AI-Powered Credit & Collections Automation Software

Reduce bad debt by up to 20% with AI agents

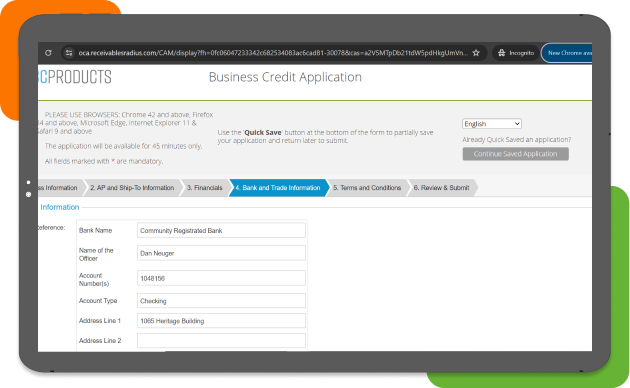

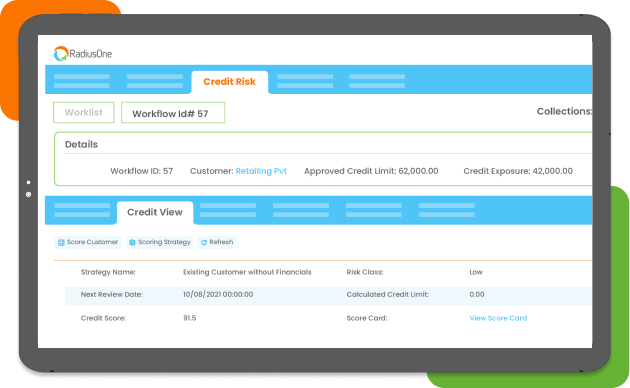

- Accelerate customer onboarding with data-driven credit decisions that minimize risk.

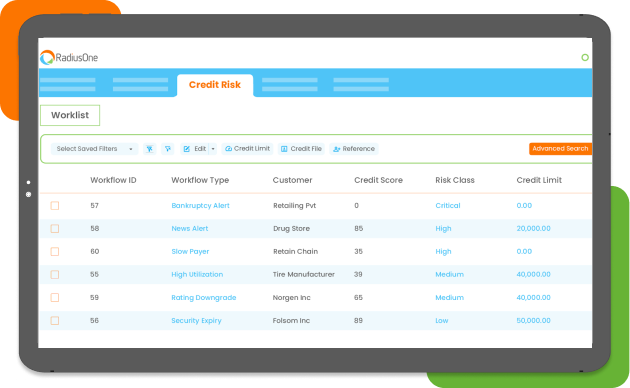

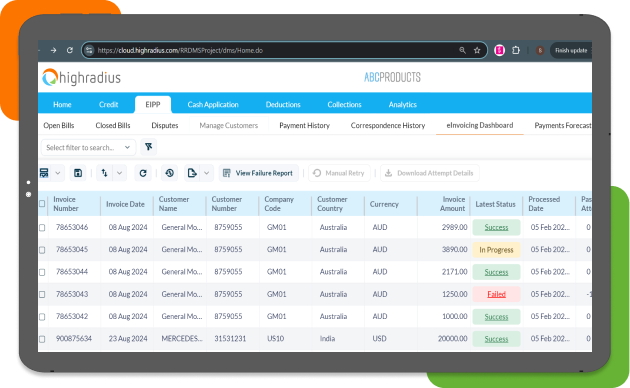

- Reduce past-due AR with AI-powered collection strategies and automated follow-ups.

- Improve collector productivity with intelligent worklists and risk-based prioritization.

Trusted by 1100+ Global Businesses

Ready to 3X Your Credit Reviews and Collections Efficiency

Just complete the form below