For many organizations, traditional cash application solutions, such as outsourcing, OCR, and RPA, once appeared sufficient. However, as remittance formats change, short-pays increase, and payments arrive without adequate context, these rigid, rules-based methods quickly become inadequate. As a result, finance teams face increased manual effort, higher operational costs, and compromised efficiency.

To address these challenges, modern finance teams are shifting to cash application software that are led by agentic AI: autonomous agents that handle end to end cash application cycle with minimal oversight. The shift isn’t just about speed, it’s about managing rising complexity in managing accounts receivables without adding headcount.

Losing $250K a Year—Without Even Noticing?

Manual cash application might be bleeding your bottom line. Before you sink another dollar into manual AR, find out how much you could be really saving.

Get My ROI EstimateFor better clarity, let’s take a closer look at how agentic AI works before diving into the six key reasons CFOs are embracing this shift in cash application.

In the context of cash application, agentic AI moves beyond offloading repetitive tasks—it enables digital agents to take full control of the process from start to finish, operating independently without the need for constant human direction. These agents do not simply follow predefined rules; they replicate the reasoning of skilled analysts, interpret incomplete information, and initiate proactive actions that traditional automation systems would overlook entirely.

Take, for instance, when a payment comes in without a remittance:

In a traditional system:

In contrast, an agent-led cash application software:

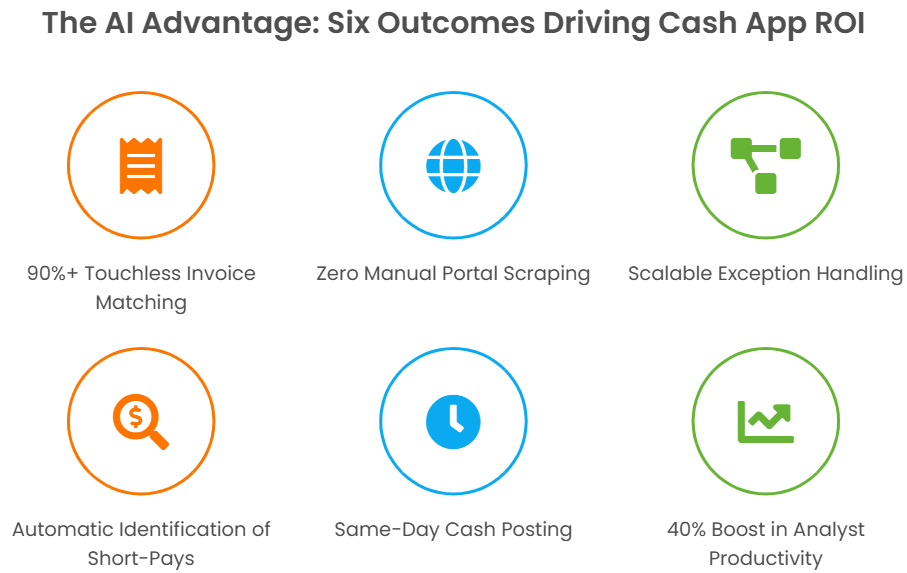

CFOs are leaning in because the agentic model changes not just efficiency metrics but the operating structure of their finance function. Here are the key business benefits the agentic AI framework delivers across the cash application lifecycle:

With legacy systems, even high automation rates stall at around 60–70% due to variability in remittance formats. Agentic AI solves this using machine learning models that adapt to the structure and language of remittances over time. Whether it's a scanned PDF in French with handwritten annotations or a multi-tab Excel file from a multinational buyer, the AI can extract and interpret the data, map it to invoices, and apply payments automatically.

This 90%+ automation of invoice-level matching isn’t just time saved—it’s the removal of the most error-prone segment of the process, dramatically improving accuracy and freeing analysts to handle only the true edge cases.

Retailers like Walmart and Target, or B2B giants like Grainger, often require suppliers to pull remittance data from their own AP portals. Traditionally, analysts spend hours logging into these sites, downloading files, and manually copying details into ERPs.

Agentic AI now automates this end-to-end—using pre-built integrations or RPA bots that simulate human actions on those portals. The system continuously monitors for new remittances, extracts the data, and posts it to the appropriate invoice—no browser tabs, no repetitive logins, no errors due to copy-paste fatigue.

Most CFOs have resigned themselves to slow exception resolution—assigning more analysts as exceptions increase. But that model doesn’t scale. Exception Management Software powered by Agentic AI changes the game by predicting the most likely invoice matches for payments with missing remittances using historical behavior patterns, customer preferences, and invoice timing. It then auto-generates customized remittance request emails, updates customer records with each interaction, and escalates only when ambiguity remains.

As a result, finance teams experience faster exception handling, significantly reducing unresolved payments and enhancing overall efficiency.

Short payments often create more confusion than actual disputes. The AI built into the agentic platform can scan remittance messages—no matter how vague or unstructured—and identify deduction reasons with high accuracy. With libraries trained on 600+ ERP implementations and retailer-specific code sets, the HighRadius’ cash allocation software can auto-map short-pays to internal reason codes and suggest resolution actions.

For finance teams, this means faster clearing, cleaner ledgers, and fewer back-and-forths with sales or customer service.

Finance leaders understand the cost of delays in cash posting—it affects forecasting, working capital, and credit decisions. With agentic AI, same-day posting becomes the norm. Payments that used to sit in queues waiting for remittance clarification are now posted automatically, thanks to real-time decision-making by digital agents.

These agents process payments continuously, 24/7 if needed, and push updates directly into the ERP, eliminating batch processing windows and reconciliation delays.

When agents handle routine matching, portal logins, exception flagging, and coding, analysts can finally get out of the weeds. This enables them to focus on systemic bottlenecks, root cause analysis, and customer outreach that actually prevent future issues.

Teams become more strategic, not just reactive, and productivity gains aren't just about volume, but about a higher quality of work across the board.

HighRadius’ Cash Application Software goes beyond simply layering AI onto legacy processes—it fundamentally redefines cash application with an agentic framework built from the ground up. Each module in the cash application suite is powered by business outcome-specific AI agents, seamlessly connected across the end-to-end cash app lifecycle:

All of this operates within a unified environment, which means finance teams aren’t switching between systems or relying on custom integrations. The agents collaborate with each other. The data flows end-to-end seamlessly. This means CFOs get a system that runs with the stability of a shared service model but the agility of a digital-native enterprise.

1. What is an automated cash application?

An automated cash application is a process that uses software or AI to match incoming payments with outstanding invoices. It reduces manual effort, speeds up reconciliation, and improves accuracy. Automation helps businesses manage cash flow efficiently. It also minimizes errors and accelerates the accounts receivable process.

2. What is an example of Agentic AI in a cash application?

Agentic AI in a cash application can autonomously make decisions. For example, it can proactively identify unmatched payments, handle exceptions, and request missing remittance data. Unlike rule-based systems, Agentic AI adapts and learns over time. This reduces human intervention and increases end-to-end automation.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center