Managing accounts receivables is critical for maintaining a healthy cash flow in any business. Metrics such as invoice aging, days sales outstanding, and bad debt directly impact cash inflows.

To streamline AR operations and reduce the time and effort required to mitigate credit risk, deliver invoices, collect payments, and match records, accounts receivable management software is essential.

However, with numerous options available, choosing the best software can be overwhelming. To simplify this process, we’ll provide tips on selecting the best accounts receivable tracking software for your business.

But before deciding on the most effective software for accounts receivable, you’ll first need to grasp the basics of the accounts receivable management software and how it can benefit your business.

Account receivables management software is a tool that automates the process of managing and tracking money owed to a business by its customers. It helps streamline invoicing, payment collection, and reporting, improving cash flow and reducing the time spent on manual tasks.

Investing in an AR management software can also lead to increased efficiency and productivity. By automating many of the manual tasks involved in receivables management, businesses can free up their finance executives and collectors to focus on higher-value tasks like credit and collections strategies. With features like automated invoicing, collections prioritization, and deduction management, businesses can streamline their operations and improve their bottom line.

Accounts receivable solutions is crucial for a business as it automates billing and collections, reducing manual errors and administrative costs. It enhances cash flow management, provides real-time financial insights, improves efficiency, and strengthens customer relationships by ensuring timely and accurate invoicing and payment processing. By investing in AR management software, businesses can reap several benefits:

Investing in accounts receivable automation software not only enhances financial management but also supports business growth by optimizing cash flow, reducing costs, and improving customer relationships. Here are the top accounts receivable automation benefits:

Once you have decided to invest in AR management software, the next step is to determine whether it has all the required characteristics and functionality.

When selecting Accounts Receivable Management Software, choosing a solution that meets your business needs and optimizes your financial processes is crucial. The right software should streamline invoicing, enhance payment tracking, and improve cash flow management. Here are some key features to look for when evaluating your options.

The first aspect to consider is automated invoicing. This feature should allow you to create and send professional, branded invoices with ease.

Ask yourself these questions before deciding:

Payment processing capabilities are essential for handling various payment methods and ensuring secure transactions.

Consider the following points:

Having access to real-time reporting and analytics is crucial for gaining insights into your financial operations.

Evaluate these aspects:

Automated reminders and notifications help ensure timely payments and keep customers informed.

Key considerations include:

Effective customer management tools can enhance the payment experience and streamline communication.

Ask these questions:

Integration capabilities are important for ensuring that your AR software works seamlessly with other systems.

Consider these points:

Security and compliance features are crucial for protecting sensitive financial data and meeting regulatory requirements.

Evaluate the following:

Customizable workflows allow you to tailor the software to your business processes and requirements.

Consider these aspects:

Cash application features can streamline the reconciliation process and reduce manual efforts.

Key questions include:

Effective dispute management tools can help resolve issues quickly and efficiently.

Consider these points:

Mobile accessibility ensures that you can manage accounts receivable on the go.

Ask these questions:

Scalability features ensure that the software can grow with your business.

Consider these aspects:

Reliable customer support is crucial for addressing any issues or queries you have.

Evaluate the following:

When choosing the best account receivable management solution for your business, following specific steps can help you make the right decision. Here are the steps:

Start by connecting with your team members who work on accounts receivable workflows to understand their challenges and requirements. This will help you set clear objectives about what you want to achieve with AR automation software.

Some questions to ask your team include:

It’s important to assess how well you’ve automated the different steps in your AR process to identify gaps and understand which processes need to be automated on priority to improve efficiency.

Once you assess your needs and the gaps in your system, you need to look for solution vendors that can help plug the gaps. Research various AR solutions and compare their features, pricing, regulatory compliance levels, and integrations. Opting for cloud-based solutions can save you CAPEX costs and improve scalability, while on-premise-hosted solutions give you better control over your data and processes.

