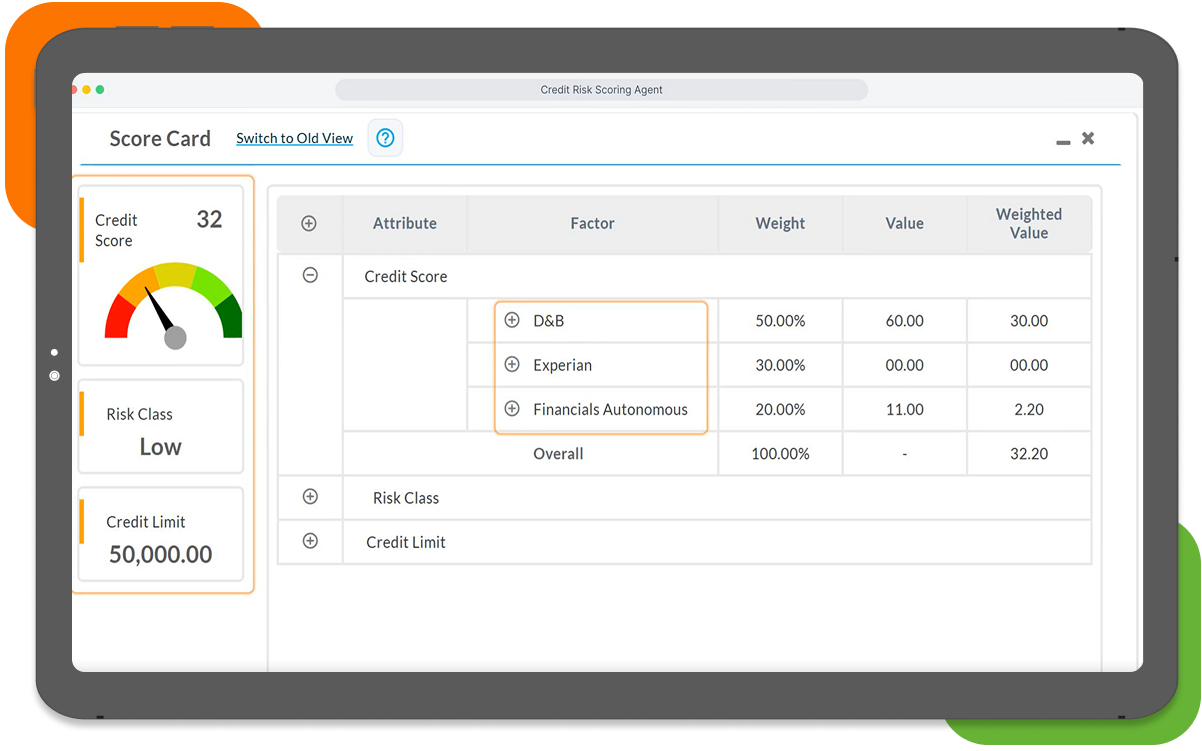

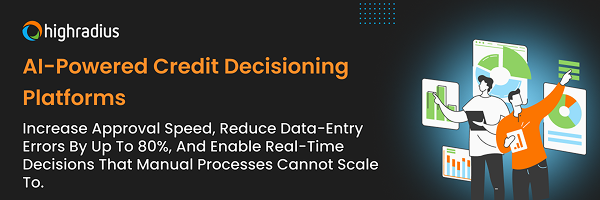

AI-Powered Credit Score Software for Predictive Risk Control

Outdated credit scoring models increase default risk.

