AI-Powered Collection Automation Software

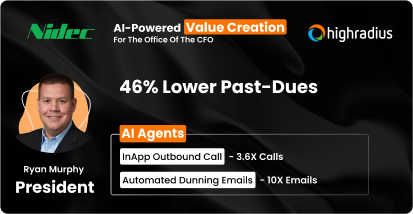

Achieve 20%+ Reduction in Past Dues via 15 AI Agents.

- Streamline Invoice Uploads to 600+ AP Portals

- Achieve 4X More Weekly Past-Due Coverage

- Boost Collector Productivity by 30%

Achieve 20%+ Reduction in Past Dues via 15 AI Agents.

HighRadius debt collection software is a comprehensive solution designed to streamline the collections process and reduce past-due accounts. Powered by Agentic AI, the collection automation platform prioritizes accounts, automates task allocation, and efficiently manages calls and emails.

With HighRadius AI agents driving the collections process, finance teams gain real time control and visibility resulting in faster recoveries, improved cash flow, and higher efficiency.

Automate Emails

Simplify communication with customers by automating follow-ups, reminders, and dunning emails. Personalized email templates and AI-driven recommendations ensure timely and accurate messaging, improving response rates and speeding up payments.

Reduce Past Due

Not all customers are the same, and your collection strategies should reflect that. With the right integrated receivables solution, you can tailor your approach to different customer segments. From polite reminders to more urgent follow-ups, personalized communication ensures timely payments and helps minimize customer churn.

Increase Productivity

Streamline collectors' workflows with centralized dashboards, automated call logging, and intelligent task assignments. These features allow collectors to focus on value-added activities, doubling their efficiency.

Real-Time Insights

Gain actionable data on collection performance, account status, and cash flow trends. Interactive dashboards provide instant visibility into critical metrics, enabling informed decision-making and proactive collection strategies.

HighRadius builds solid partnerships and offers robust integration capabilities by integrating with 110+ banks, 40 credit agencies, 50+ ERPs, and 15+ billing systems globally.

Ready to Connect HighRadius with Your ERP?

Download ERP FactsheetOptimize collections through five success pillars, a maturity model roadmap, and proven results.

Download EbookDownload 6 expert-built RFP templates + 129 must-ask vendor evaluation questions.

Download TemplateStruggling with overdue invoices? This aging dashboard makes prioritization effortless.

Download TemplateAgentic AI doesn’t just automate—it takes initiative, adapts in real time, and continuously improves collections performance.

Traditional automation handles repetitive tasks but can’t respond to real-time shifts in customer behavior—often missing critical context.

Agentic AI prioritizes accounts, chooses outreach channels, and escalates cases based on live data—not static rules.

The system evolves with every interaction—refining strategies across customer segments to increase collection success rates.

With Agentic AI handling execution, collectors focus on exception management, approvals, and strategic account resolution.

Debt collection automation software leverages technology to optimize tasks like sending payment reminders, tracking overdue accounts, and prioritizing collection efforts. By automating these processes, businesses can reduce delays, ensure timely follow-ups, and enhance operational efficiency.

This collection software streamlines collections workflows, minimizes errors, and enables collectors to focus on high-value accounts while maintaining effective and professional communication with clients.

Businesses need a debt collection management system to streamline and enhance the recovery of overdue payments efficiently. The software automates follow-ups, prioritizes accounts, and provides real-time tracking, improving cash flow and reducing overdue balances.

Automated debt collection software offers several key benefits, including streamlined processes that automate reminders and account tracking, making collections more efficient. It accelerates payment recovery, reduces manual errors, and enhances cash flow by minimizing delinquencies. Additionally, it supports better client relationships by ensuring professional and consistent communication throughout the collection process.

See how it works

Manual debt collection processes can be tedious, error-prone, and inefficient, leading to longer payment cycles and strained customer relationships. These challenges not only hinder cash flow but also make it difficult to scale operations as a business grows.

Collectors spend significant time on repetitive tasks like sending reminders, logging communications, and updating spreadsheets, reducing the time available for strategic collection efforts.

Without collections automation, identifying high-risk accounts or prioritizing tasks becomes difficult, leading to missed opportunities to recover overdue payments quickly.

Manual data entry and tracking increase the likelihood of errors in account information, payment details, or follow-up actions, leading to inefficiencies and customer dissatisfaction.

Collectors lack real-time insights into overdue accounts, payment trends, or performance metrics, making it harder to optimize strategies or forecast cash flow accurately.

Inconsistent or poorly timed follow-ups can irritate customers, risking damage to long-term relationships and goodwill.