Key accounts receivable software features:

|

Feature |

Description |

|

Billing and invoicing |

Auto-generate invoices and deliver them via emails or directly to customers’ accounting or AP systems. |

|

Payment processing |

Process multiple payments including ACH, checks, and wire transfers. Allow customers to schedule payments, pay in installments or partially. |

|

Aging reports |

Keep track of aging receivables and categorize them based on the number of days outstanding (< 30 days, etc.). |

|

Worklist prioritization |

Automatically rank outstanding accounts based on the amount and days overdue. |

|

Customer self-service portals |

Allow customers to identify their amounts due and pay anytime using their preferred channels. |

|

Credit risk scoring |

Check the credit scores of customers using predefined models and data from multiple sources. |

|

Automated dunning |

Automatically sends reminder emails to customers about their payment due dates and amounts. |

Other good-to-have features include automated cash reconciliation, in-app calling for collectors, and deductions management.

When selecting an AR solution, ensure it can integrate with your ERP, accounting, or CRM software. Look for plug-and-play integrators to speed up implementation and avoid extra costs. Out-of-the-box integrators can help you navigate the process without much IT support. HighRadius’ solutions are built for all popular ERP systems, including NetSuite, Sage Intacct, Microsoft Dynamics, SAP, and Oracle.

This is one of the key deciding factors in your software purchase journey. AR software solutions may be priced on a per-user basis or the number of invoices sent. Check if your company policies allow you to subscribe to the vendors’ pricing model. Study if they fall within your budget limits and can help you achieve target ROIs within the specified timelines.

Along with evaluating the software solutions, check the vendors’ credibility, clientele, and service levels. You don’t want to be stuck with an unresponsive vendor after the software implementation.

Some key parameters to evaluate the vendor on include:

1. Application uptime: This metric helps you gauge whether your application will be available 24×7. It will also give an idea of which party will be responsible if the service is disrupted by planned downtime or unplanned outages. The common industry standard is to support 99.9% uptime.

2. Response levels: This metric promises how much time it will take your AR SaaS vendor to recover from a cybersecurity incident from the time it has been detected. Other business continuity and disaster recovery metrics, such as recovery time objective (RTO) and recovery point objective (RPO), help you know how much time it will take for you to get your data in case of an incident and how much of the data you’ll be able to recover, respectively. The shorter the RTO, RPO, and incident response time, the better the vendor’s service.

3. Security measures: Since financial and client info is one of the most confidential data, it is pertinent that your AR solution adheres to the highest security standards. This also helps from a regulatory standpoint. If you are using SaaS AR software, check for the multi-tenant security measures, location of data centers, data retention, data encryption, and access privileges.

4. Grievance TAT: Check the customer service turn-around-time (TAT) of the vendor. Does the vendor promise to reply or initiate action on your grievance within four hours? How long does the vendor say they take to resolve issues – less than 48 hours or more? To provide your customers excellent customer service, your AR application and payment portal must be available at all times without any hiccups.

Ensure that the above metrics are covered in the service level agreement you sign with the AR software vendor. Add any other conditions or services that are crucial to meet your business goals. Track whether the AR software vendor upholds all the promises mentioned in the SLA.

Once you’ve shortlisted a few vendors, the next steps are to touch base with them via email, chatbot, or social media to better understand their offerings and start a conversation.Take demos of the solutions to get a feel of their interface and features. Chat with the solution experts to understand the limitations of the product and any additional costs due to customization or other requirements.

Questions to ask during a demo session:

Share your solution comparison and vendor analysis with all the stakeholders, such as the CFO, finance director, AR manager, and other executives. Include the stakeholders in the demo calls and other high-level discussions. Based on your interactions with the vendors and the scores you’ve allotted to their solutions and services, shortlist 1-2 vendors to proceed with.

These five steps can help you choose the best accounts receivable collection tools for your business. And if you’re looking for an AR software solution that can help streamline your AR processes, HighRadius can help. In the next section, we’ll discuss how HighRadius can help streamline your AR processes.

