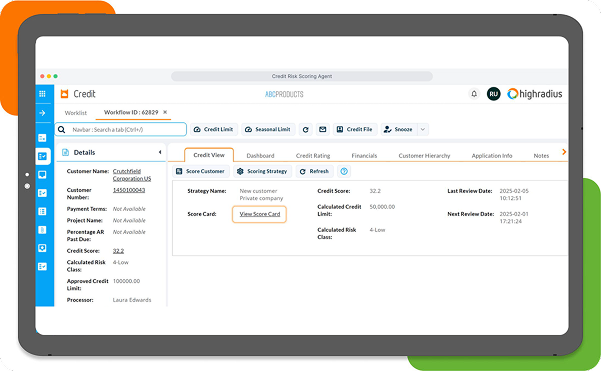

Credit Decisioning Software for Real-Time Risk Decisions

Manual credit reviews slow approvals and inflate past-due risk.

Highradius credit decisioning software led by 13 AI agents automates 80–90% of decisions and monitors credit risk in real-time.

- 90%+ faster credit approvals without compromising policy

- 70% faster customer onboarding without any frictions

- 20% lower bad-debt exposure with real-time risk monitoring