According to a recent McKinsey survey of senior credit-risk leaders from 24 major financial institutions, 20% have already implemented at least one generative AI use case in credit, while another 60% plan to do so in the next year. In other words, nearly 80% of major lenders and B2B credit providers are preparing to embed AI deeply into their credit-risk workflows, marking one of the fastest technology shifts the industry has seen.

AI is now redefining the credit landscape by automating document analysis, extracting insights from financial statements, generating credit memos, accelerating underwriting steps, and strengthening early-warning systems for portfolio risk. These capabilities reduce manual work, boost risk accuracy, and enable businesses to deliver faster, more standardized commercial credit decisions at enterprise scale.

In this guide, we have curated a list of 6 of the best credit scoring and application software solutions for 2026, designed to help credit teams leverage AI and data-driven tools to modernize their operations and make more informed credit decisions.

Credit scoring and application software is a digital tool that evaluates a customer’s creditworthiness and automates credit application decisions using financial and behavioral data, helping businesses approve or decline requests faster and more consistently.

Modern software go a step further by automating the entire lifecycle of credit applications, from document capture and validation to risk scoring, approvals, and credit limit assignment, ensuring consistency, speed, and policy alignment. It's the next-generation evolution of credit scoring engines, combining AI, predictive analytics, and cloud automation to deliver faster, more accurate credit evaluations.

Unlike traditional credit scoring that depends on fixed parameters and manual efforts, modern credit scoring tools learn from historical and transactional data and ensure dynamic risk assessment. These tools use credit scoring models that use factors like payment history, credit utilization, and account activity to calculate a score that predicts how likely a customer is to default. Higher credit scores indicate lower risk.

HighRadius Named a Leader for the 3rd Year in the Gartner Magic Quadrant - #1 in Execution and Vision for Invoice-to-Cash.

Download the full reportFor enterprises seeking to streamline the credit assessment process, here’s a snapshot of the top credit scoring and application software solutions in 2026:

| Software | Best Suited For |

| HighRadius | Mid to large enterprises that need end-to-end, AI-driven credit decisioning with real-time risk monitoring and fully automated credit application workflows. |

| Esker | Organizations that require compliant, policy-driven credit decisioning supported by bureau integrations. |

| SideTrade | Companies managing high-volume portfolios that benefit from predictive analytics and multi-source risk intelligence. |

| Quadient | Credit teams prioritizing structured, document-led credit workflows with standardized scoring and approval routing. |

| Gaviti | Mid-market teams shifting from manual processes to a simple, fast digital credit application and scoring workflow. |

| Serrala | SAP-centric enterprises needing deeply embedded, ERP-native credit scoring and automated credit-limit decisions. |

For businesses, accurate credit decisions prevent bad debt and protect cash flow amid rising transaction volumes. Credit scoring and application software automate risk assessment using data like payment history and financials, delivering consistent scores in minutes. This minimizes defaults, speeds onboarding, and scales approvals without bias. Finance teams gain portfolio visibility, enabling dynamic terms and compliance. By leveraging AI-driven models and enriched data sources, these systems deliver consistent, real-time risk insights that strengthen cash-flow predictability and support faster, policy-aligned credit processes.

In 2026, leading platforms are moving beyond static scoring formulas and manual workflows to deliver AI-powered, real-time credit assessments. These solutions streamline every step of the credit application lifecycle, including data capture, verification, scoring, and approvals.

HighRadius’ credit management software offers AI-powered credit scoring and online credit application capabilities. With the help of AI agents, the platform automates the complete credit application lifecycle, capturing documents, verifying customer information, scoring creditworthiness, and recommending credit limits based on risk policies. Its AI models learn from historical data, payment patterns, industry risk indicators, and macroeconomic fluctuations to deliver dynamic scoring instead of static, rule-based assessments.

Key capabilities:

What sets HighRadius apart is its continuous, real-time risk monitoring that automatically updates scores as new data flows in from ERPs, credit bureaus, financials, and trade references. Credit teams gain a comprehensive 360° view of customer risk and can approve, hold, or escalate applications directly within the platform.

Streamline Your Credit Decisions with AI

Leverage AI-powered credit scoring, automate approvals, and gain real-time insights to reduce risk and accelerate cash

Download The DatasheetEsker’s credit scoring and application software aggregates data from credit bureaus, financial documents, and ERP systems to produce reliable risk scores. AI assists with document validation and data extraction, minimizing manual review.

Key Capabilities:

Esker is ideal for enterprises requiring consistent, compliant decisioning across multiple regions, offering visibility, audit trails, and predictive insights to manage credit exposure effectively.

SideTrade’s credit scoring and application solution emphasizes predictive analytics to help businesses assess customer risk more effectively. It consolidates financial data, payment histories, and market trends to generate actionable risk scores, highlighting accounts that may require attention.

Key Capabilities:

SideTrade is especially suited for large and mid-sized companies managing extensive customer portfolios, offering a blend of automation, predictive insights, and analytics-driven credit decisioning.

Quadient’s credit scoring and application module focuses on automation and process compliance. It captures and validates customer data, generates risk scores based on internal and external inputs, and routes applications through predefined approval paths.

Key Capabilities:

Quadient is particularly suitable for enterprises that value structured, compliant processes and need a solution that integrates credit scoring with document validation efficiently.

Gaviti provides credit management software with smarter credit scoring and application functionality aimed at simplicity and speed for SMBs and mid-market organizations. It digitizes document collection, validates customer data, and calculates risk assessments using financials, payment history, and predefined credit rules.

Key Capabilities:

Gaviti is ideal for businesses moving away from spreadsheets and email-based approvals, offering a streamlined workflow that improves turnaround times while maintaining risk control and operational efficiency.

