How to Trade Manual Tricks for Digital Treats at the CFO’s Office?

What you’ll learn

- Explore why finance leaders should adopt a digital-first approach to combat finance horror stories.

- Learn how to overcome the process-specific roadblocks faced by a lean finance team using technology

- Understand the impact of digital-first strategy on business transformation

If you’re watching a horror movie, chances are you would be expecting a jump-start scene, which is almost always sprinkled throughout the movie. Yet, despite anticipating the scary scene, you’re startled each time, and a chill runs down your spine. If you apply this horror-movie experience to a CFOs office, it has had its share of jump-start moments in the past couple of years, be it the pandemic, economic slowdown, and the global political situations, to name a few. And, there are more to come, like the ongoing inflation that is prevalent today. So, how can the CFOs office remain strong to tackle such jump-start horror situations?

If you’re watching a horror movie, chances are you would be expecting a jump-start scene, which is almost always sprinkled throughout the movie. Yet, despite anticipating the scary scene, you’re startled each time, and a chill runs down your spine. If you apply this horror-movie experience to a CFOs office, it has had its share of jump-start moments in the past couple of years, be it the pandemic, economic slowdown, and the global political situations, to name a few. And, there are more to come, like the ongoing inflation that is prevalent today. So, how can the CFOs office remain strong to tackle such jump-start horror situations?

In the new economy, technology is the driver of change. And as a finance leader, investing in technologies to empower your teams, support business growth, and stay competitive becomes imperative.

This eBook focuses on the various technological solutions that can be used to overcome the process-specific challenges faced by a lean team.

We will also talk about how HighRadius can help your business to eliminate these challenges using autonomous finance solutions. So, let’s get started.

How are mid-market businesses operating in the new normal?

“Hybrid work models’, ‘Augmented workforce’, and ‘Digital-first strategy’’ are moving from buzzwords to reality now. So far 2022 has been the year when almost every task can be handled with a single click, yet many mid-market businesses are still managing their finance operations manually and working in graveyard shifts.

During the pandemic, two-thirds of businesses faced cash flow challenges. Therefore, companies are shifting their focus towards empowering finance professionals by aligning technology and business goals to focus on growth and working capital management.

From Darkness to Light

Why do mid-market businesses need to shift to a digital-first strategy?

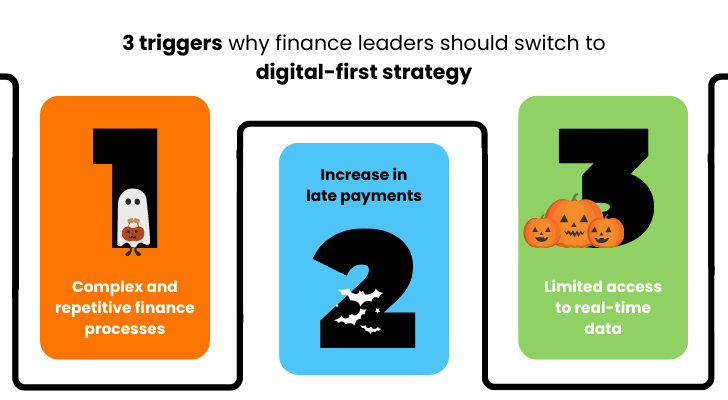

A digital-first strategy leverages digital tools to achieve specific business goals. It aims to provide finance leaders with real-time visibility across the entire finance process of the organization and boost the productivity levels of their teams. Here are some reasons why finance leaders at mid-sized businesses need to shift to a digital-first strategy.

- Cemeteries of manual process: Complex and repetitive finance processes lead to a decrease in team productivity. In the current scheme of events, analysts spend the majority of their time in low-value work.

- Dead Debts: Increase in late payments leads to higher DSO and creates pressure on working capital. Businesses are forced to incur unnecessary debt to meet their short-term needs and financial obligations when a lot of cash is stuck as AR.

- Growling KPIs: Limited access to real-time data leads to inaccurate tracking of critical business metrics such as DSO and DDO and hinders CFOs from taking data-driven decisions undermining business’ performance.

Let’s look at how leveraging digital technologies can solve challenges faced by teams within key finance functions like accounts receivables, treasury, and accounting.

Avoid Tricks and Go for Treats

Upgrade credit risk management with advanced technology

Your finance team might need to spend hours daily onboarding new customers, collecting customer data, assessing credit scores, and conducting periodic reviews. The heavy reliance on manual approaches to complete the tasks leaves no time to focus on high-value strategic functions. Let’s take a closer look at the challenges faced by credit analysts and try to solve them with technology.