Choosing the right receivables management software can significantly improve your collections, reduce DSO, and streamline your AR operations, but only if you avoid a few common pitfalls that businesses often overlook. Many teams rush into a decision based on price or flashy features, without considering day-to-day usability, scalability, or integration needs. Avoiding these mistakes will ensure you pick a solution that actually solves your AR challenges instead of creating new ones.

Some tools automate small parts of AR but don’t support the full receivables lifecycle. If you buy a limited solution, you’ll still end up with manual work and disconnected processes. Always evaluate whether the software covers invoicing, collections, cash application, credit, and dispute management collectively.

Receivables management software is only as powerful as its ability to connect with your ERP. Poor integration leads to inaccurate data, syncing issues, and delays in reporting. Make sure the solution offers plug-and-play connectors, real-time data sync, and compatibility with all your ERP instances.

Modern AR teams rely on AI for forecasting payments, prioritizing collections, and identifying at-risk customers. Software without AI quickly becomes outdated and limits your ability to make proactive decisions. Ensure the platform includes predictive insights and automation that evolve with your business.

Even the best receivables management software fails if your team doesn’t use it. Many organizations pick overly complex tools that require heavy training or force users to switch from familiar workflows. Look for intuitive interfaces, Excel-like environments, and guided workflows to ensure smooth adoption.

Some tools automate tasks but don’t improve visibility into cash flow, DSO, or customer risk. Without strong analytics and real-time dashboards, leadership can’t make informed decisions. Choose a platform that offers clear, role-based reporting and strong forecasting capabilities.

Low-cost options often lack essential AR features, integrations, or support, which ultimately costs more in the long run. Instead of comparing price tags, evaluate the total ROI: time saved, accuracy gains, faster collections, and cash flow improvements.

What works for your current AR volumes may not support your business two years from now. Ensure the software can scale across regions, business units, transaction volumes, and evolving credit or collection policies.

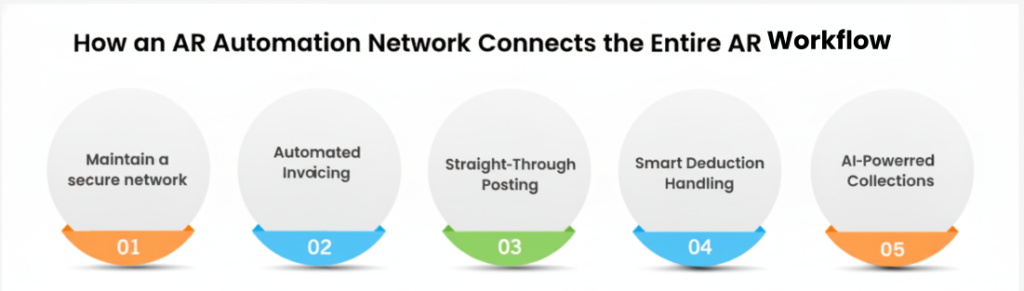

Modern AR automation is no longer about isolated tools for invoicing, collections, or cash application. In 2026, leading finance teams are shifting toward a fully connected AR automation network — a unified ecosystem where ERPs, banks, customer portals, payment channels, and communication workflows operate together. A connected network helps AR teams move past fragmented processes and gain real-time visibility into customer behavior, open receivables, remittance data, and payment trends. The result is faster decision-making, fewer manual touches, and smoother cash flow management across the enterprise.

Traditional AR systems handle tasks in silos, such as one tool for invoicing, another for payments, and another for collections. An AR automation network connects all these touchpoints, creating a continuous data flow between customers, banks, and finance systems. With AI powering every interaction, teams benefit from unified dashboards, synchronized customer data, and automated workflows that adjust based on real-time risk, payment patterns, and invoice activity. For CFOs, this translates into greater control over cash flow and a scalable foundation for global AR operations.

The AR technology ecosystem has undergone a significant transformation over the last decade, evolving into a diverse and competitive landscape of AR automation companies that cater to various organizational needs, process complexities, and industry environments.

