For businesses, remittance advice holds the key to accurate and efficient financial record-keeping. Understanding the fundamentals of it is essential to maintaining favorable supplier relationships and enhancing your accounting process.

However, grasping and interpreting remittance advice is a notoriously challenging process. Did you know that companies spend countless human hours matching open invoices with payments?

So, if you’re struggling with this issue, read on! In this article, we’ll explain what remittance advice is, what information it includes, and how to manage and process it efficiently and accurately.

Remittance advice is a document that a customer sends to a supplier to notify them of a payment made. It includes details such as the payment amount, date, and invoice number, and helps the supplier match the payment to the correct invoice and keep accurate accounting records.

While the use of remittance advice originated when checks were widely used, many global businesses still transact via check and send their check remittance advice along with the payment for suppliers to maintain a record. However, even though digital payments are now commonly practiced, remittance advice is still relevant today.

Remittance advice comes in two broad formats: hard copy and soft copy in electronic format. Let’s take a closer look at these formats.

Paper-Based Remittance Advice: These remittances are usually paper-based documents that are either hand-written or printed. They contain information such as an invoice number and the payment amount. While this format is becoming less common with the rise of digital payments, some businesses still prefer to receive paper-based remittance advice.

Email Remittance Advice: Customers usually send the remittance information through email. The remittance is either present in the body of the email or as an attachment. This format is becoming increasingly common as more businesses adopt digital payments and move away from paper-based processes.

EDI-Based Remittance Advice: An EDI is a combination of alphanumeric characters, making it ideal for businesses processing large payment volumes and seeking to automate their accounts receivable processes. Large enterprises typically send remittances through EDI machines.

Web-Based Remittance Advice: Web-Based Remittance Advice is a digital method of sending payment information from a customer to a supplier using a web-based portal. It’s useful for businesses that process a high volume of payments from a single customer, and is commonly used by retail giants like Amazon and Walmart to streamline their payment processes.

When it comes to remittance advice, the information you receive can vary depending on the payment method used. For example, if you’re receiving a check, you can expect to receive a lengthy paper remittance advice with all the necessary details about the payment.

However, if you’re receiving an automated clearing house (ACH) payment, the remittance advice may not include any information at all.

If the remittance is sent via email, your accounts team can monitor the payment or communicate with the point of contact (POC) in case of any discrepancies. It’s important to ensure that all necessary details are included in the remittance advice to avoid any confusion or errors in the payment process. However, basic remittance advice typically includes the following details:

Once you receive the remittance advice, your accounts receivable team will use the information provided to update their records and apply the payment to the correct invoices. This step is crucial in ensuring that payments are processed accurately and in a timely manner.

When you receive remittance advice, you can expect to see a detailed list of all the invoices covered by the payment. This list will include important details such as the corresponding invoice numbers, dates, and purchase order numbers. If the customer has taken any discounts, this information will also be noted on the remittance advice.