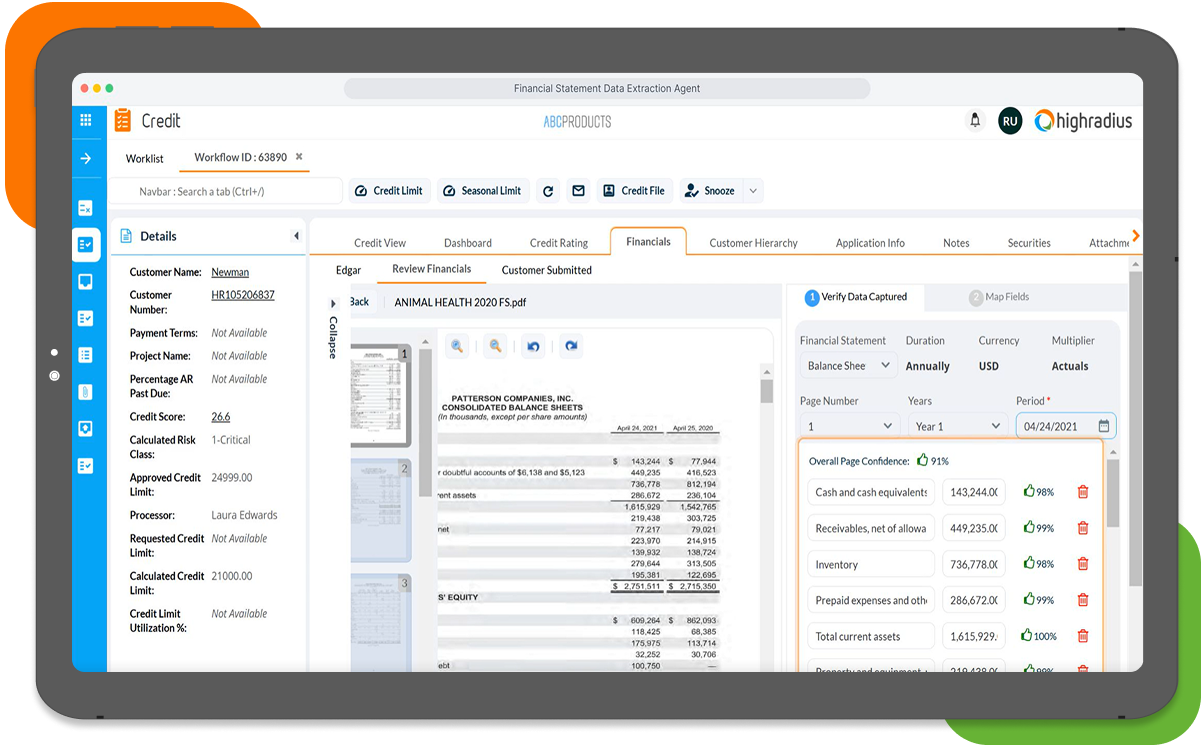

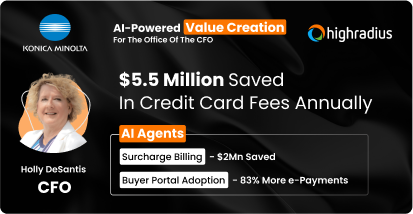

HighRadius’ automated credit scoring tool reduces $57 million credit risks annually.

