By 2026, CFOs are under sharper scrutiny than ever — liquidity is tightening, DSO cycles are stretching, and capital efficiency defines resilience. Choosing the best accounts receivable automation software now represents more than mere automation. It delivers autonomous AR performance, eliminates manual tasks, predicts customer payment behavior, and optimizes working capital at scale. In fact, with the right accounts receivable automation software companies see 75% fewer manual interventions and 3× faster collections velocity.

For finance leaders, “best” means measurable impact, that is connected data, predictive intelligence, and scalable automation that turns receivables into working capital. Here’s how the top accounts receivable automation software stack up where it matters most.

When liquidity is tight, CFOs can’t afford technology that just automates the surface. The best accounts receivable automation software drives tangible business outcomes: reduced DSO, lower delinquency, and higher cash predictability. This comparison highlights how major AR automation vendors stack up on AI intelligence, system integration, and operational scale.

The table below distills the essential features that underpin automation maturity and long-term scalability.

| Core Capability | Functionality Benchmark | Financial Impact |

| AI & Automation | Predictive intelligence across collection and cash workflows | 3× faster collections and higher cash flow predictability |

| ERP Integration | Two-way sync with ERP and CRM systems | Real-time visibility into receivables and customer accounts |

| Cash Application | 100% auto-match with AI-based exception management | Reduced unapplied cash and faster reconciliation |

| Dispute Management | Centralized case tracking with automated escalation | Lower write-offs and faster resolution cycles |

| Scalability | Cloud-native deployment with API flexibility | Supports growth without increasing AR headcount |

| Audit and Compliance | SOC 2, GDPR, and audit logs embedded | Enhances transparency and control in every close cycle |

Bottom Line: Instead of comparing names, finance leaders should measure technology by the business outcomes it enables, which includes cash acceleration, risk control, and operational scale.

Collectors log into 600+ customer portals every month, tracking invoices manually!

While AI-led accounts receivable software unlocks 10X Faster Invoice Uploads with 2x more productivity.

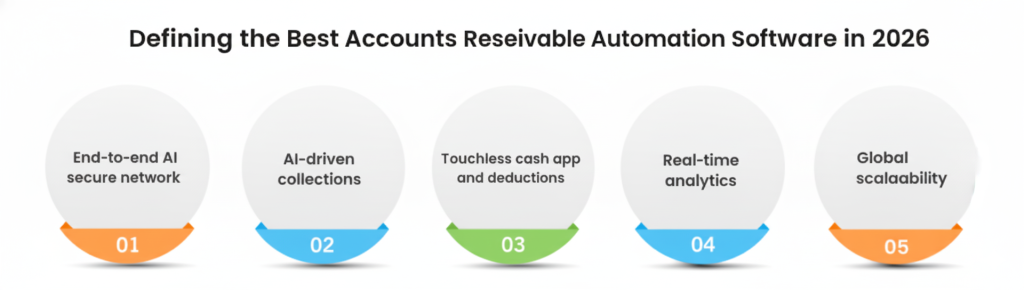

Download Feature GuideIn 2026, the best accounts receivable automation software is no longer judged by task-level automation but by how intelligently it connects every receivable workflow. CFOs are shifting from fragmented tools to unified AI systems that accelerate collections, increase accuracy, and strengthen cash visibility.

A fully automated accounts receivable software delivers a connected automation layer that manages invoicing, payments, collections, deductions, and cash posting in one flow, reducing manual intervention by up to 90%.

Predictive algorithms identify high-risk accounts and late payers in advance, allowing collectors to focus where recovery impact is highest.

Intelligent invoice matching with 95% accuracy ensures near touchless reconciliation and faster dispute resolution.

Live dashboards for DSO, team productivity, and exceptions empower CFOs with actionable insights across every region.

Built on a cloud-native, SOC 2 and GDPR-certified infrastructure, HighRadius scales seamlessly for global AR teams operating across currencies and entities.

CFOs evaluating the best accounts receivable automation software should look beyond feature lists and focus on bottom-line outcomes: faster cash, fewer touchpoints, and complete control. The right platform becomes a growth enabler and not a cost center.