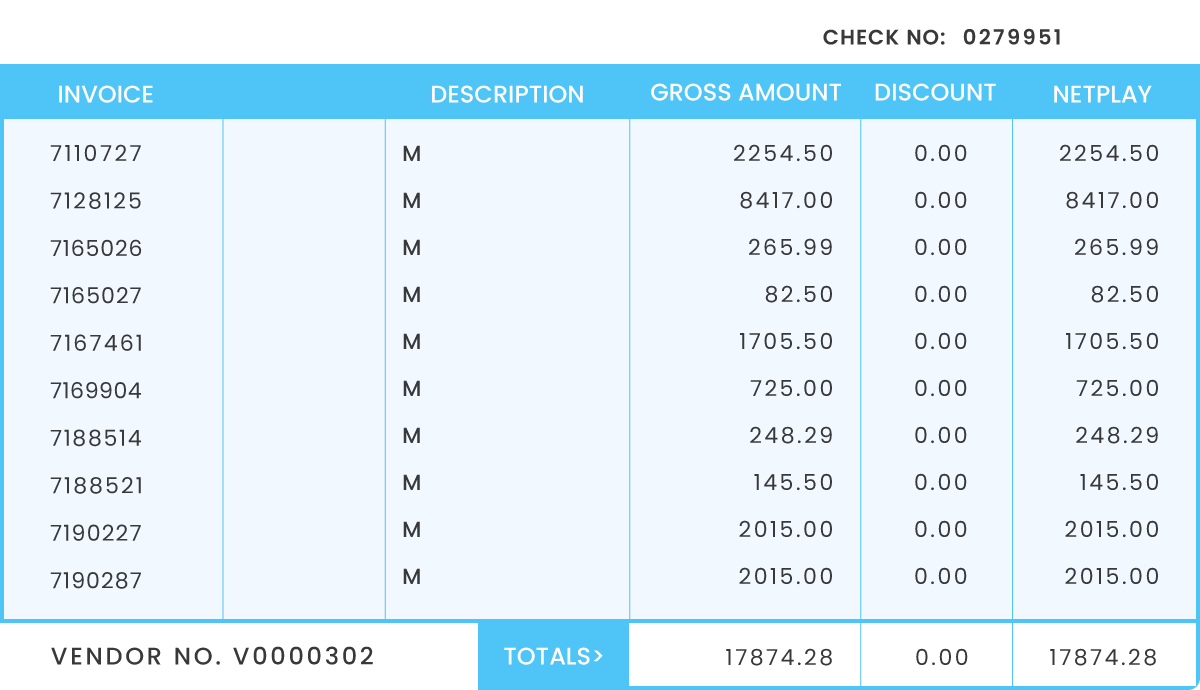

Let us consider a buyer-supplier ecosystem where the buyer is PentaCorp, and the supplier is ABCCorp. As PentaCorp releases the payment corresponding to the goods supplied by ABCCorp, they also send remittance advice. The following images include a check remittance advice example:

Matching payments to customers and invoices, figuring out what to do if the remittance is different from the receivables and properly coding all exceptions are the three primary activities involved in posting payments to open receivables. Broken down further, the individual manual tasks include:

Now that we’ve looked at the primary activities involved in posting payments to open receivables, let’s take a closer look at some common challenges that businesses face when processing remittance advice:

With electronic payments gaining popularity, businesses must tackle the task of capturing remittance details sent via email, EDI, web portals, and various other channels. Without a streamlined and integrated process, this can lead to duplicated data entry and errors, giving rise to inefficiencies and delays.

This can be particularly difficult when payments are received for multiple invoices or line items. Without clear and accurate remittance advice that includes all the necessary details, it can be challenging to match payments to the correct accounts, leading to errors and delays.

Businesses may also face difficulties with manual data entry, incorrect or incomplete information, and delayed or missing remittance advice. These challenges can result in inefficiencies, errors, and delayed payment processing, which can impact cash flow and cause frustration for businesses.

Do you remember the old days when remittance details were delivered by courier and A/R clerks had to manually post receipts in the accounting system? It was a time-consuming and inefficient process. But today, things are different. Electronic delivery of remittance details via FTP folders, BAI files, or similar formats streamlines payment posting to your A/R system, saving you time and money.

With electronic delivery, remittance advice in BAI format contains the machine-captured bank routing number, account number, and check amount. You can also add additional details, such as invoice numbers and payment amounts, to the file. However, traditional lockboxes require additional data entry at an added cost.To avoid duplicating data entry into your A/R system, it’s essential to integrate multiple electronic payment channels. This prevents inefficiencies and delays in processing payments. Despite the growth of electronic payments, there remains inefficiency in posting B2B remittance data to the A/R.

The shift towards electronic payments has created new challenges for cash application teams. While electronic payments are faster and more efficient than paper checks, the corresponding remittance information provided via email has presented potential issues. To achieve 100% automation of email remittance advice, two key aspects must be considered: linking email remittances to payments and extracting remittance information from emails. Let’s take a closer look at them.

If you’re in charge of cash application, you know how important it is to link payments to their corresponding email remittances. While this can be easy with paper checks, email remittances require a bit more effort.