- 20% lower bad-debt exposure with predictive credit scoring

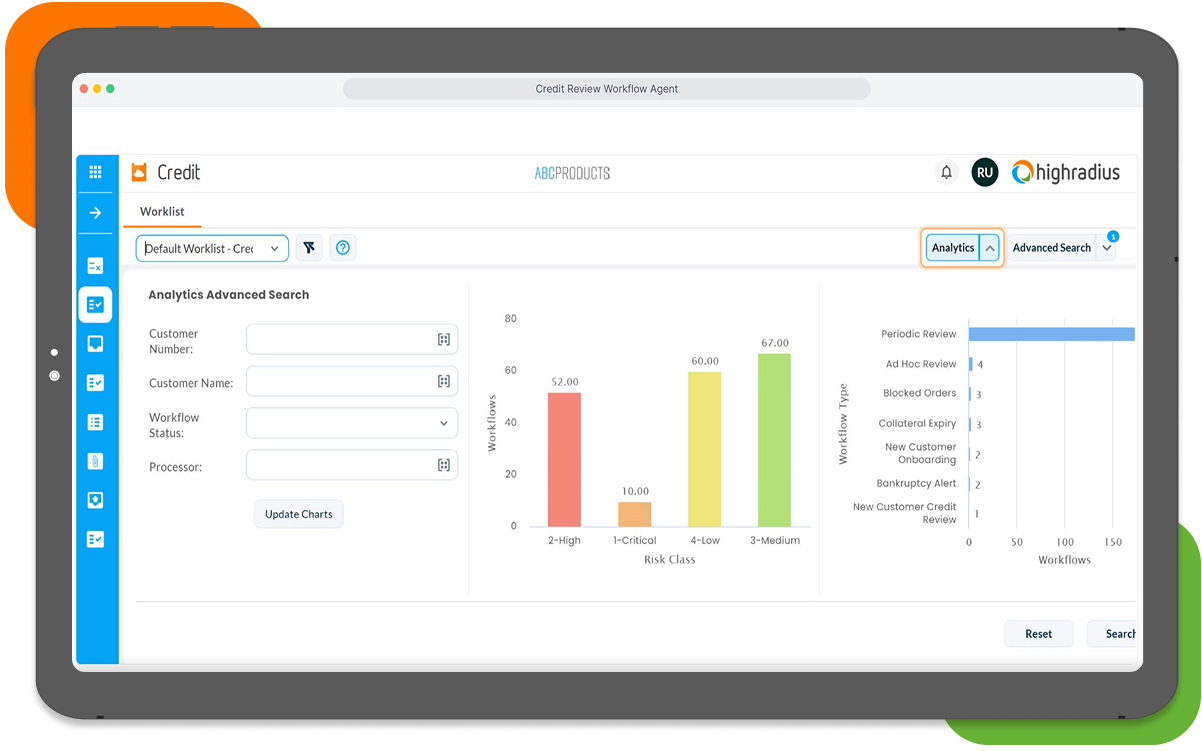

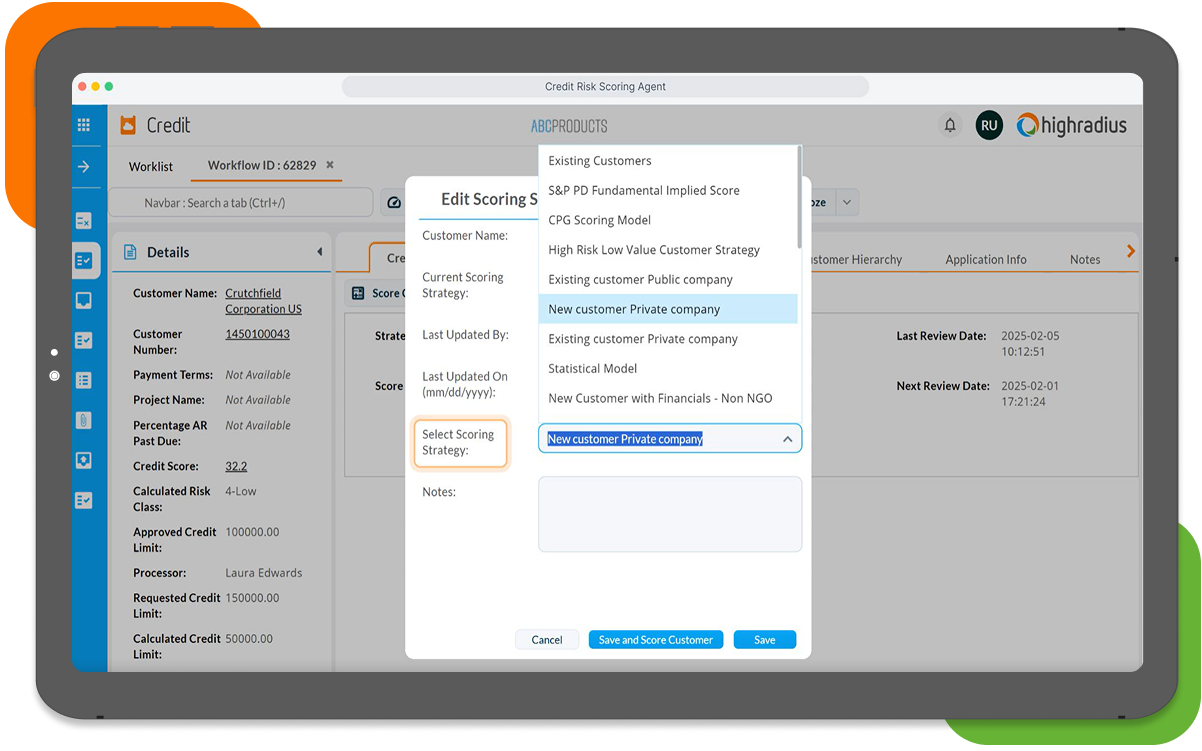

- 50% faster credit limit decisions with AI-based risk models

- 80–90% automated credit risk evaluations using AI scoring agents