Five Treasury Technology Trends CFOs Should Look out for in 2022

Financial technologies are transforming the corporate treasury, causing both opportunities as well as challenges. Read this ebook to discover the top five treasury technology trends that CFOs should know about in 2022 to stay ahead to the curve.

Why do CFOs need to redefine their 2022 goals for treasury?

The pandemic led to an accelerated pace of innovation and the adoption of technology. Both midmarket and enterprise treasury were affected due to the pandemic, which urged them to improve their cash flow visibility and reassess multiple scenarios for better risk management. 2020 proved that the treasury department’s role has become more crucial than ever due to cash flow volatility. CFOs have placed a high focus on accurate and regular cash forecasting to measure and mitigate risks. However, some organizations are still continuing to forecast cash manually, which affects both accuracy and frequency of cash forecasting.

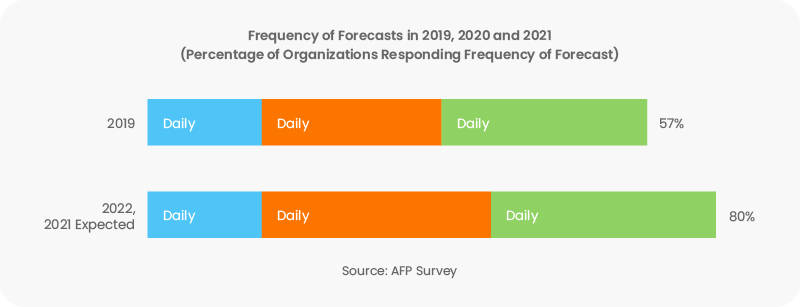

According to an AFP survey, the forecast frequency (daily, weekly, and monthly) surged to 80% during COVID-19, up from around 57% in 2020 and 2021.

Post-pandemic influence on treasury and treasury software

- Treasury technology trends such as real-time cash reconciliation, bank fee reduction, digital collaboration with trading partners started to transform treasury functions

- CFOs started to demand up-to-date cash flow reports with high visibility to make timely decisions

- Leveraging modern treasury management systems for cash forecasting and accurate cash flow management became the top priority for the treasury

CFOs all over the world are developing new technology-oriented goals. They are attempting to build endurance, agility, and an adaptive nature within the treasury department, given the likelihood that existing circumstances may become the new normal in the coming years. This allows organizations to maintain and support their operations, credit reputation, and capital growth strategies. Corporates are focusing on altering their company strategy to be more cash-centric, with an emphasis on value addition.

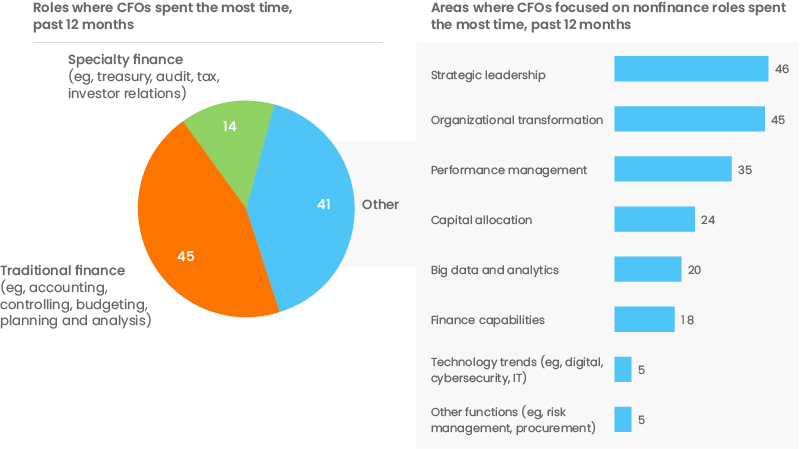

Moreover, CFO responsibilities and functions have transformed significantly in recent years. McKinsey’s survey states that treasury, audit, tax, and investor relations, as well as basic financial tasks like accounting, controlling, budgeting, planning, and analysis, are monitored by CFOs. But at the same time, CFOs are also focusing on strategic leadership, organization transformation, and performance management.

As the roles of the CFOs have started to expand, they need to keep up with the changes within treasury. Here are the five treasury technology trends that CFOs should look out for to help their organizations maintain and support their treasury operations, credit reputation, and capital expansion strategies:

5 latest treasury technology trends

1. RPA for process automation

RPA (robotic process automation) is a software robot that mimics human behaviors. It’s most commonly employed in treasury and finance to automate time-consuming, manual operations, allowing practitioners to focus on more important tasks.

CFOs are keen to shift from transactional to strategic tasks to focus on adding more value to the business. RPA is being leveraged by companies to reduce their laborious manual tasks that reduce the efficiency and productivity of teams.