We discussed the challenges in detail in the first part of the series.

Trick: Hectic credit data aggregation

Manually gathering and assessing data from credit applications, and credit reports of customers for onboarding is a time-intensive process for a lean team.

Treat: Online credit application

Moving credit applications online, integrating them with credit agencies, and securing them with e-signature technology helps eliminate manual work and incomplete credit applications. It replaces a paper-intensive credit management process with an electronic one to enable better credit portfolio and risk management and onboard new customers quicker.

Trick: Difficulty in setting credit limits

AR teams invest a lot of time and effort in completing the research and analysis needed to set optimal customer credit limits. Yet, in many cases, they still end up assigning incorrect credit limits, thus increasing bad debts.

Treat: Credit decision accelerator

Credit decision accelerators utilize AI-powered credit scoring models to evaluate and set credit limits for customers based on data from credit reports, financial statements, and payment histories. It automates the credit management process, enabling quicker and more accurate credit decisions.

Trick: Inability to keep track of risk accounts

Performing periodic checks manually becomes challenging and time-consuming due to a growing customer base. It leads to numerous pending periodic reviews and takes away focus from critical accounts.

Treat: AI-enabled credit risk monitoring

Automation solutions with real-time visibility into customer credit data could help with credit risk monitoring to avoid late payments. Credit analysts receive real-time alerts regarding bankruptcy, change in credit score, and changes in payment behavior to stay on top of risks and control overall bad debt.

Overall benefit to credit team

Other than digitizing the onboarding of new customers, digital transformation of the credit risk management process also helps the teams save time by automating data collection and credit scoring. This leads to faster customer onboarding and reduces bad debts, creating a positive impact on the business’s cash flow and customer retention rate.

Ghost Manual Approaches

Take the digital-first approach to invoicing

You might think invoicing is a fairly simple process, but businesses often struggle in this area. Some make consistent invoice errors whereas some fail to generate invoices on time. In certain scenarios, companies also switch between physical and electronic invoices, resulting in confusion. To improve the overall business performance and secure a competitive advantage, businesses must overcome significant invoicing challenges, such as:

Trick: Delay in sending invoices

Manually producing a huge number of invoices and sending them to individual customers takes a significant amount of time, leading to a poor customer experience.

Treat: e-Invoicing

e-Invoicing enables electronic invoice generation and delivery. It ensures that the documents are error-free and are sent to customers on time using electronic invoice data. With e-Invoicing in place, you achieve scalability, reduce business costs, and eradicate delays.

Trick: Inability to track invoice status

Delivering invoices through a combination of digital and traditional channels makes it difficult for the team to track invoice status in real-time.

Treat: Open tracking of invoice status

Open tracking of invoice status provides you with real-time information on whether the invoice is paid, partially paid, or overdue. It saves the time and effort required in regularly logging into multiple portals to check the status of invoices.

Trick: Inability to manage disputes

In the absence of proper tools, finding the right invoice to verify disputes is labor-intensive as manually sent invoices are scattered across physical warehouses and spreadsheets.

Treat: Customer self-service portal

Customer self-service portal provides a platform for your customers to access and manage invoices, and account statements, and make payments in multiple formats. It enables the team to manage disputes effectively by providing 360-degree visibility into billing and payments.

Overall benefit to billing and payments team

End-to-end automation in invoicing empowers teams to focus on critical tasks by automating repetitive workflows such as invoice generation, delivery, and tracking. It also enables your teams to keep a track of disputes for faster resolution. As a result, invoicing teams have better visibility into the complete AR process and the customer experience is improved.

Scared Efforts won’t Yield Results

Make the leap to a proactive collections management system

Make the leap to a proactive collections management system and move away from paper-based manual processes. Collections at first can seem to be a very painstaking process. But over the decades, there have been significant advancements in collections management using technology. Let’s discover how businesses can overcome the major challenges of manual collections management.

Trick: Delayed correspondence

AR teams have to manually prioritize accounts, customize each correspondence, and send them to individual customers. In absence of a proper dunning outreach, risks of write-offs and DSO increase significantly.

Treat: Automated dunning outreach

Collections management software sends automated payment reminders via email to low-risk customers and helps you to scale up dunning outreach. One can also access ready-to-use dunning templates and update them according to business needs.

