Through HighRadius’s automated solutions, e-delivery of invoices via different platforms can help businesses in reducing their invoicing costs by 70%.

Automation has transformed financial transactions between businesses and customers. While traditional payment methods were challenging to manage, the new-age electronic billing systems ensure seamless transactions and better order to cash management.

Electronic billing (eBilling) acts as a one-stop solution for sending and paying bills electronically making it easier for businesses and their customers to send and receive bills online. It also enables customers to pay using their preferred payment channel.

The entire process of electronic billing is performed digitally, from creating bills and invoices to allowing payments. It is especially useful for organizations that send recurring bills to their clients.

This A to Z guide will delve into the benefits of eBilling and will help you learn all about how it works.

An electronic bill is a paperless alternative for sending or receiving a bill. The bills can be sent across as a PDF file or other electronic formats via different digital mediums. This enables the customers to have the option to inspect invoices before paying.

Customers can also set up automated payments to make eBill transactions easier and make the purchasing process hassle-free. Billers and customers can both profit from eBills because it is faster, more convenient, less expensive, and more secure.

Here is a sample of what an ebill or an einvoice looks like:

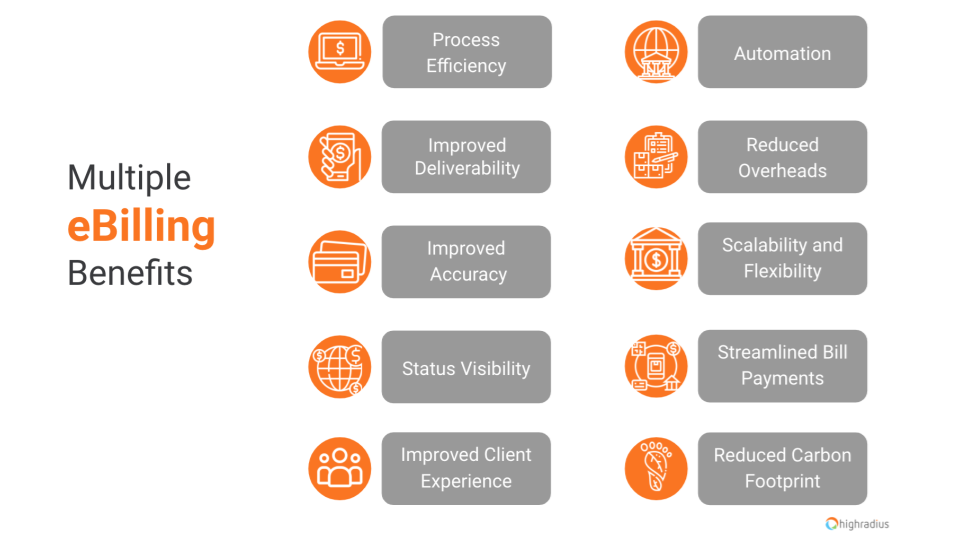

eBilling is a solution for issuing bills and collecting payments online. With the help of eBilling, customers can get bills via emails, online portals, or even in machine-readable data formats.

eBilling combines the billing system of a merchant, the banking system, and a payment portal for the customer. As the eBilling process is quick, effective, and streamlined for both customers and businesses, electronic billing is a better fit for modern accounting teams. This eBilling and e-Payment portal enables the payer to get copies of their bills as well as update information.

eBilling is a critical component of modern finance. It is used by the accounts payable (AP) and accounts receivable (AR) departments to automate workflows and reduce reliance on paper-intensive operations.

eBilling improves the productivity of multiple corporate units, all the way from accounting to customer support. eBills generated by the AR department often serve as the payee and are paid by the AP department, which serves as the payer.

Accounting teams can easily balance and reconcile accounts with the help of eBills. And, customer service agents can access electronic records and handle issues using eBills.

According to a report by Billentis, the global eBilling and eInvoicing business was worth 4.3 billion EUR in 2019 and is expected to grow to 18 billion EUR by 2025.

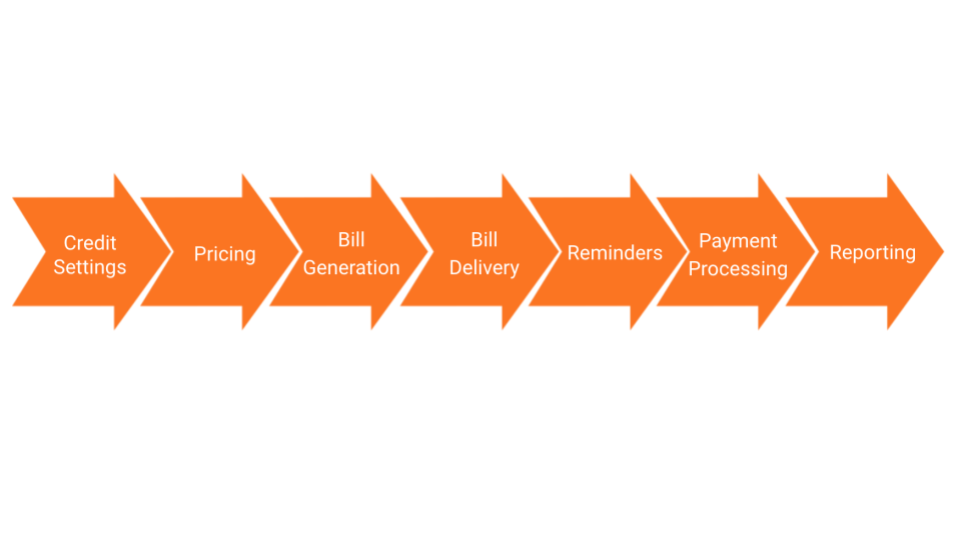

The eBilling process encompasses many steps, including pricing and credit setting, which can be manually set for each customer or determined by rules-based automation. Here are the steps involved in the eBilling process.

