Key Takeaways

- Electronic invoicing (e-invoicing) is a modern and efficient invoicing method that replaces traditional paper invoices with electronic formats.

- E-invoicing offers significant benefits such as increased accuracy, reduced operational costs, and minimized days sales outstanding (DSO).

- Embracing electronic invoicing is an environmentally responsible approach that contributes to waste reduction and resource conservation.

- Automation and e-invoicing lead to better compliance, data accuracy, and synchronization, reducing the risk of duplication or discrepancies.

- Understanding customer preferences, tailoring e-invoices to their needs, and providing incentives can boost acceptance and adoption rates.

Introduction

For decades, traditional paper invoicing has been the standard for businesses worldwide. However, in recent years, electronic invoicing (e-invoicing) has gained significant traction globally.

The adoption of e-invoicing is on the rise as both buyers and suppliers recognize its advantages, including cost reduction, error reduction, faster payments, and streamlined procedures. If you haven’t made the switch to electronic invoicing, now is the perfect time to do so.

In this article, we’ll simplify the process for you by covering everything you need to know about e-invoicing, from its benefits to establishing a successful adoption strategy. Let’s get to it.

What Is Electronic Invoicing (E-Invoicing)?

E-invoicing involves the creation, delivery, and receipt of invoices in an electronic format, usually through secure online platforms. Instead of dealing with physical paper, businesses and customers interact with invoices electronically, allowing for a faster, more accurate, and eco-friendly invoicing experience.

Why Do Businesses Use Electronic Invoices?

In today’s fast-paced business landscape, electronic invoices have become vitally important. Their efficiency and cost-effectiveness outshine traditional paper invoices. In fact, according to a survey by Billentis, companies can save up to 80% in processing costs by transitioning to electronic invoicing. This transition not only slashes printing and mailing expenses but also mitigates the risks tied to human error and misplaced invoices.

Electronic invoice management simplifies tracking and boosts record-keeping quality, shining a positive light on your accounting. Plus, quick deliveries speed up payments, playing a crucial role in smart cash flow management.

Beyond the financial gains, embracing electronic invoicing also resonates with eco-friendly ideals. Going paperless not only benefits the bottom line but also actively aids in waste reduction and resource conservation.

With a grasp on these foundational reasons, let’s now explore the extensive benefits of electronic invoice processing.

Benefits of Electronic Invoicing (E Invoicing)

E-invoicing enhances the invoicing process by reducing costs, improving accuracy, and accelerating payment cycles. With electronic invoicing, manual data entry becomes obsolete, eliminating the potential for human errors and ensuring greater accuracy in the invoicing process.

Let's now explore the six prominent benefits that electronic invoicing brings to the forefront, transforming the way businesses handle their financial operations:

1. Increased accuracy

Electronic invoicing eliminates the possibility of human errors, resulting in a substantial reduction in mistakes.

By ensuring precise data entry, it safeguards the integrity of financial records, leading to fewer disputes and a more streamlined financial process.

The enhanced accuracy fosters client trust and enhances overall operational effectiveness.

2. Reduced operational expenditure

Embracing eInvoicing isn't just about digital evolution; it's a tangible way to slash operational expenses. By eliminating paper, printing, and mailing costs, businesses can reduce their financial load.

Moreover, the expense tied to correcting paper invoice errors vanishes, providing significant relief for mid-sized businesses.

3. Minimized days sales outstanding (DSO)

Automation streamlines invoice creation by cutting down on human involvement. Manual data gathering often leads to errors and delays. With automation, analysts are liberated from the task of collecting data, sending invoices, and fixing mistakes.

This swiftens the entire accounts receivable process, leading to quicker closure of deals and ultimately shrinking the days sales outstanding (DSO).

4. Harmonized data

Electronic invoices provide businesses with enhanced security and compliance. They can implement robust encryption measures and authentication protocols to protect sensitive financial information.

Moreover, electronic invoices can be integrated with accounting software, allowing for seamless integration and synchronization of financial data, reducing the risk of data duplication or discrepancies.

5. Streamlined bulk invoicing

Sending multiple invoices to the same client without manual effort is now possible. Automated solutions speed up cash conversion with streamlined remittance aggregation, accurate invoice matching, and seamless cash reconciliation.

The outcome? A more efficient invoicing process, freeing your team to concentrate on important tasks and getting payments faster.

6. Environmentally responsible approach

Electronic invoices promote environmental sustainability by cutting paper usage and eliminating the need for physical mailings, making businesses more eco-friendly and reducing their carbon footprint.

Wondering How to Set-up a Successful E-invoicing Adoption Strategy?

