The 11 Unbeatable Collection Email (Letter) Templates

This e-book provides templates for 21 most effective credit and collection letters that will help you communicate better with your customer. The e-book is a culmination of our work with credit and collection experts over more than 700 credit and A/R transformation projects across the world.

The 11 Unbeatable Collection Email (Letter) Templates

3.1 Pro-active payment reminders

Sample email 3.1 is written to inform the customer regarding payment dues Best-practices:

- Be polite ? remember that this is just a pro-active reminder; do not assume that the customer will default

- Clearly specify the invoices and the due-dates

- Urge them to make a payment with their earliest A/P run

- Share options for easy payment methods through an EIPP portal

Click on the icon to download the email templates

Click on the icon to download the email templates

3.2 Early-payment discount reminders

Sample email 3.2 is written to inform the customer regarding early payment discounts they can avail Best-practices:

- Clearly call out the offer ? a discount on early payment

- Clearly spell out the date by which payment must be made

- Detail any invoices with the actual amounts to be paid ? this clears any confusion in buyers manually calculating final amounts

- Urge them to make a payment with their earliest A/P run

- Provide convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

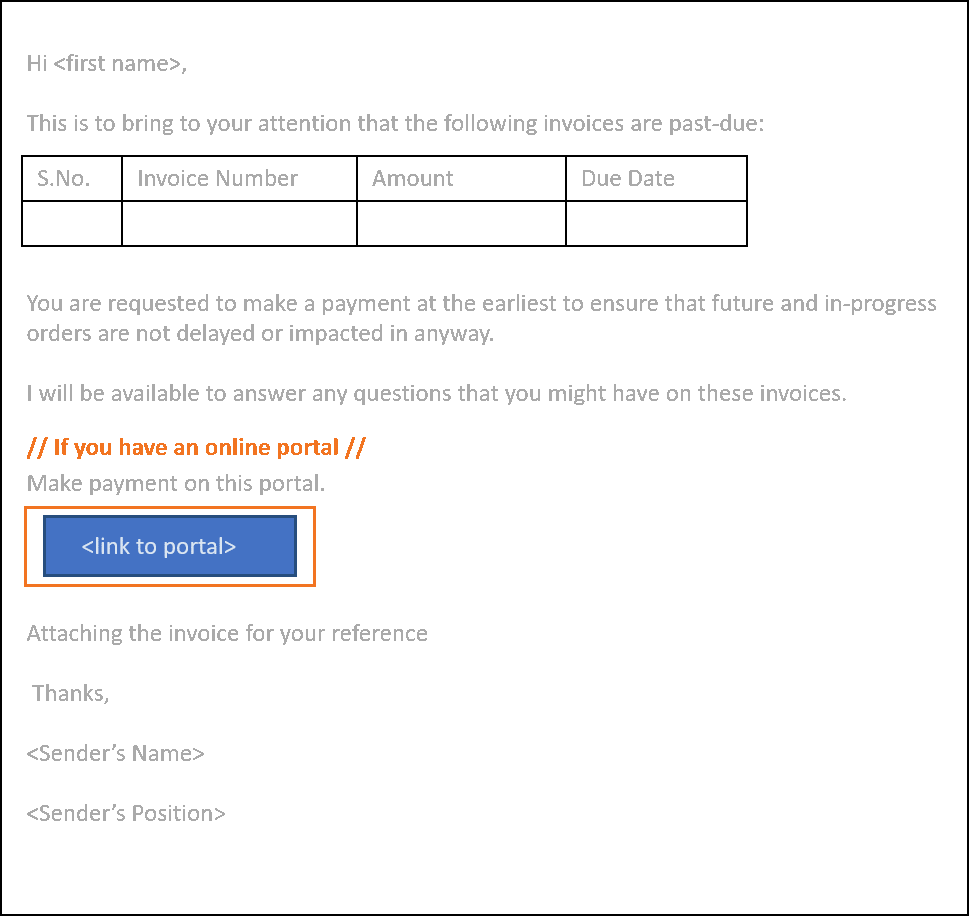

3.3 First past-due reminders

Sample email 3.3 is written as the first reminder for the customer?s past-due invoices Best-practices:

- Clarify whether the customer has received any previous invoice copies

- Call out the invoices for which payment has been delayed ? specify the actual date

- Ask the customer to reach out to customer serivce in case of any issues

- Offer convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

3.4 Second past-due reminder

Sample email 3.4 is written as the second reminder for the customer?s past-due invoices Best-practices:

- Clearly inform about the delay in payment

- Call out the email as a ?second? past-due reminder

- Remind the customer to make a payment at their earliest possible

- Offer the option of making a payment commitment through your EIPP portal

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.5 Third past-due reminder

Sample email 3.5 is written as the third reminder for the customer?s past-due invoices Best-practices:

- Call out the possible outcomes for further non-receipt

- Drop any non-essential courtesy or flowery language

- Remind the customer to make a payment at their earliest possible

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.6†Suspension of credit

Sample email 3.6 is written to inform the customer that the credit for their account has been suspended due to prolonged delinquency Best-practices:

- Inform about discontinued credit

- Clearly specify the reason for discontinuation of credit to the account

- Call out the total value of outstanding or past-due invoices

- Offer reaching out directly to a customer service representative as the first option

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.7 Default on payment commitment

Sample email 3.7 is written as a reminder to the customer about the unfulfilled payment commitment Best-practices:

- Include the details of the invoice, amount and promised payment date

- Ask the customer to contact a customer service representative for any help in facilitating the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.8 Escalation notice

Sample email 3.8 is written in an extra-ordinary circumstance in which the recipient is being reached out to for long outstanding dues Best-practices:

- Highlight all the information they need to help process the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

- Use this template sparingly to avoid diluting its impact and value

Click on the icon to download the email templates

Click on the icon to download the email templates

3.9 Collecting from key accounts

Sample email 3.9 is written as a polite reminder to the customer to clear few invoices that have outstanding payments Best-practices:

- Appreciate the relationship with the customer

- Be polite and helpful with any additional details they may need in processing the payment

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place

Click on the icon to download the email templates

Click on the icon to download the email templates

3.10 Collecting from Slow-paying customers

Sample email 3.10 is written to collect from customers who are very slow in their payments and have outstanding invoices Best-practices:

- Share all information required in a single place

- Be up-front about the implications of continued delay in payments

- Offer support in answering any questions

- Offer convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

3.11†Collecting from Fast-paying customers

Sample email 3.11 is written as a polite reminder for customers who are usually fast-paying but have some outstanding invoices Best-practices:

- Be polite ? these customers have always paid you on-time

- Offer the benefit of doubt and ask them to reach out to customer service for any help

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place

Click on the icon to download the email templates

Click on the icon to download the email templates