Credit Risk Management Software Solution

Stop reactive credit decisions with 13 AI agents before it impacts cash flow

- 70% faster customer onboarding

- 3x credit reviews daily

- 2X Faster Deduction Resolution

- 30% reduced blocked orders

Stop reactive credit decisions with 13 AI agents before it impacts cash flow

AI-driven credit risk assessment software enables faster approvals, lower defaults, and real-time portfolio visibility while maintaining strict governance across enterprise credit operations.

Automated credit risk management software replaces manual reviews with standardized risk evaluation and workflow-based routing. Integrated credit scoring engines and automated credit scoring ensure faster approvals while enforcing credit policies consistently across regions and business units.

By combining financial statements, payment behavior, and third-party data, the credit risk analysis software delivers explainable, repeatable decisions. AI-based credit scoring software and credit risk scoring system software reduce subjectivity and improve decision accuracy across high-volume credit portfolios.

Continuous monitoring powered by credit risk analytics software and predictive modeling tools for credit risk analysis surfaces exposure changes, utilization spikes, and adverse events in real time. Credit teams can mitigate risk early—before blocked orders or write-offs occur.

Centralized dashboards within the credit risk management platform provide a unified view of exposure, bad debt trends, and limit utilization across customers, industries, and geographies. Leaders gain actionable insights using enterprise-grade credit risk tools to guide risk strategy and growth decisions.

Credit risk assessment software aggregates internal and external data to build complete, decision-ready credit profiles.

AI-driven credit scoring engines apply predictive models to assess risk consistently at scale.

Policy-based credit automation software ensures speed without compromising control.

Continuous oversight turns risk management into a proactive discipline.

Connect HighRadius credit risk management software solution with leading ERPs via rapid deployment, minimal IT effort, and enterprise-grade security

Ready to Connect HighRadius with Your ERP?

Choose the right tools that empower your credit risk decisions.

Download free templateBuild a best-in-class credit scoring model for predicting credit risks and reducing bad debts.

Download eBookDetect credit risks early on and identify key concerns of risk assessment.

Download WhitepaperCredit risk management software is a purpose-built credit risk platform that helps organizations evaluate, control, and continuously monitor customer credit exposure using AI-driven assessment, analysis, and analytics. Unlike manual credit reviews or spreadsheet-based processes, the software consolidates financial statements, payment behavior, ERP exposure, and third-party bureau data to power automated credit scoring and generate consistent, policy-aligned credit limits.

As a modern credit risk assessment software, it tracks shifts in customer behavior, utilization, and external risk signals in real time, automatically triggering reviews, escalations, or approvals. Advanced credit risk analytics software gives finance teams a centralized view of portfolio risk, highlights concentration and default trends, reduces bad debt, and enforces standardized credit policies across the enterprise—at scale.

Automated credit risk management software replaces fragmented, manual credit processes with AI-driven decisioning, continuous monitoring, and portfolio-level analytics. Compared to spreadsheet-based or analyst-led reviews, modern credit risk software delivers faster approvals, more accurate risk assessment, and scalable governance across the enterprise.

| Area | Automated Credit Risk Management Software Solutions | Manual Credit Processes |

|---|---|---|

| Credit Evaluation | AI-driven credit risk assessment tool evaluates risk consistently using internal ERP data, payment behavior, and third-party bureau inputs. | Credit evaluations vary by analyst judgment, workload, and data availability. |

| Risk Monitoring | Continuous monitoring using credit risk analysis software detects deterioration, utilization spikes, and adverse events in real time. | Risks surface only after missed payments, blocked orders, or defaults occur. |

| Approvals & Decisioning | Policy-based automation and automated credit scoring reduce approval cycles while enforcing standardized credit rules. | Approval speed depends on hierarchy, availability, and manual follow-ups. |

| Analytics & Visibility | Credit risk analytics software highlights portfolio concentration, exposure trends, and limit utilization without manual reporting. | Portfolio insights require manual data consolidation and periodic reporting. |

| Scalability | Scales across customers, ERPs, geographies, and business units using a centralized credit risk management platform. | Manual processes break down as transaction volume, complexity, and global operations grow. |

Agentic AI enables end-to-end credit management—from credit assessments and limit assignments to risk monitoring and credit holds—without constant manual intervention. This credit management software continuously adapts to customer behavior, utilization, and risk signals in real time, ensuring tighter control with less effort.

By analyzing financials, payment history, credit exposure, and third-party risk data, Agentic AI drives intelligent credit actions—such as limit adjustments, reviews, or escalations.Unlike rule-based systems, this credit management solution reduces subjective decisions while improving approval accuracy and speed.

The system detects anomalies like exceeded limits, deteriorating risk profiles, or inconsistent credit terms and automatically triggers corrective workflows.These credit management tools ensure faster resolution, stronger policy enforcement, and fewer manual reviews for credit teams.

As customer volumes increase, Agentic AI continuously reprioritizes accounts, recalibrates risk thresholds, and balances reviewer workloads.This allows enterprises to scale using a single credit management software platform—without adding headcount or compromising credit discipline.

Enterprise credit teams need credit risk management software that integrates deeply with data sources, applies AI consistently, and maintains compliance as volume grows. The following criteria help guide that choice.

Effective credit risk assessment tools integrate internal data with external credit agencies to create accurate, up-to-date risk profiles. Fragmented data limits decision quality.

Modern credit risk analysis software uses AI to score customers, detect deterioration, and trigger proactive reviews. Avoid tools that rely solely on static scorecards or spreadsheets.

Credit risk management software solutions should support configurable approvals, escalation paths, and review cycles across multiple ERPs and geographies.

Credit risk analytics software must provide real-time visibility into exposure, utilization, and concentration risk. Portfolio insights should be accessible without manual reporting.

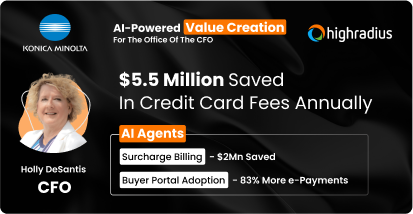

Leading enterprises are rethinking credit decisions with AI—using a credit risk management software solution to automate everything from credit scoring and blocked order prediction to proactive risk monitoring and dispute resolution. With this intelligent credit management tool, businesses have achieved a 20% reduction in bad debt and unlocked over $2M in additional cash flow within just six months.

Book A Discovery Call

Most businesses rely on a combination of internal scorecards and external bureau models to evaluate credit risk. Modern organizations increasingly use credit scoring software and credit scoring platforms that combine financial data, payment behavior, and third-party signals to generate consistent, explainable risk scores at scale.

Automated credit scoring uses AI-powered credit scoring software and credit scoring engines to evaluate risk using real-time data and predictive models. Unlike manual scoring, which depends on analyst judgment and static spreadsheets, automated credit scoring delivers faster decisions, consistent outcomes, and scalable governance across large credit portfolios.

Credit risk management software for banks centralizes credit risk assessment, monitoring, and analytics while enforcing policy consistency and auditability. By integrating ERP exposure, customer behavior, and external bureau data, banks use credit risk assessment software to reduce defaults, improve regulatory compliance, and manage portfolio risk more proactively.

Effective credit teams use a combination of credit risk management tools, credit risk analysis software, and credit risk assessment tools. These tools automate risk scoring, monitor exposure continuously, and provide portfolio-level insights—enabling faster credit decisions and better control compared to manual processes.