Trick: Inability to stay on top of at-risk customers

In the absence of actionable insights and customer segmentation strategies, it is difficult for lean teams to identify and approach high-risk accounts on time.

Treat: Data-driven prioritization of customers

An automated solution leverages AI to predict risk classes based on customer payment behaviors and interactions across calls, emails, and other modes of inbound communications. It helps to reduce DSO by enabling rule-based data-driven prioritization for engaging with at-risk customers.

Trick: Unable to track customer information

Lean teams struggle to acquire customer information and payment updates while sending out correspondence. The absence of quick access to customer data delays the payment.

Treat: Centralized data repository

A centralized data repository provides one-click access to all customer communication including call logs, received payments, notes, and promise-to-pay trends, in a single place. It saves the hassle of collecting customer information from multiple data sources.

Overall benefit to collections team:

Utilizing the right set of digital tools in collections management boosts analysts’ productivity levels by automating account prioritization, enabling touchless dunning, and providing complete customer interaction history. This optimizes the working capital of the business, increases the account coverage percentage, and reduces the days sales outstanding (DSO).

Fearsome Efficiency is the Way to Go

Drive transformation with modern cash apps

Cash application is a resource-intensive process in accounts receivable. However, automation has a lot to offer in this space and make things simpler for businesses. So it is ideal that you automate cash applications and shift resources to higher-value activities such as collections and credit. Here are the solutions to the key challenges in a traditional cash application process:

Trick: Manual remittance aggregation

AR teams face difficulty aggregating the data due to multiple sources and formats of remittances. Manual remittance aggregation is laborious, error-prone, and results in a prolonged cash application process.

Treat: Optical character recognition

OCR is capable of scanning any document or file to convert images of typed, handwritten, or printed text into machine-encoded text. With an automated solution that has AI-enabled OCR, businesses can capture remittance data automatically from check stubs. Currently, more than 40% of credit and AR departments are evaluating OCR technology to eliminate manual cash reconciliation and posting.

Trick: Time-intensive invoice matching

Manually extracting data from backup documents, entering details into spreadsheets, and matching it to payments, increases the overall time to cash.

Treat: Intelligent invoice matching

Intelligent invoice matching can easily match payments with open invoices, and identify deductions, discounts, and any inconsistencies for individual line items. It also reduces FTE costs by eliminating manual intervention.

Trick: Delayed cash posting

Due to the high volume of work, AR teams are unable to execute same-day cash posting in the absence of systems that directly integrate with ERP.

Treat: Straight-through cash posting

Straight-through cash posting is a process used to speed up the processing of transactions without human intervention. An automated AI-based solution enables straight-through, invoice-level cash posting within 24 hours into ERP even in complex business scenarios such as parent-child relationships, and prepayments.

Overall benefit to cash application team:

Automation of the cash application process saves the time of your teams by automating remittance aggregation, invoice matching, exception handling and enabling zero-touch cash posting. This increases hit rates and reduces the need for manual efforts significantly.

Digital Crystal Ball: Forecasting with Automation

Build financial resilience with optimized treasury management

Building a resilient finance function with automation protects your business during an economic downturn. It also frees up the bandwidth of treasury teams. Here are some ways in which technology solutions can help overcome the challenges of treasury management:

Trick: Obstacles to treasury growth potential

Treasury operations are generally handled by a very lean team, or only by the CFO in some cases. Due to the absence of task segregation, teams often fail to discover new investment opportunities and optimize their working capital.

Treat: Automated cash forecasting

Automated cash forecasting provides accurate AI-based cash flow forecasts. This enables better cash repatriation, pooling, and hedging over the short and long term. It helps the teams to focus on high-value tasks by saving time and eliminating manual errors.

Trick: Delayed data accumulation for cash forecasting

Delayed data accumulation happens due to a lack of global cash visibility. The treasury team often faces repercussions such as insufficient cash return and unexpected expenditure for this.

Treat: Automated data gathering

Automated data gathering and consolidation of financial data increases granular visibility and improves reporting to the CFOs. With automation, transaction-level data is gathered seamlessly from numerous sources such as banks and ERP. It enables an in-depth analysis of cash flows across various cash flow categories, regions, and currencies.

Trick: Inaccurate variance analysis

The treasury team spends hours on cash forecasting, thereby leaving little time for variance analysis. Hence, it is conducted at the last minute and is not accurate.