Automation improves cash visibility through drill-down capabilities into entity-level data. So, without having to hunt through different spreadsheets and portals, treasury teams can readily access data at any moment.

Here are several instances of how treasury can achieve ROI with RPA:

- Cash positions and cash flow forecasts – gathering data from several systems and applications, checking for consistency based on limits, constructing and sharing reports with relevant stakeholders for review or decision-making

- Manual file uploads and downloads are still required for payment and bank statement processing using EBS systems or letters. Bots save time, keep information private, and leave a digital audit trail that manual payment file handling lacks

2. AI and big data analytics for processing and analyzing datasets

Artificial Intelligence and analytics are widely being adopted by treasury for a variety of purposes such as:

- Cash flow planning

- Regulatory compliance

- Cash forecasting

- Commodity and credit risk management

- Hedging

Apart from cost savings, AI also helps to generate accurate forecasts based on historical data trends, accurate scenario modeling, and variance analysis. Accurate cash forecasts help CFOs gain confidence in making decisions on borrowing, investing, acquisitions, repatriation, and risk management. Traders can also use AI for risk management and order flow management to improve efficiency and expedite execution.

Asset allocation and stock selection are based on ML models’ ability to spot signals and capture underlying correlations in large data, as well as the optimization of operational processes and risk management.

3. Cloud-based TMS and SaaS for scalability and flexibility

Treasury management systems enable businesses to automate critical financial operations — such as communicating with banking partners or pulling cash flow data in real-time — while also ensuring the security of financial data. A cloud-based TMS is a solution that is fully stored and accessible in the cloud from any location with an internet connection. In this manner, data is continuously logged between access points and the cloud itself. The demand for cloud-based TMS and SaaS treasury solutions is surging enormously due to the following advantages:

- Easy access for users from any location with the internet and accessible via different devices

- Real-time data updates ensure that all users have access to the most up-to-date information

- Deployments are easier and more secure, resulting in increased scalability

- There is no limit to how much data you can store, and you can always upgrade for more space if you need it

Treasury management systems (TMS) are becoming increasingly popular for centralized and accurate cash flow management.

4. Treasury APIs for achieving real-time reconciliation

APIs or Application Programming Interfaces enable permitted third-party developers to build products and services on top of software applications to access data and execute transactions. Throughout the end-to-end payment chain, APIs can decrease manual errors and improve operational efficiency. APIs help the treasury department to monitor all of their transactions without having to contact their bank or pay for banking fees.

These are the additional advantages of using APIs:

- Retrieve real-time data from financial accounts and reconcile transactions in real-time

- Directly transfer data from various bank portals, ERPs, TMS, and FP&A systems into the treasury software

- Facilitate real-time payments and reporting processes

- Monitor account activities and user entitlements to prevent fraudulent access and actions

5. Blockchain for smart treasuries

Blockchain is growing rapidly in the realm of treasury. Corporate treasurers are looking into blockchain use cases to improve the efficiency of their treasury management processes. CFOs today are considering blockchain to improve the efficiency of their treasury management processes. But, when it comes to blockchain, businesses are conservative when deploying, preferring to wait until a solution or product has demonstrated long-term value and stability.

These are the following benefits offered by blockchain in treasury:

- In investments, reduces the time and resources required to ensure that investments are made when and where they are desired with minimal human intervention

- In payments, enables more efficient payment systems for corporations, whether to enable vendor payments or move cash internally

- Interacts with multiple counterparties with proper documentation for a commercial transaction

Summary

Artificial intelligence (AI), Robotic process automation (RPA), Cloud-based TMS, APIs, and Blockchain are transforming the cash management landscape by helping treasury overcome the following roadblocks:

- Inaccurate or infrequent variance analysis

- Low forecast accuracy, leads to low confidence when making strategic decisions

- Global forecasting and visibility challenges

- Decentralized process for gathering data

- Inaccurate forecasting of A/R and A/P

- Indirect cash forecasting

Additionally, using application program interfaces (APIs) to access both bank and internal systems can dramatically improve the timeliness, consistency, and completeness of cash-flow forecasting information, especially when combined with robotic process automation (RPA). According to a Euromoney survey, 57% of corporate treasurers anticipate using APIs to help with cash forecasting and cash management across several banking partners.

Here are some of the benefits of using the above technologies:

- Minimal errors

- Faster process

- Time savings

- Increased productivity

- Enhanced security and decision making

Schedule a call with HighRadius today to discover more about the treasury technologies such as cash forecasting cloud and cash management software that CFOs should use to redefine their treasury goals for 2022.