Use this quick accounts receivable checklist to evaluate your next AR automation partner:

Many global finance teams continue to depend on legacy AR systems that limit automation, require heavy manual input, and slow down recovery cycles. The result is reactive cash management and limited visibility into true performance metrics.

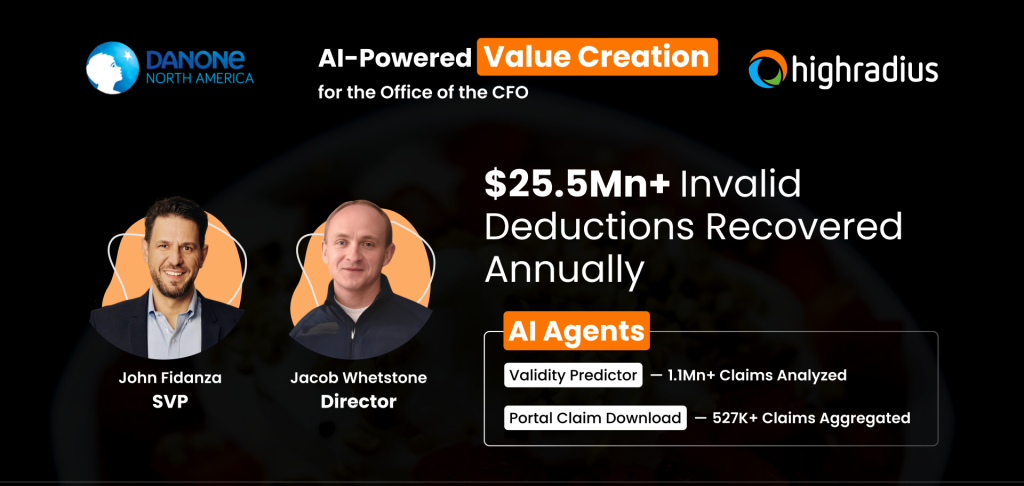

To address these gaps, Danone implemented autonomous, agentic AI powered, accounts receivable software to standardize deduction management and automate cash application at scale. Within months, the company achieved a $25.5 million annual recovery in invalid deductions and reduced Days Deduction Outstanding by 25 days.

With 95%+ touchless posting and unified dashboards, the AR team gained real-time insights into collections, disputes, and exception trends. The result — a 75% increase in team productivity and stronger compliance oversight.

Most finance teams still run AR operations across disconnected systems — one for invoicing, one for collections, and another for disputes. These silos delay payments, obscure cash positions, and increase manual effort. CFOs lose time chasing visibility instead of managing liquidity.

HighRadius offers the best Accounts Receivable Automation Software offers a connected solution that modernizes every touchpoint across the Order-to-Cash cycle. CFOs gain measurable control over cash flow, reduced DSO, fewer disputes, and faster closes, thereby turning AR from an operational cost into a capital advantage.

Here are the key features.

Automates 95%+ of cash postings with AI-based remittance capture.

Collection Automation Software:

Predictive worklists optimize collector focus for maximum recovery.

Digitizes customer billing with real-time delivery and compliance.

Automates root-cause tracking and resolution workflows.

Uses AI models for accurate limit approvals and proactive risk control.

Simplifies payment acceptance across multiple methods and geographies.

Automates follow-up schedules with intelligent reminders.

The result? Businesses get 10% reduced DSO, 20% reduced past dues and 30% increased invoicing productivity.

The best accounts receivable automation software unifies invoicing, cash application, and collections on a single AI platform to reduce DSO, minimize manual effort, and improve cash flow accuracy and visibility across the entire Order-to-Cash cycle.

AR automation software eliminates manual processes, accelerates collections, and provides real-time visibility into cash positions. CFOs gain data-driven insights to improve liquidity management, forecast working capital, and make faster, more informed financial decisions.

Prioritize AI-driven cash application, intelligent collections prioritization, seamless ERP and banking integration, predictive analytics, and configurable dashboards that streamline receivables management and improve working capital efficiency.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center