Manual cash application still consumes 25% of finance resources and delays cash realization by days. In 2026, Autonomous cash matching agents are enabling CFOs to post more than 90% payments instantly, accelerate and optimize working capital, and slash manual touchpoints by 80%. Cash application automation in 2026 provides full visibility across ERPs and banks, turning reconciliation from a bottleneck into a real-time competitive advantage.

This blog talks about the key trends that are transforming cash application automation in 2026 and what CFOs must prioritize to get the maximum benefits from cash application automation solutions.

Revenue Misstatements From Failed Cash Application Cost Millions!

While AI achieves accurate remittance matching with increased FTE productivity.

Download eBookCash application automation uses AI, machine learning, and OCR to automatically process customer payments, reconcile invoices, and post cash in real-time. By removing manual intervention, enterprises cut reconciliation cycles, increase accuracy, and free AR teams to focus on value-added work.

For CFOs, this delivers faster cash posting, near-zero reconciliation errors, and improved working capital management. With autonomous capabilities, enterprises achieve up to 95% auto-match accuracy and operational efficiency that turns AR from a cost center into a cash flow accelerator.

Cash application automation now delivers speed, accuracy, and control. CFOs using AI matching, OCR invoice capture, and autonomous posting reduce manual work, unlock working capital, and manage enterprise liquidity.

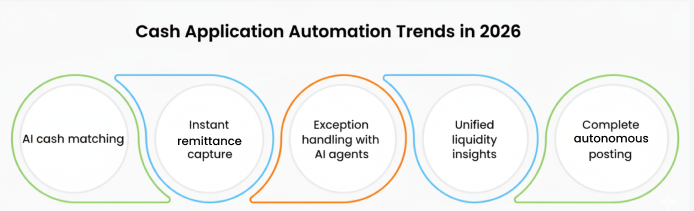

Self-learning AI now handles diverse remittance formats from emails, bank statements, lockboxes, and digital payment portals. These models continuously learn from historical patterns and new remittance structures, improving auto-match precision over time. HighRadius reports that enterprises achieve 95–98% match accuracy, reducing manual reconciliation by up to 80%. For CFOs, this translates to faster cash realization, fewer unapplied payments, and immediate working capital impact, turning cash application into a strategic driver rather than an operational burden.

OCR, API, and RPA integrations ingest remittances in real time from over 70 customer portals, emails, and digital channels, eliminating manual downloads and human errors. Payments flow seamlessly into the AR system, providing finance teams with instant visibility into account receivables. This real-time capture reduces lag, ensures up-to-date cash positions, and accelerates liquidity management for enterprises operating at scale across geographies.

Agentic AI now autonomously identifies mismatched or partially matched payments, cross-references invoices, and determines the optimal posting without human intervention. These intelligent AI agents continuously learn from each exception, adapting rules and patterns across global payment workflows.

Enterprises report up to 85% reduction in exceptions, slashing manual review cycles and accelerating cash realization. Moreover, CFOs free AR teams from repetitive exception handling, enabling them to focus on strategic forecasting, customer engagement, and proactive working capital management, turning cash application into an autonomous, high-value function rather than a manual bottleneck.

Integration across ERPs, bank APIs, and payment networks provides CFOs a single view of liquidity across the enterprise. By consolidating AR and AP data, finance leaders gain actionable insights for strategic cash allocation, risk management, and forecasting. Real-time dashboards empower decision-makers to identify cash surpluses, prioritize critical payments, and optimize working capital, bridging the gap between operational execution and boardroom strategy.

Automation now spans from payment posting to journal entries, reconciliations, and exception workflows. Teams no longer have to post payments manually in ERPs. Automation does that while reducing cycle times to hours rather than days. CFOs benefit from full transparency, reduced DSO, and a frictionless AR process. By eliminating bottlenecks and human delays, finance teams operate at digital speed, enabling enterprises to scale cash management without adding headcount.

CFOs are prioritizing autonomous, AI-driven cash application solutions to accelerate cash flow, reduce errors, and free finance teams for strategic work. Cash Application Automation addresses these priorities:

Automatically extracts invoice and remittance data from emails, PDFs, and portals, eliminating manual data entry and errors. CFOs gain faster visibility into receivables and accurate cash projections.

Payments received via email or customer portals are ingested in real time, reducing manual download and posting steps, and ensuring finance teams have up-to-date cash positions.

AI automatically matches payments to invoices using invoice numbers, payor details, or memos, achieving 95%+ auto-match accuracy and minimizing unapplied cash.

Unmatched or partially matched payments are analyzed and recommended for posting autonomously, reducing exceptions by up to 85% and freeing AR teams for higher-value tasks.

From invoice capture to posting and reconciliation, automation ensures faster cash application cycles, improved DSO, and full visibility into working capital.

As CFOs head into 2026, the cash application function is evolving from a back-office task to a strategic growth lever. The shift toward agentic AI, real-time remittance capture, and end-to-end automation signals one thing that finance leaders must operate with speed, accuracy, and insight. Manual posting, exception delays, and reconciliation gaps are no longer tolerable in an infrastructure where every minute of trapped cash impacts working capital.

HighRadius Cash Application Automation keeps up with this challenge with AI-driven precision and scalability. The solution captures remittances from emails and portals in real time, matches payments with 95%+ accuracy, and posts directly to ERPs, removing unnecessary human intervention.

Key Capabilities:

The result? CFOs gain 90% straight through cash posting while eliminating 100% bank lockbox fees.

Cash application automation uses AI and machine learning to match incoming payments with invoices automatically. It eliminates manual posting, reduces errors, and accelerates cash flow by integrating bank data, remittance, and ERP systems in real time.

Automation tools extract remittance data from emails, portals, and bank statements, then use AI to match payments with open invoices. Unmatched exceptions are flagged for quick review, giving finance teams faster, more accurate cash posting and reporting.

CFOs adopt automation to improve accuracy, reduce processing time, and gain real-time visibility into receivables. It cuts manual effort by up to 85% and accelerates cash posting, enabling better working capital management and forecasting precision.

Key benefits include faster cash posting, higher match rates, fewer write-offs, and better AR visibility. Automation also strengthens control, reduces costs, and supports data-driven decisions for CFOs focused on liquidity and operational efficiency.

AI-driven solutions now achieve 95%+ auto-match accuracy by learning from historical remittance patterns. They continuously improve exception handling and enable end-to-end automation across O2C, delivering faster reconciliations and smarter forecasting.

HighRadius Cash Application Software connects directly to banks, ERPs, and customer portals to automate remittance capture and matching. With AI-led algorithms and real-time reconciliation, it helps finance teams post cash faster and improve accuracy.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center