As businesses grow, managing larger volumes of overdue accounts manually becomes unmanageable, leading to longer collection cycles and increased past-due amounts.

Understanding these challenges is the first step to improvement. Implement these strategies to overcome inefficiencies and optimize your collections.

Streamline follow-ups with automated dunning to address unpaid invoices and identify problem accounts quickly. Ensure reminders follow a structured timeline, with clear escalation steps for faster resolution of issues.

Adapt your approach to match the customer’s business context. Avoid generic messaging and use personalized reminders to increase response rates. Address root causes like payment methods or regional differences to resolve late payments effectively.

Leverage diverse communication channels such as emails, calls, and texts for tailored outreach. Align the right stakeholders on both sides of the conversation to increase impact and urgency. Multi-channel strategies help gauge feedback and drive faster payments.

Set clear, measurable objectives like reducing overdue invoices or Days Sales Outstanding (DSO). Track and communicate progress with your team to ensure alignment and sustained improvements in cash collection.

Access 11 collection email templates designed to simplify follow-ups and recover dues faster.

Download The TemplateImplementing debt collection software can transform how your business manages overdue accounts, streamlining workflows and improving cash recovery rates. A smooth transition requires a strategic approach, from assessing your needs to training your team and optimizing the system. Here’s a step-by-step process for successfully implementing collections automation software, ensuring maximum efficiency and value for your business.

Identify your business challenges, such as high past-due accounts or low collector productivity. Determine the features you need, like AI prioritization, automation, or ERP integration.

Choose a collections automation platform that fits your requirements. Consider factors like scalability, customization, integration capabilities, and user-friendliness.

Create an implementation roadmap with clear timelines, milestones, and responsibilities. Ensure alignment with stakeholders like finance, IT, and collections teams.

Gather and clean your existing collection data. Work with your vendor to migrate customer records, outstanding invoices, and payment history into the new system.

Customize workflows for dunning emails, reminders, and account prioritization. Configure automation rules for seamless task management.

Connect the software with your ERP, CRM, or accounting tools to ensure smooth data exchange and real-time updates.

Provide comprehensive training for your collectors and relevant teams. Highlight features like automated reminders and real-time reporting.

Run pilot tests to validate data accuracy, workflow efficiency, and automation reliability. Address any issues before full deployment.

Roll out the software to your team and monitor performance. Use built-in analytics to track KPIs like DSO, recovery rates, and collector productivity.

Gather feedback from your team and customers to optimize processes. Regularly update the software to leverage new features and maintain efficiency.

Slash past-due balances, improve collector productivity, and accelerate cash recovery with AI-powered collections software. Top-performing teams didn’t just optimize follow-ups—they turned automation into real results.

Book a Discovery Call

A debt collection software is designed to manage overdue accounts and streamline collection efforts. It automates key tasks like sending reminders, tracking communications, and managing overdue balances. The system integrates with other business platforms, improving efficiency and maximizing collections.

Collection software can save cost by automating key processes such as payment reminders, account tracking, and follow-ups. This reduces manual labor, minimizing human error and operational costs. The collection automation software improves cash flow, accelerates collections, ultimately reducing overhead.

Payment collection software reduces debts by automating the follow-up process for overdue accounts. It prioritizes high-risk debtors based on account aging and outstanding balances. By sending timely dunning emails and reminders, it improves recovery rates and decreases the outstanding debt.

AI in debt collection analyzes historical payment data, identifies trends, and predicts debtor behavior. AI-driven collections automation platform automates prioritization of accounts, based on the best time and channel for debtor engagement. This personalized approach enhances communication and increases recovery success.

Debt collection software costs vary based on features, depending on factors like AI automation capabilities, advanced reporting tools, workflow customization, and user volume. Larger enterprise solutions may have custom pricing based on data volume, user tiers, number of integrations, and implementation support.

When choosing debt collection management software, consider the following factors:

Debt collection software gives Collection teams a cleaner way to reach customers with timely reminders, personalized follow-ups, and clear payment options. Instead of manual calls and scattered emails, the system tracks every interaction and sends the right nudge at the right moment, which keeps relationships intact while helping businesses get paid faster.

Most modern platforms plug into ERPs, CRMs, and billing tools without much friction. This means that data stays synced across invoices, credit limits, promises-to-pay, and dispute updates, so collectors don’t waste time reconciling information or chasing the wrong accounts.

Yes. By automating follow-ups, prioritizing high-risk accounts, and flagging delayed payments early, it tightens the entire recovery cycle. Businesses spot problems sooner, step in with the right strategy, and prevent delinquent accounts from slipping into write-off territory.