It is not easy for CFOs to manage a workforce that is spread across multiple locations. They need to focus on and optimize different systems, groups of employees, processes, and workflows to fast-track business growth. Here are the top challenges that executives face while managing a distributed workforce.

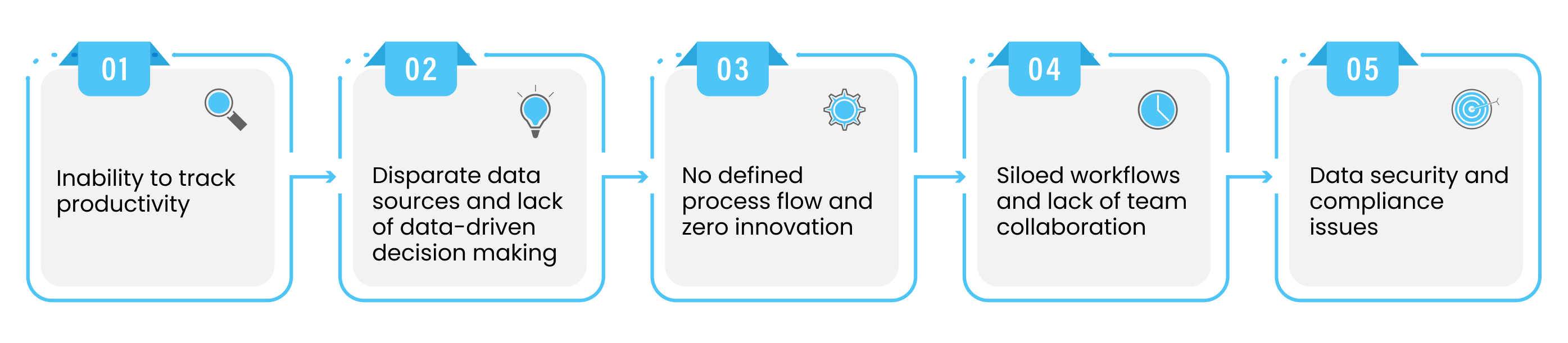

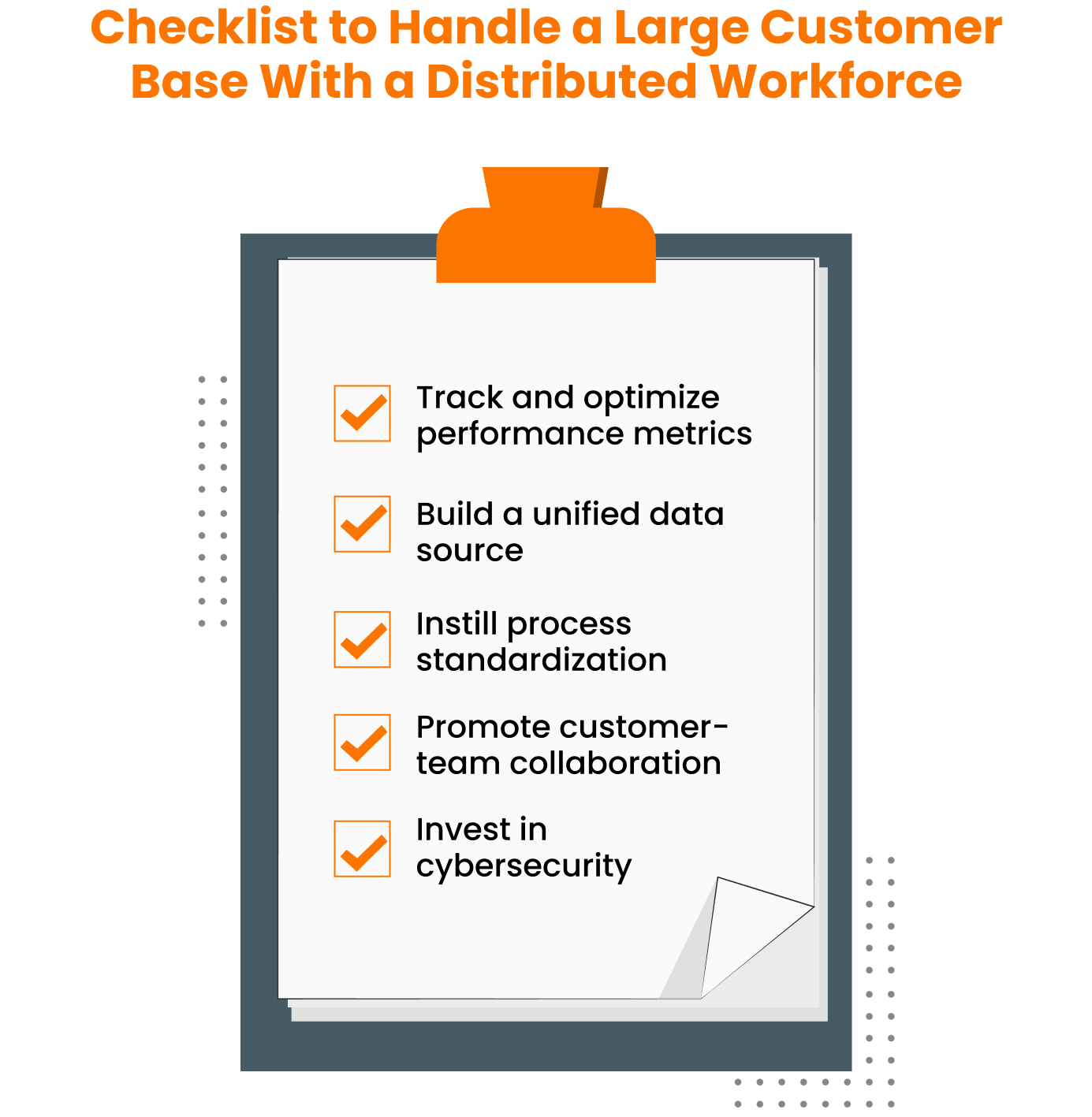

1. Inability to track productivity

It is difficult for CFOs to have an overview of employee productivity for a distributed workforce. If you think about it only in terms of time, then it wouldn’t be challenging to track the 40 hours of the work week for every employee. But getting insights into what they are actually spending their time on is what’s important.

For that, finance executives can track KPIs like the collector effectiveness index (CEI), the average time to collect cash, or ask employees to fill in time sheets to track their activities. However, it can lead to more workload and reduce their overall productivity.

Tracking KPIs using disconnected systems and for multiple locations isn’t easy. Therefore, organizations find it difficult to identify system gaps and cannot improve the overall efficiency of the various workflows.

2. Disparate data sources and lack of data-driven decision making

CFOs often struggle to gain accurate business insights because of disparate data sources, tech stacks, and non-integrated systems at multiple office locations. And the lack of proper understanding of business analytics leads to indecision or decisions that adversely affect the organization’s performance.

For example, teams located in separate office locations might store customer information in different ways, e.g. CSV files and using remote monitoring and management (RMM) applications. The use of disparate systems will make it complex to collate all data in one place and get usable information.

Businesses also struggle to keep their data clean due to manual data entry practices that result in errors and duplicate information. This makes it difficult to visualize the data effectively and turn them into reports, graphs, and dashboards, which could have been used to drive business growth.