As organizations move away from manual collections, fragmented credit workflows, and error-prone cash application processes, the choice of an automation partner has become a strategic decision that directly influences working capital efficiency and customer experience. This section provides a detailed look at how the vendor landscape is structured today, how capabilities have evolved, and what finance leaders should consider when evaluating the right fit for their AR operations.

AR automation companies typically fall into three broad segments, each serving distinct business needs:

These solutions deliver end-to-end automation across the entire receivables lifecycle, including credit management, collections, dispute resolution, deductions, and cash application. Key capabilities include:

They serve large organizations with high volumes, global operations, and complex approval workflows.

These AR automation companies focus on delivering robust automation without requiring heavy customization or lengthy deployment cycles. Typical strengths include:

They are most effective for organizations with a growing transaction volume and a need to streamline repetitive tasks.

These vendors focus on solving specific AR challenges exceptionally well—rather than offering a broad suite. Examples include tools for:

These are ideal for organizations looking to build a modular automation stack or augment their existing AR systems.

Although each vendor differentiates itself in unique ways, most leading AR automation companies now offer a baseline set of modern capabilities:

What varies dramatically is the depth, accuracy, and intelligence behind these capabilities.

As AR automation becomes more sophisticated, several factors distinguish true automation leaders:

Market-leading platforms don’t just automate tasks—they analyze historical trends, assess customer payment behavior, and prioritize collector workloads. This elevates AR teams from reactive operations to proactive decision-making.

Top AR automation companies offer real-time, bidirectional integrations that support complex posting logic, custom fields, and multi-entity structures. This level of integration ensures data consistency, making “touchless AR” achievable.

Vendors with full lifecycle coverage, from credit management to invoicing, collections, dispute handling, and cash application deliver superior data continuity and reduce tech stack fragmentation.

As organizations expand, they require vendors that support:

Only a subset of AR automation companies consistently offer these capabilities.

Before shortlisting vendors, CFOs and AR leaders should evaluate:

Understanding these internal priorities helps organizations identify which category of AR automation company best aligns with their operational needs and long-term automation vision.

With dozens of AR automation companies offering overlapping features, the evaluation stage is often where finance leaders struggle the most. What looks similar on a product page may perform very differently in real-world AR operations. To choose a partner that will genuinely reduce manual work, improve cash flow visibility, and scale with your business, it’s essential to compare vendors using a structured, criteria-based approach. This section outlines the core dimensions that matter most when assessing AR automation platforms, beyond superficial feature checklists.

Not all automation is equal. Some vendors digitize existing AR tasks, while others fundamentally eliminate manual work through machine learning and predictive workflows.

Key questions to assess automation depth:

Vendors with deeper automation capabilities help teams achieve higher productivity gains and lower DSO without needing to hire more staff.

Integration is one of the biggest differentiators among AR automation companies. A strong integration ensures consistent data flow, reduces reconciliation errors, and enables real-time insights.

When comparing integrations, look beyond “pre-built connectors” and evaluate:

A well-integrated platform becomes an extension of your ERP—not an isolated tool.

Modern AR teams rely heavily on analytics for forecasting, prioritizing collections, and identifying customer risk. The maturity of a vendor’s AI and analytical models can significantly impact performance outcomes.

Assess:

The more advanced AR automation companies offer embedded AI that continuously improves efficiency and decision-making—not generic dashboards.

Some vendors excel in one discipline (like cash application), while others offer full-suite capabilities. A broader suite means fewer systems to manage and better data consistency.

Evaluate whether the vendor covers:

The more unified the AR automation environment, the stronger the operational visibility and the lower the total cost of ownership.

Implementation timelines vary widely among AR automation companies. Some require months of IT involvement; others offer rapid deployment with minimal disruption.

Check for:

Shorter and smoother implementations accelerate ROI and reduce change management friction.

Since AR data includes financial, tax, and customer information, security standards cannot be compromised.

Evaluate:

Security maturity is often where the difference between legacy AR tools and enterprise-grade AR automation companies becomes clear.