The first stage in any billing procedure is to determine the credit limit and remittance due date. Modern eBilling solutions manage everything from sales to credit end-to-end, to optimize speed and reduce risk.

The next stage determines the cost of the goods or services delivered. Pricing can be retrieved from a database and applied to accounts or contacts as needed via an electronic billing solution.

ebills are generated from ERP or accounting system data. They are then put into the appropriate bill template for each recipient—from PDF to EDI. This process is automated and works faster than traditional manual bill creation.

The delivery of eBills can take place via email, portal, file transfer, or direct data transmission and can be automated.

Bill notifications can be sent through SMS, email, social media, or other methods to notify recipients that their eBill is now available via a secure web gateway.

If the biller suspects that a customer has not opened or paid their bill within a certain duration, an automatic dunning reminder can be sent to encourage quick payment.

eBilling has a unique advantage over paper billing. Clients can be provided with a link to click and pay online via credit card or direct deposit.

Tracking and reporting on eBill delivery, receipt, and whether the receiver has read or reviewed their eBills provides an upper hand when combating late payments and maintaining a healthy cash flow.

Computer systems that help with invoice generation, delivery, and payment acceptance are known as electronic billing systems. Typically, an invoice moves along the following process through an electronic billing system:

Step 1: A billing system compiles customer billing information

Step 2: The system then generates customer bills

Step 3: A system for electronic billing receives the billing

Step 4: Bills are compiled and delivered to the customer online

Step 5: Customer receives an email alerting them about the new bill

Your company can receive payments on time and maintain payment records if you optimise your invoicing and billing procedures. The time it takes to charge and produce invoices frequently makes billing and invoicing highly burdensome. Which is why you need the best-fitting einvoicing and ebilling solution for your business.

Here are a few things to keep in mind while scouting for the best fit:

Before trying to find the right fit for your business, it is essential to figure out the requirements and the basic necessities you expect in your ideal billing and invoicing software.

Choose a billing and invoicing software system that is simple to use, doesn’t demand a lot of training, and takes little time. Make sure the type of software can quickly produce professional invoices. The people in charge of billing and invoicing can check this parameter.

You cannot choose the optimal billing and invoicing software after examining only one of the available options. You should contrast the many software programmes that are available and the reviews that have been written about them. Consider the functions of these software packages, their prices, and the distinctive functions that these software solutions offer.

For companies that utilise numerous systems, integration is a crucial element. All the necessary data may be seen on a centralised dashboard if the invoicing and billing system offers integration. As a result, you won’t have to switch between systems, which will save you time. It minimises manual mistakes while simultaneously speeding up data input labour.

A software solution that evolves with growing enterprises is necessary. Therefore, you should make sure the software is scalable and will function properly even when you have to produce several invoices and bills each day when picking your perfect invoicing and billing software.

It is important to choose the most economical yet most functional billing software for your business. Post listing out the required feature functionalities you must decide a budget for the software. It is good to get the most sophisticated software however there is no point if you are not going to use all the features.

Electronic billing and electronic invoicing may sound quite similar, however, they have many differences. While true electronic billing may be defined to include invoicing, electronic invoicing does not encompass all aspects of electronic billing. We could also say that electronic invoicing is a subset of electronic billing.

| eBilling | eInvoicing |

|---|---|

| It is the process of managing bills online, including bill creation, making payments, and receiving payments. | It is a function of accounts payable used to electronically process invoices and upload them to the system of records. |

| eBilling system in an organization includes electronic invoicing and the payment counterpart. | eInvoicing is a segment of the eBilling system, without any payment function. |

| An eBill serves as proof of transaction. | An invoice is a legal document required for financial reporting. |

Companies are increasingly moving away from using mail to connect with customers as the internet’s use and accessibility grow. And eBilling is on its way to becoming a market standard. Computerized payment systems are now the most effective marketplace choice for effectively and efficiently performing transactions. Yes, there are corporations still using certain older paper billing systems, but the practice has declined significantly. And as businesses phase out paper invoicing totally, eBilling will become the norm.

At HighRadius we help businesses automate their billing and invoicing processes and unlock the features and functionality of AR automation to its fullest. Our eInvoicing solution includes a set of AI-powered solutions designed to support AR processing for companies across industries. HighRadius solution provides

Contact your bank and credit card issuers to learn about the online billing options they provide. Do inquire about the fees involved, such as transaction costs and monthly minimums.

There are two main types of electronic billing systems used for eBilling. They are biller-direct systems and bank-aggregator systems.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Talk to our experts