3. Absence of well-defined process flow and zero innovation

In a distributed workforce, multiple stakeholders might need to work together to accomplish a task. But without a defined process flow, it gets complicated to do even simple tasks, thus reducing the overall process efficiency. It also means businesses are unable to focus on strategic tasks, and there is a lack of innovation.

Due to the chaotic processes, analysts often end up spending a lot of time on low-value tasks and going back and forth on communication between teams, impacting team productivity. For example, if the sales and credit teams aren’t aligned, the customer onboarding process will be delayed. It’s because the priority of the sales team is to fast-track bringing in new customers while the credit team has to ensure their creditworthiness.

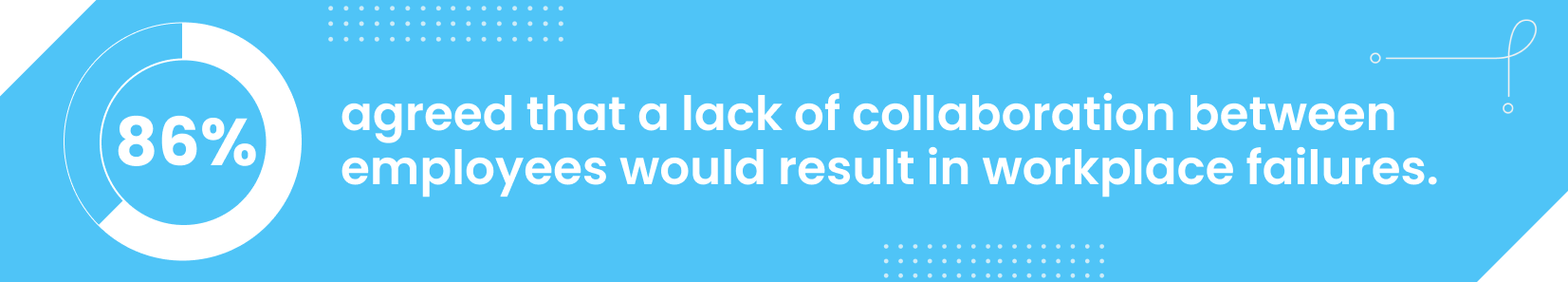

4. Siloed workflows and lack of team collaboration

With business processes becoming more complex and lengthy, CFOs are struggling to keep workflows connected. Plus, a lack of collaboration among team members working from different offices adds to the challenges. It is seen that a distributed workforce often suffers from communication and collaboration challenges that slow down crucial functions.

If team members aren’t aligned properly on a project, it will result in poor management leading to suboptimal results and bad execution. Employees might also suffer from low morale, which could lead to discord between teams. With so many gaps in the system, there could also be an increased risk of loss of data.

5. Data security and compliance issues

Organizations often fail to implement strong data security measures. And with a huge data footprint, it can lead to breaches which is a major security issue. This can result in much legal and financial trouble.

Businesses also need to ensure that they meet regulatory requirements across various geographies from where they operate or have customers. Data compliance requirements are essential for companies, and to operate in a region, they must follow all the local privacy regulations.