration, finance leaders can stop chasing payments and start driving enterprise strategy.

HighRadius is the only provider offering a truly Autonomous Finance Office, designed to accelerate billing processes. From credit to cash, our AI agents work tirelessly to ensure your balance sheet reflects your company’s strength, not its inefficiencies.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center