Business strategies are the blueprints for a brighter tomorrow. They pave the way for companies and their teams to overcome hurdles and thrive in a dynamic landscape. Yet, a pivotal key to a triumphant digital transformation lies in effective strategies. As you gear up for e-invoicing, consider a three-pronged approach to ensure seamless adoption within your organization:

1. Customer segmentation

Understanding your customers and their preferences lays a strong foundation. Begin by assessing your customer base and categorizing them into segments that are open to embracing e-invoicing.

This strategic segmentation not only helps you target the right audience but also ensures a smoother transition. By identifying customers who are ready to transition, you create a win-win scenario that fosters cooperation and speeds up the adoption rate.

2. Audience-customized outreach strategies

Once you’ve established customer segments, dive deeper into their unique needs. This knowledge allows you to craft e-invoices that cater to individual requirements, enhancing their experience. The power of customization cannot be understated. By aligning e-invoices with what your customers value most, you’re not just automating processes, but you’re creating meaningful interactions that resonate. This personalized approach can accelerate the acceptance of e-invoicing and contribute to higher adoption rates.

3. Optional incentive programs

Incentives have an undeniable sway over decision-making. Consider establishing enticing incentive programs as part of your e-invoicing strategy. Discounts, rewards, or exclusive offers for customers who embrace electronic invoicing can act as persuasive catalysts.

These incentives not only make the shift more appealing but also underscore your commitment to providing value. By sweetening the deal, you can fast-track the transition and motivate customers to opt for e-invoicing willingly.

As you venture forward, remember that an effective strategy adapts and evolves. Continuously assess the impact of your e-invoicing adoption approach, and be prepared to tweak strategies based on real-time feedback.

Now, let’s dive into three powerful tactics that will further amplify your e-invoice adoption rates, making the transition even more seamless and impactful.

3 Effective Approaches to Fast-Track the E-invoice Adoption Rate

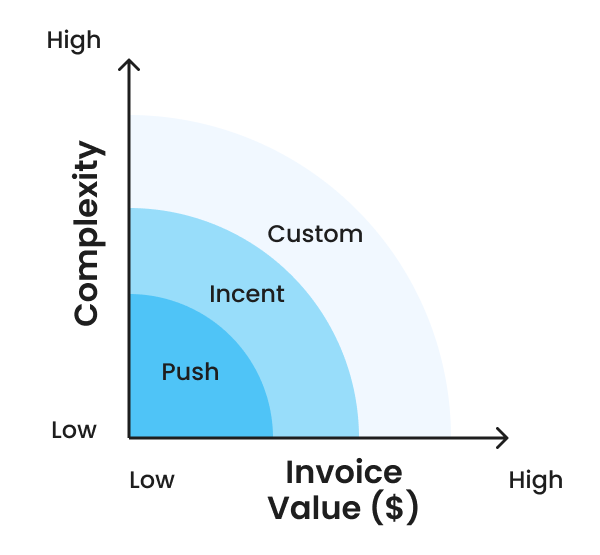

E-adoption strategies aren’t one-size-fits-all; they should align with invoice value and complexity. To convince your customers to embrace e-invoicing swiftly, it’s crucial to choose the right approach. Let’s delve into three effective approaches that cater to varying needs and preferences:

1. Push Adoption: The E-Invoice Default

This approach serves as a powerful nudge, encouraging customers to embrace e-invoicing by default. While it might not be the favored route for larger corporations, it plays a pivotal role in expediting digital transformation for smaller businesses.

By automatically enrolling customers into e-invoicing, you create an environment where the default choice becomes the electronic option. This can significantly increase adoption rates, especially among businesses that may be hesitant to make the shift voluntarily.

2. Incentive Adoption: The Motivation Game

In this approach, you leverage incentives, both individual and social, to persuade customers to make the switch. Offering incentives such as charitable donations on behalf of your customer’s company can be a compelling motivator.

However, this approach necessitates a multi-faceted communication campaign to effectively drive adoption. It’s crucial to keep a close eye on campaign ROI and adjust incentives as needed to maintain customer engagement and enthusiasm for e-invoicing.

3. Custom Adoption: Tailored Solutions for High-Value Customers

For customers with unique needs and specific requirements, the custom adoption approach is key. It involves analyzing customer requests and determining how to accommodate them.

Based on this analysis, you can develop tailored outreach programs and offer incentives that align with each customer’s individual needs and preferences.

This personalized approach ensures high-value customers receive the attention and solutions they require, making the transition to e-invoicing smoother and more attractive.

Each of these approaches serves a distinct purpose and can be adapted to suit the diverse range of customers you may have. The key lies in understanding your customer base, their preferences, and their specific challenges to choose the most effective strategy.

Continuously assess and adjust these methods to optimize e-invoice adoption rates.