Features matter, but real-world outcomes matter more. Buyers should look for vendors with proven success across organizations similar to theirs.

Assess:

AR automation is not a one-time software purchase, it’s an ongoing operational partnership.

Finally, evaluating AR automation companies requires understanding the full cost picture—not just subscription fees.

Consider:

The right vendor should provide transparency around costs and clear projections of financial impact.

Want to streamline your accounts receivable processes? HighRadius’ Accounts Receivables suite of solutions can help. With HighRadius, you can automate your entire AR process, from invoice delivery and tracking to collections worklist prioritization, payment predictions, and cash projections. Powered by AI and RPA-based tools, HighRadius’ solutions can help you reduce manual efforts and errors, improve efficiency, and increase cash flow.

More than 700 of the world’s leading companies have transformed their order to cash, receivables, and treasury processes with HighRadius. Our customers include PepsiCo, Anheuser-Busch InBev, Sanofi, Kellogg Company, Sysmex, and many more.

HighRadius offers AI-powered Cloud-based tools for the Office of the CFO, which brings modern digital transformation capabilities like artificial intelligence, robotic process automation, natural language processing, and connected workspaces as out-of-the-box features for the finance & accounting domain.

This suite of solutions automates all aspects of your accounts receivables process, including EIPP Cloud, Collections Cloud, Credit Cloud, Deductions Cloud, and Cash Application Software.

So if you’re ready to streamline your AR processes and improve your cash flow, connect with us today to understand how our solutions work and how we can help your business.

Five KPIs for accounts receivable are: 1) Days Sales Outstanding (DSO), 2) Accounts Receivable Turnover Ratio, 3) Collection Effectiveness Index (CEI), 4) Percentage of Receivables Over 90 Days, & 5) Bad Debt to Sales Ratio. These metrics assess efficiency and effectiveness in managing receivables.

To automate accounts receivable, implement software that manages invoicing, payment tracking, and communication with customers. This includes automatic invoice generation, electronic payment processing, reminders for due payments, and real-time reporting for better cash flow management.

AP automation involves streamlining the process of managing outgoing payments to vendors, including invoice processing and payment execution. AR automation focuses on optimizing incoming payments by automating invoicing, payment tracking, and customer communication with the help of accounts receivable management software.

Use accounts receivable management software to automate invoicing, track payments, send reminders, and generate real-time reports, ensuring accuracy and efficiency in monitoring outstanding receivables.

Automate collections by using accounts receivable management software to send scheduled payment reminders, manage recurring invoices, process payments, and update payment records automatically, reducing manual effort and improving cash flow.

An AR automation network is a connected system of tools, portals, banks, and data sources that work together to automate invoicing, collections, disputes, and cash application. It centralizes customer data, improves visibility, and speeds up cash flow.

It eliminates data silos, automates routine work, and provides real-time insights into payments, remittances, and open invoices. AR teams gain faster decision-making, fewer errors, and higher cash-collection efficiency.

It allows finance teams to scale globally, improve customer experience, and maintain accurate, real-time receivables data. CFOs rely on connected AR networks for better liquidity planning and operational efficiency.

Here’s the thing: when customers get clear invoices, consistent reminders, and easy payment options, they pay faster. AR automation does exactly that by standardizing communication and offering self-service payment links. Many teams use accounts receivable management software to keep everything timely and predictable, which naturally improves on-time payments.

Most teams start by checking if the tool integrates with their ERP, supports multi-entity operations, and gives real-time cash visibility. The best systems also automate dunning, handle disputes, and offer strong reporting. This is where accounts receivable management software helps because it centralizes these workflows instead of scattering them across spreadsheets and email threads.

Global teams deal with currency differences, varying tax rules, and complex customer structures. Good AR platforms handle multi-currency billing, localized workflows, and global dashboards so teams aren’t stitching data together manually. Using account receivable management software keeps those complexities under control and ensures consistent processes across regions.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center