Treat: Analytics engine with What-If analysis

Analytics engine automatically recalculates variances and saves copies as snapshots which are then used in reports and dashboards. It performs accurate variance analysis over multiple cash flow categories, and durations that help to find the root causes of variance to take necessary corrective measures.

Overall benefit to treasury team:

Leveraging automated treasury management solutions results in enhanced efficiency of analysts by eliminating manual work of data gathering and creating forecasts. It provides consolidated forecasts to improve decision-making with increased data accuracy.

Fend-off Error Zombies

Tackle the complexities of Record To Report process

In today’s intensifying economic headwinds, finance leaders must lead decision-making with insight, speed, and confidence. Nonetheless, many finance departments still face inefficiencies in their record-to-report process. Here, we will discuss how we can overcome the roadblocks of the record-to-report process by utilizing technology.

Trick: Delay in financial closing process

Manually gathering, analyzing, reconciling, and adjusting account balances, from multiple sources delays the financial closing process.

Treat: End-to-end financial close automation

End-to-end financial close automation eliminates manual work and enables day-zero close through immediate and accurate decisions. A financial close automation solution improves the closing process by boosting efficiency, visibility, and timeliness.

Trick: Error-prone account reconciliation process

The whole process of account reconciliation is highly prone to error when performed manually. Multiple data sources and formats, and dozens of stakeholders with interdependent tasks all add to the process complexity.

Treat: Automated anomalies detection

Automated anomalies detection enables proactive reconciliations by providing a list of potential anomalies that helps in addressing issues proactively rather than waiting until month end for adjustments. It enables a faster and more accurate reconciliation process.

Overall benefit to record to report team:

Continuous accounting saves your teams from manual work during the month-end close and provides a connected workspace for teams to ensure faster reviews and approvals. In the traditional R2R process, there was barely enough time to manage the close, but with the time saved, now finance teams have the additional bandwidth to drive continuous improvement.

Transformation Story: The impact of digital-first finance teams on Mercury Marine

Digital-first teams are transforming the finance landscape of mid-market companies. Let’s take a look at the business transformation story of Mercury Marine.

About Mercury Marine

Mercury Marine is an industry-leading developer and manufacturer of a broad range of marine propulsion systems for recreational and commercial applications acquired by Brunswick Corporation in 1961.

Challenges

Mercury Marine has multiple ERP systems across a global IT landscape and diverse business units creating a complex credit management scenario which resulted in:

- Time-consuming and error-prone data entry

- Siloed AR processes due to disconnected ERP systems

- Long onboarding process of 4.5 days

Solution

Mercury Marine adopted HighRadius’ automation solution which provided:

- Online credit application

- Auto-prioritization of large accounts

- Individual analyst worklists

- Automatic capture of credit agency reports

Impact

With the right set of tools and technology Mercury Marine’s team witnessed:

The way forward with Autonomous Finance

HighRadius is the market leader in the emerging software category called Autonomous Finance and aims to disrupt how the Office of the CFO is executing key finance functions like accounts receivable, treasury, and accounting with AI. HighRadius Autonomous Finance Platform is a dynamic data-driven platform whose behavior continuously morphs as the underlying domain-specific data changes.

With Big Data, AI and NLP technologies HighRadius solutions help bring real-time intelligence to automate clerical, repetitive work empowering users to make timely and accurate decisions.

The Autonomous Finance platform is currently available for three key parts of the Office of the CFO: Autonomous Receivables for Order to Cash, Autonomous Treasury for Treasury and Risk Management, and Autonomous Accounting for Record to Report.

To transform your finance landscape and shift your finance team, request a demo NOW! Or miss the competitive edge that 58% of businesses are planning to achieve before the end of 2022.

Read the third part-’Holistic Financial Solution vs. Best-of-Breed Solutions for Finance Function Transformation’, to go deeper into how HighRadius solutions can level up your business by eradicating all the challenges faced by your finance teams with the power of automation.

There’s no time like the present

Get a Demo of Autonomous Receivables Platform for Your Business

HighRadius Integrated Receivables Software Platform is the world’s only end-to-end accounts receivable software platform to lower DSO and bad-debt, automate cash posting, speed-up collections, and dispute resolution, and improve team productivity. It leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes and also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier accounts receivable process to the buyer accounts payable process. Integrated Receivables have been divided into 6 distinct applications: Credit Software, EIPP Software, Cash Application Software, Deductions Software, Collections Software, and ERP Payment Gateway – covering the entire gamut of credit-to-cash.