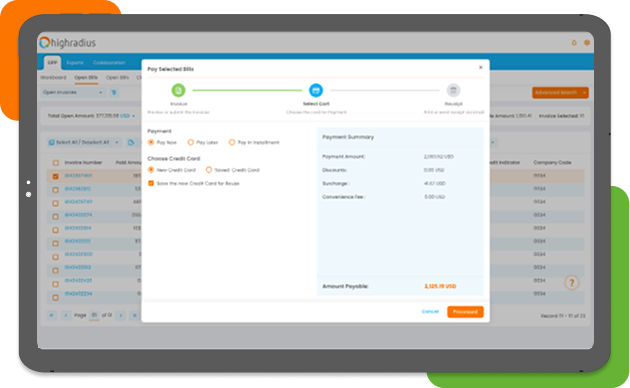

Invoice-to-cash Automation Software

Reduce bad debt by 20% with AI agents

- Minimize costly invoicing mistakes and disputes by leveraging AI.

- Automate collections and remittance matching to shorten your cash conversion cycle.

- Enhance visibility and control over all aspects of your invoice-to-cash process.

Trusted by 1100+ Global Businesses

Turn Invoices Into Cash—Faster and Smarter with AI Automation

Just complete the form below