Serrala provides ERP-native credit scoring and application software for SAP-centric enterprises. It analyzes financials, credit exposure, and bureau data to generate contextual risk scores.

Key Capabilities:

Serrala is best suited for large SAP users seeking embedded, policy-aligned credit decisioning within their core ERP system, combining speed, accuracy, and governance.

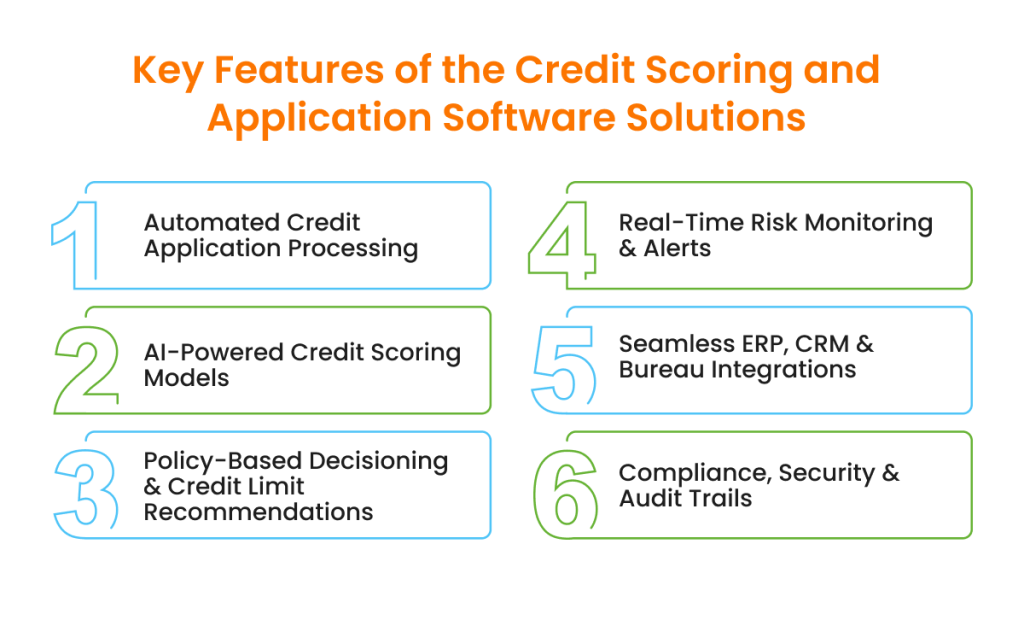

When evaluating credit scoring and application software solutions, it is important to understand the core capabilities that enable accurate risk assessment, faster decisioning, and consistent credit governance. The most effective platforms bring together automation, integrated data sources, and advanced analytics to streamline the entire credit lifecycle - reducing manual effort, lowering bad-debt risk, and supporting confident, policy-aligned credit approvals.

Choosing the right credit scoring and application software demands a strategic evaluation tailored to your credit operations. Finance leaders must prioritize tools that deliver AI-driven accuracy, real-time data integration, and scalable automation for overall process efficiency. Here’s what to consider:

Managing credit risk doesn’t have to be a constant challenge. The right credit scoring and application software can make a real difference by automating manual processes, providing real-time insights, and helping your team make faster, smarter lending decisions. The key is finding a solution that fits your business, integrates seamlessly with your existing systems, and is easy for your team to adopt.

With the right platform, you can reduce the risk of defaults, standardize decision-making, and scale your credit operations without adding complexity. Automation transforms credit management from a reactive task into a strategic advantage, giving your team the time and data to focus on high-value activities, such as growing customer relationships and making informed financial decisions.

Modern credit scoring and application tools bring clarity, efficiency, and intelligence to your credit processes, helping businesses manage risk confidently while supporting growth and long-term financial stability.

** This blog reviews 6 credit scoring and application software solutions; the 1–6 sequence is for reference only and does not indicate ranking or quality.

Credit scoring software improves credit decisioning by automating application evaluations, providing accurate risk predictions using AI, standardizing credit assessments, and enabling faster approvals. It reduces human error, ensures consistency across all applications, highlights high-risk customers, and allows finance teams to focus on strategic tasks rather than manual processing, improving overall efficiency.

Key features of a credit scoring software include AI-driven scoring models, integration with ERP and banking systems, real-time monitoring and alerts, customizable scoring criteria, workflow automation for approvals, compliance management, and advanced analytics dashboards. These features enable fast and scalable credit decisions while meeting regulatory requirements and adapting to industry-specific needs.

Yes, modern credit scoring software integrates with banking platforms, ERP, and accounting systems, allowing real-time access to financial data. This enables automated credit decisions, synchronized records, improved workflow efficiency, and reduced errors. Integration ensures that credit evaluations are based on the most accurate and up-to-date financial information available.

Almost all industries extending credit benefit from credit scoring and application software to manage risk and streamline processes. This includes banking, B2B commerce, retail, e-commerce, telecommunications, utilities, healthcare, and insurance. These sectors rely on accurate credit assessments to reduce financial risk, speed up approvals, monitor customer portfolios, and ensure that both consumer and business clients meet their payment obligations reliably.

Modern credit scoring tools use financial history, credit bureau reports, payment and behavioral data, alternative data such as utility and rent payments, and industry-specific metrics like company financials or trade references. Combining these data types improves predictive accuracy and helps assess creditworthiness beyond traditional financial information.

The cost depends on the business size, software features, and deployment type. Cloud-based solutions for small businesses are more affordable, while mid-sized and large enterprises investing in AI-driven scoring, advanced analytics, and full system integrations can expect higher subscription or licensing fees.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center