You can either link them manually, which can be time-consuming and delay the cash application process, or you can opt for an AI-enabled email engine. This tool can accurately extract all the payment and remittance information from the email, and even match them up using simple algorithms. Plus, these tools are typically 100% accurate, so you can be confident that you’re not missing any important information.

When it comes to extracting remittance information from emails, you might be tempted to use OCR technology. However, this can also be a labor-intensive and resource-intensive process, especially when you have to draw rectangles around each remittance. Plus, it introduces the added cost of paper, which can further stretch your team’s resources.

The good news is that email remittances are actually one of the most convenient forms of remittance to automate. The data is already provided in electronic form, so you can eliminate much of the complexity and errors of OCR. Best of all, an AI-enabled email engine can do all of this without requiring customer-specific templates or IT projects, which can save you time and money in the long run.

As cash application becomes increasingly complex, many vendors have tried different solutions to address the problem. However, some solutions, such as repurposing OCR template-based systems, end up transferring the burden of creating and managing templates to the business team, resulting in manual effort being shifted from applying cash to managing templates. This defeats the purpose of automation and creates a “Template Hell” scenario that extends beyond paper checks and into electronic remittance.

Fortunately, advancements in Artificial Intelligence (AI) and Machine Learning (ML) are now making it possible to automate email remittance processing. AI-enabled solutions can learn to identify emails containing remittance information by examining keywords and attachments, and can extract relevant data fields for cash application. This is true whether the remittance is provided in the email body or an attached file. Best of all, AI-based solutions can eliminate the need to navigate templates and achieve optimal automation rates.

Email remittance, like other electronic methods for providing remittance, presents a significant opportunity for automation. Since errors due to scan quality and paper formatting are inherently avoided, automation rates can reach 100%. In fact, during implementations, some of the fastest automation rates are realized on customers who submit remittance via email. By automating your cash application process, you can save your cash application team time and money, and focus on more strategic initiatives.

If you’re struggling with manual remittance processing, you’re not alone. This time-consuming task can be a major drain on resources and can lead to errors and delays in your order-to-cash process. But with HighRadius’ AI-based Cash Application Software, you can streamline your remittance processing and achieve significant savings in time and money.

One of the key features of this solution is AI-based EMail Remittance Capture, which automatically captures remittance information for electronic payments sent via email. This includes tables, plain text, and pdf/excel/word attachments, making it easy to match payments from the banks. This feature alone can save your team countless hours of manual effort, freeing them up to focus on more important tasks.

But that’s not all – HighRadius also offers AI-Based Check Remittance Capture, which automatically extracts accurate and noise-free check remittance information from all industry-standard bank payment file formats and remittance file formats such as PDF, HTML, Excel, JPEG, and more. In addition, HighRadius’ Automated Portal Remittance Capture feature allows you to easily capture remittance information from customer portals, while Unbundled Payment-Remittance Processing automatically links and processes electronic payments and remittances received separately.

By utilizing HighRadius’ Cash Application solution, you can enable 95% straight-through cash posting, same-day cash application, and 100% savings in lockbox key-in fees. This can have a significant impact on your bottom line, helping you to improve cash flow and reduce costs. So why wait? Schedule a demo today to see how HighRadius can help transform your order-to-cash process.

A check remittance advice is a document sent with a check payment that provides details about the payment, such as the invoice number and amount paid. It helps the recipient apply the payment to the correct account and reconcile their records.

An email remittance advice is the electronic version of a check remittance advice. It is a document sent via email that provides details about a payment, such as the invoice number and amount paid. It helps the recipient apply the payment to the correct account and reconcile their records.

Remittance advice example: “Dear [Name], Please be advised that payment of [sum] has been made in respect of invoice [number and reference], via [method of payment], on [date]. Please confirm receipt and contact us if there are any discrepancies. Thank you for your prompt attention to this matter.”

Remittance information refers to the details provided along with a payment, typically in the form of a money transfer. This information helps identify the purpose of the payment, such as an invoice number, account number, or other relevant information.

Achieve 100% automated remittance aggregation from checks, emails, and web portals